The stock markets sit in a dicey situation with not only the Omicron variant adding stress to economic growth, but with Fed Chair Jerome Powell commenting on the possibility of speeding up tapering.

Though the Fed has long stressed inflation to be transitory, it seems as though their tune is changing as the central bank takes a closer look at economic data. However, as news unfolds, whether it be of more tapering or the new variant, we can watch how the treasury bonds and high yield corporate bonds fare through the coming week.

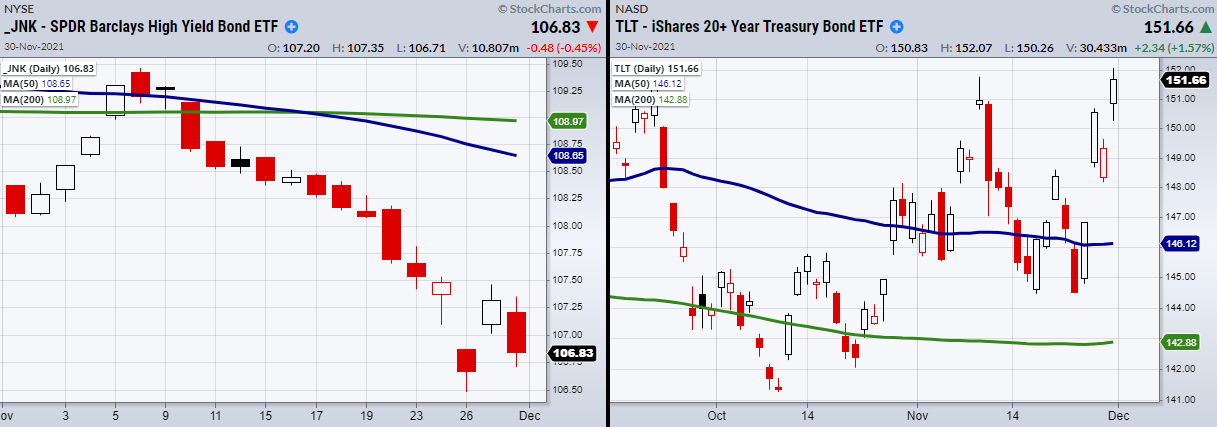

Keeping track of High Yield Corporate Bonds ETF via SPDR® Bloomberg Barclays High Yield Bond ETF (NYSE:JNK) along with iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) have always been great spaces to watch when the market gets into a pivotal situation.

So far, JNK, which helps show investors’ appetite for risk, is lingering over its 200-Week moving average at $106.79. Below that is Monday’s low at $106.48. If these price levels cannot hold through Wednesday, the market picture does not look so good for the bulls.

Additionally, keep an eye on the TLT as it has come into a special resistance area dating back to July this year. Currently, TLT needs to clear and hold over $151.82. If TLT can clear and stay above this area, along with JNK breaking lower, this shows that traders are becoming more cautious as they rotate money out of risky assets (JNK) into safer plays (TLT).

Of course, if the inverse happens, with JNK holding key support or pushing higher and TLT failing to clear resistance, we can watch for more economic upside.

However, if TLT and JNK make no deciding price move, watching from the sidelines is never a bad option and can sometimes be the best position to take.

ETF Summary

- S&P 500 (SPY) 454 to 452 watching for support.

- Russell 2000 (IWM) 214 next support area.

- Dow (DIA) 343.62 the 200-DMA.

- NASDAQ (QQQ) 387-384 next area to hold.

- KRE (Regional Banks) 2 closes under 50-DMA at 71.32 will confirm a cautionary phase change.

- SMH (Semiconductors) 314 next resistance area. 297 minor support level.

- IYT (Transportation) 258.95 the 200-DMA.

- IBB (Biotechnology) Could easily test support at 150.21.

- XRT (Retail) Now watching to hold over the 200-DMA at 93.33.

- Junk Bonds (JNK) 106.48 needs to hold.

- SLV (Silver) Needs to find support.

- USO (US Oil Fund) Needs to get back over the 200-DMA at 48.09.

- TLT (iShares 20+ Year Treasuries) 151.82 resistance area.

- DBA (Agriculture) Needs to close over 19.37 the 50-DMA.