Market Brief

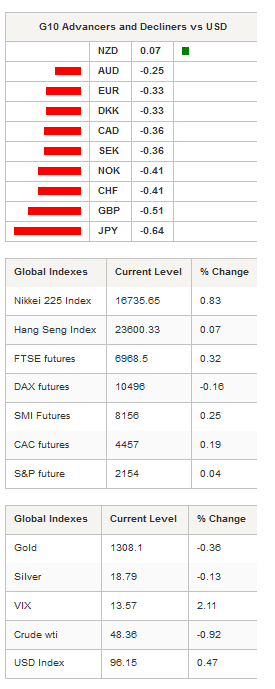

The Japanese yen went under renewed downside pressure as the Bank of Japan’s quarterly Tankan sentiment survey showed that Japanese companies revised their inflation expectation to the downside, expecting now consumer prices to rise 0.6% in the next year compared to 0.7% in the July report. USD/JPY tested 102.39 in Tokyo as a lower reading means that the central bank will have to step in try to lift those expectations. USD/JPY will most likely continue to trade with an upside bias, especially since the last economic data from US suggests that the manufacturing sector stabilized in September.

The ISM manufacturing index rebounded in September after a dip below the 50 threshold in the previous month. The ISM headline printed at 51.5 in September from 49.4 in the previous month on solid improvement in new orders and production. However, employment remained below the neutral threshold, printing at 49.7 versus 48.3 prior. In our opinion it is a bit early to talk about a rebound, especially after the severe slowdown of the manufacturing sector in 2014-2015. Similarly, the Markit manufacturing PMI came in slightly above expectations at 51.5 versus 51.4 median forecast. The US dollar rallied strongly in Tokyo with the dollar index surging 0.45% to 96.11.

The pound sterling was also in free fall this morning and broke the low from July 6. GBP/USD reached 1.2765 in early European session, the lowest level since June 1985. After months of hemming and hawing, the UK government decided to put the Brexit process on schedule, setting the timing for triggering Article 50 by the end of the first quarter 2017. Since Monday, the market has been panicking again as the potential effect of the Brexit are still unclear.

In the equity market, Asian regional markets were broadly trading in positive territory, while China is closed for the Golden week holiday. The Nikkei was up 0.83% and the broader Topix index rose 0.71%. In Europe, German futures were blinking red despite easing fears over DB. In the UK, the futures on the FTSE were up 0.30%, while the ones on the SMI rose 0.29%.

Currency Tech

EUR/USD

R 2: 1.1616

R 1: 1.1428

CURRENT: 1.1171

S 1: 1.1046

S 2: 1.0913

GBP/USD

R 2: 1.3445

R 1: 1.3121

CURRENT: 1.2777

S 1: 1.2000

S 2: 1.0520

USD/JPY

R 2: 107.90

R 1: 104.32

CURRENT: 102.45

S 1: 99.02

S 2: 96.57

USD/CHF

R 2: 0.9956

R 1: 0.9885

CURRENT: 0.9779

S 1: 0.9522

S 2: 0.9444