This post was written exclusively for Investing.com

The talk of the town lately seems to be that the recent stock market gains are directly tied to the Federal Reserve’s re-expansion of the balance sheet. But in fact, a fair comparison of the activity of the three major central banks, the Fed, the European Central Bank and the Bank of Japan, tell quite a different story.

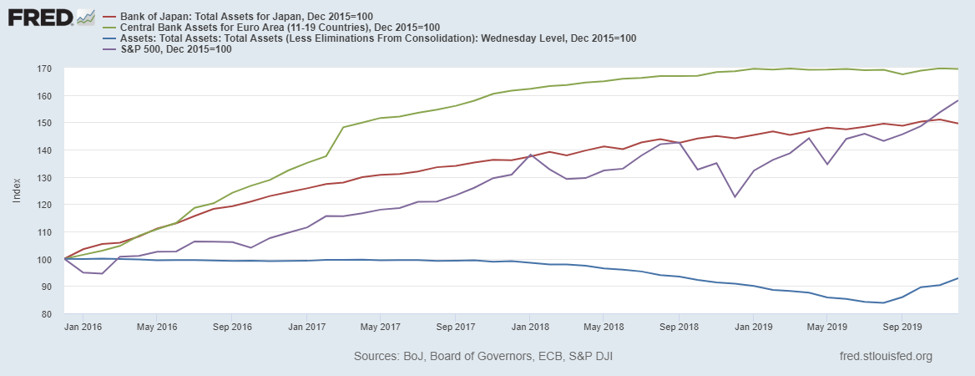

When comparing the S&P 500 to the three central bank’s balance sheets, it appears to resemble that of the ECB and the BOJ more closely than that of the Fed. The charts show the S&P 500 certainly had no problem rising from the end of 2016 throughout most of 2018, all while the Fed was raising rates and shrinking the balance sheet.

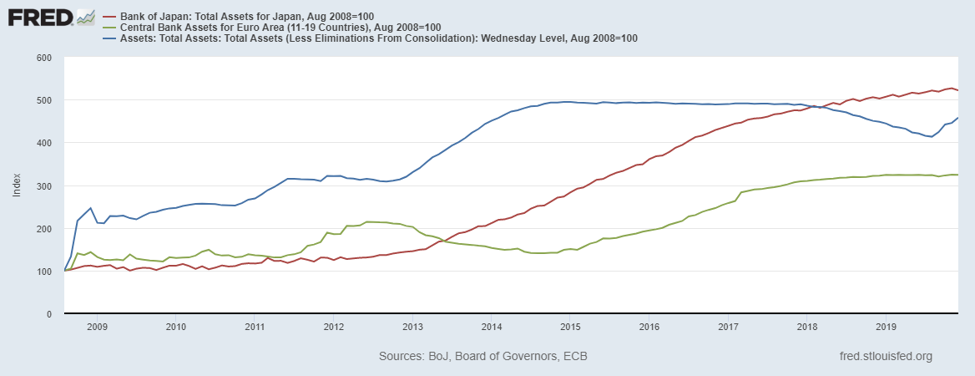

Balance Sheet Expansion

The data shows when indexing the three central monetary expansion since August 2008; the BOJ has continually been the most aggressive central bank adding to its balance sheet, rising by nearly fivefold presently to ¥573 trillion from ¥110 trillion at the end of 2018. However, the Fed stopped raising its balance sheet entirely by the end of 2014.

It’s Not Just the Fed

When digging into the data more recently, it shows the ECB and BOJ have rapidly expanded their balance sheets since December 2015. From that time through September 2018, the S&P 500 rose by roughly 40%. That was while the balance sheet of the Fed fell by around 6%. In fact, by August 2019, the Fed’s balance sheet had declined by almost 16%. Meanwhile, the stock market was in the process of rebounding from a global growth scare in the fourth quarter of 2018.

Perhaps one could argue that it was the rapid expansion of the balance sheet of the BOJ, which rose by roughly 50%, and the ECB which climbed by 70%, which is responsible for the markets climb higher. The increase in the S&P 500 since the end of 2015, appears to resemble that of the BOJ and the ECB balance sheet, more than that of the Fed at that time.

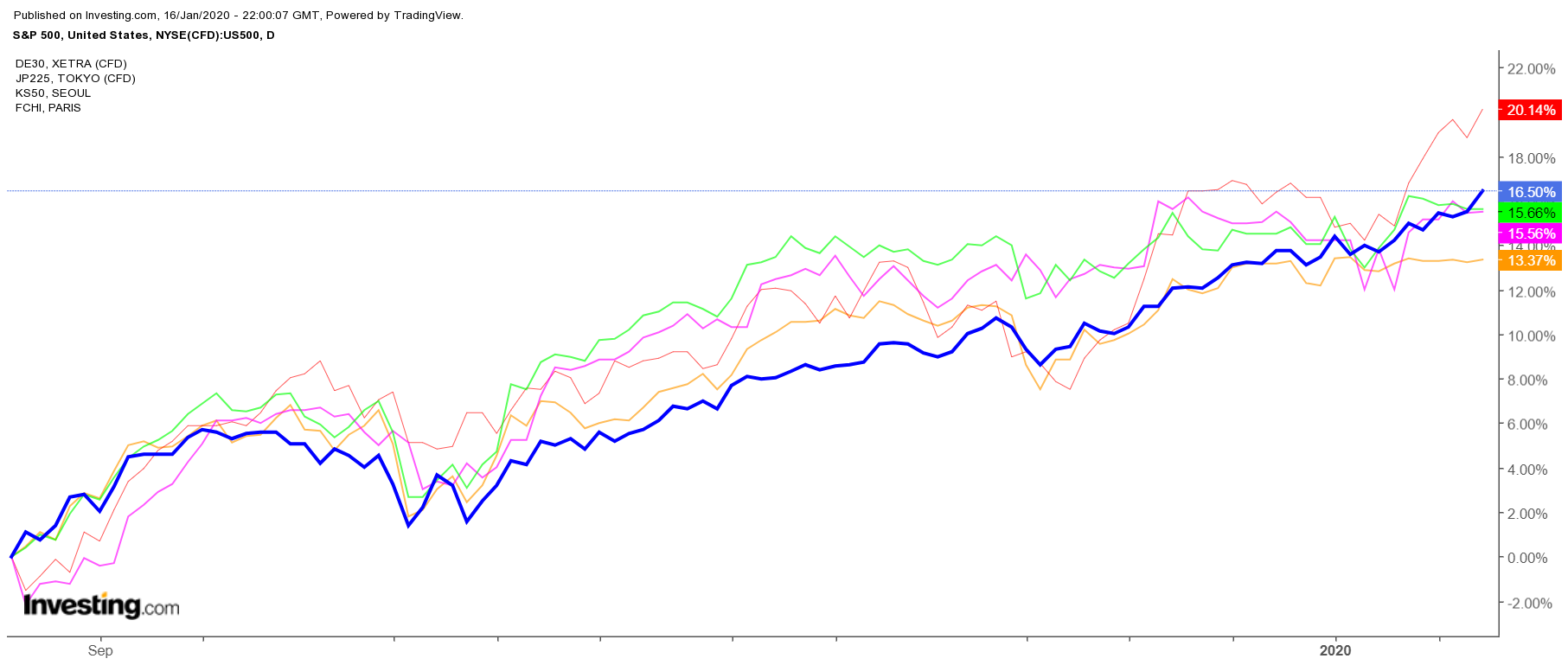

Global Equity Market Rally

What is even more interesting is that the recent equity market rally isn’t happening just in the U.S. stock market. Markets in Europe and Asia have rallied sharply since the beginning of October 2019. So perhaps there is something more to the recent rally, then the Fed’s balance sheet expansion.

Since reaching its low in August, the Fed has increased its balance sheet by about $400 billion through December. Meanwhile, the balance sheets of the BOJ and ECB have been stable. However, since August 23, the S&P 500 has risen almost 16.5%, the German DAX has climbed by around 15.6% and the Nikkei has jumped by 15.5%. Also, the South Korean KOSPI has improved by over 20%, and the French CAC is up 13.3%, and the list goes on.

Is the Fed’s ramping-up of the balance sheet over the last four months responsible for the entire global equity markets recent rally? Anything is possible. It is also just as likely that the ECB and BOJ have had a hand in it as well. But, it could be just as likely that the rise is due to fears of a global growth slow down and recession have eased, which is resulting in optimism returning to the markets, and projections for faster earnings growth in the future, while still trading at a historically reasonable valuations.

Just how long the equity markets around the world will continue to rise seems to be anyone’s guess. If the markets are rising because of optimism that the global economy is improving, then it could just be the start of a longer-term path higher. If it is genuinely the Fed lifting the entire global equity market, then we all better hope they don’t stop.