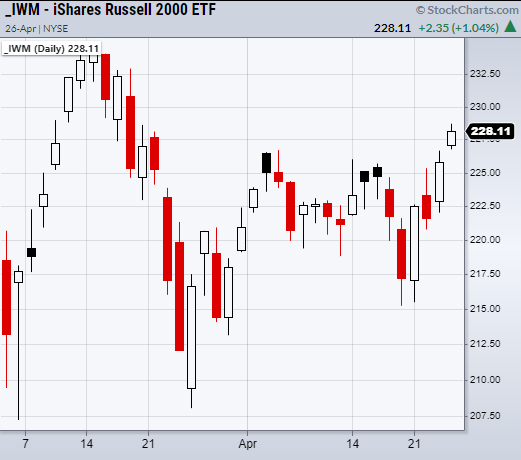

Sunday, we concluded that if most of the major indices could clear to new highs, along with the Russell 2000's iShares Russell 2000 ETF (NYSE:IWM) breaking out of resistance from $226.69, the market had the potential to make a powerful move up.

However, while none of the indices broke out to new highs Monday, IWM was able to clear its pivotal resistance level at $226.69.

This is important because IWM has been lagging for most of April, while the NASDAQ100 Invesco QQQ Trust (NASDAQ:QQQ), Dow Jones—SPDR® Dow Jones Industrial Average ETF Trust (NYSE:DIA), and S&P 500's SPDR® S&P 500 (NYSE:SPY) were able to break to new highs and are currently holding near them.

A continued rotation back into the small caps would be a healthy shift for the market; especially if the other indices hold their current price levels.

Next, we can watch for IWM to head back to new highs at $234.53.

To add more depth to the current market picture, key sectors, like biotech—iShares NASDAQ Biotechnology ETF (NASDAQ:IBB) and semiconductors—VanEck Vectors Semiconductor ETF (NYSE:SMH)—were able to clear or hold over pivotal areas.

SMH made a break back through its 10-Day moving average and IBB had a second daily close over its 50-DMA.

This confirmed a bullish phase change.

However, if the major indices cannot clear to new highs, we have 3 main price levels to watch for.

- SMH to hold over its 10-DMA at $249.28.

- IWM to stay over $226.69 as a new support level.

- IBB to stay over the 50-DMA at $154.42.

ETF Summary

- S&P 500 (SPY) Doji day. Holding near highs.

- Russell 2000 (IWM) 234.53 high to clear.

- Dow (DIA) 342.43 high to clear.

- NASDAQ (QQQ) 342.23 high to clear.

- KRE (Regional Banks) Doji day. Support 66.68.

- SMH (Semiconductors) 258.59 resistance.

- IYT (Transportation) 262.85 the 10-DMA.

- IBB (Biotechnology) Confirmed bullish phase change over the 50-DMA at 154.42.

- XRT (Retail) Like this to hold over the 10-DMA at 91.86.

- Volatility Index (VXX) Doji day.

- Junk Bonds (JNK) 108.56 support.

- XLU (Utilities) Broke support of the 10-DMA at 66.67.

- SLV (Silver) Watching to hold over 24.

- VBK (Small Cap Growth ETF) 288.11 new support.

- UGA (US Gas Fund) Held over 50-DMA at 31.82.

- TLT (iShares 20+ Year Treasuries) 140.34 resistance.

- USD (Dollar) 2 Doji days in a row. Watching to hold over 90.68.

- MJ (Alternative Harvest ETF) Looks good if it holds over the 10-DMA at 20.96.

- LIT (Lithium) Holding over the 50-DMA.

- XOP (Oil and Gas Exploration) Cleared the 10-DMA at 76.86.

- DBA (Agriculture) 18.75 next main resistance area from 80-month moving average.