Market Brief

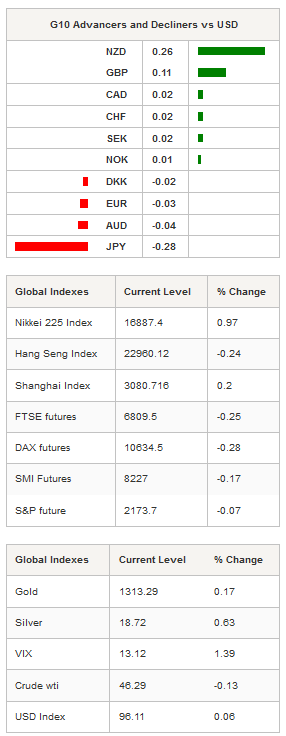

The yen slid further in Tokyo after data showed that Japan’s industrial production remained unchanged in July and that it widely missed the median forecast. After breaking the 102.83 resistance implied by the high from August 2, USD/JPY managed to stay above that resistance as it consolidated gains at around 1.0315. Japan’s industrial production came in flat in July, well below the forecast of +0.8%m/m and the previous reading of +2.3%m/m. On a year-over-year basis, industrial production contracted 3.8%, while the market was looking for a figure closer to -3.0%. It looks like a discouraging start to the third quarter; however, looking at the details, the weak July figures were mostly due to the sharp contraction in inventories, which could be interpreted as either a good or a bad sign. However, over the last few months, the FX market has been almost insensitive to economic data from Japan with the USD/JPY being exclusively driven by central bank (BoJ and Fed) announcements and market sentiment (risk-on/risk-off). We expect the dollar to continue strengthening as market participants continue to gradually price in an interest rate hike from the US.

The South Korean won surged 0.45% against the greenback on Wednesday after strong industrial production figures. The industrial production gauge increased 1.6%y/y in July, beating estimates of 0.4% and above the previous month’s reading of 0.8%. USD/KRW slid 0.35% to 1,114.8.

In New Zealand, the Kiwi extended gains as the business confidence survey suggests that the economy still has some good days ahead. The confidence index eased slightly to 15.5 in August from 16 in July, but still well above its 12 month moving average (currently at 6.6). NZD/USD initially rose to 0.7254 before easing to 0.7230 as USD bulls returned. The Fed tightening story will be the main driver and should add substantial pressure on the currency pair.

In the equity market, Japanese stocks took advantage of the sharp depreciation of the yen as the broad Topix index rose 1.27%, while the Nikkei was up 0.97%. Mainland Chinese shares were trading in positive territory with the CSI 300 rising 0.34%. In Hong Kong, the Hang Seng was off 0.26%, while in Taiwan the Taiex slid 0.46%. In Europe, equity futures are slightly off, pointing to a lower open.

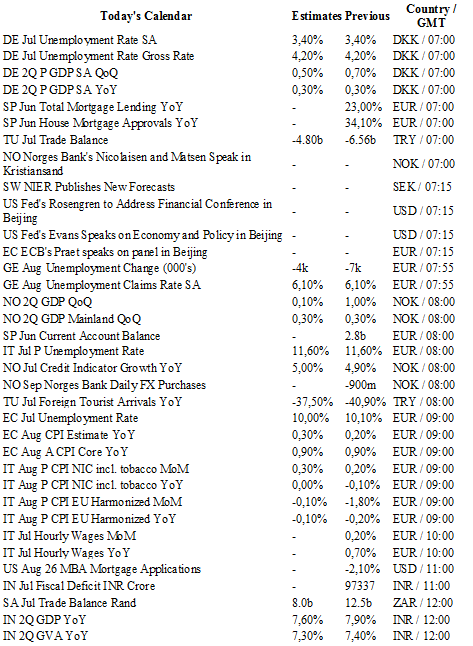

Today traders will be watching GDP from Denmark; trade balance from Turkey; unemployment from Germany; GDP from Norway; CPI from the euro zone and Italy; MBA mortgage application, ADP, Chicago purchasing manager, pending home sales and US crude oil inventories; interest rate decision, primary budget balance and GDP from Brazil.

Currency Tech

EUR/USD

R 2: 1.1616

R 1: 1.1428

CURRENT: 1.1142

S 1: 1.1046

S 2: 1.0913

GBP/USD

R 2: 1.3534

R 1: 1.3372

CURRENT: 1.3099

S 1: 1.2851

S 2: 1.2798

USD/PY

R 2: 107.90

R 1: 105.63

CURRENT: 103.20

S 1: 99.02

S 2: 96.57

USD/CHF

R 2: 1.0328

R 1: 0.9956

CURRENT: 0.9838

S 1: 0.9522

S 2: 0.9444