Financial markets opened in a risk-averse mood on Monday due to the escalation of the Russia-Ukraine crisis. Still, sentiment improved during the Asian session today, perhaps due to willingness by both sides to continue negotiating.

Overnight, besides headlines surrounding geopolitics, we also had an RBA decision. The bank kept all its policy tools untouched as expected and noted that the war in Ukraine is a source of uncertainty.

EU and US Shares Slide Due to Escalation in Ukraine, RBA Highlights Uncertainty

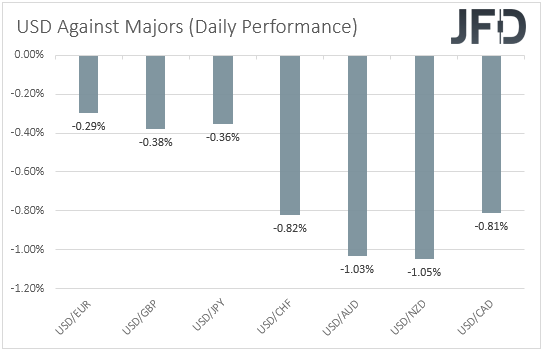

The US dollar was found lower against all the other major currencies during the early European morning Tuesday, despite opening the week higher. The main gainers were AUD, NZD, and CAD, while the currencies against which the greenback lost the least ground were GBP, JPY, and EUR.

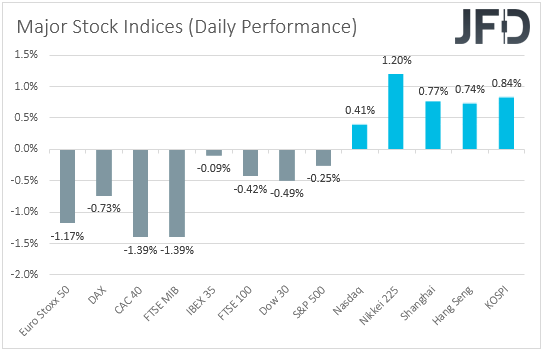

The weakening of the US dollar and the strengthening of the risk-linked currencies Aussie, Kiwi, and Loonie, suggests that market sentiment improved again at some point yesterday, or today in Asia. Turning our gaze to the equity world, we see that major European indices slid again due to the Russia-Ukraine crisis intensifying over the weekend, with Wall Street following suit.

The exception was NASDAQ, gaining 0.41%, helped by Tesla (NASDAQ:TSLA) and Rivian Automotive (NASDAQ:RIVN), which jumped 7.5% and 6.5%, respectively. Appetite improved during the Asian session today, with all indices under our radar trading in the green.

As we already noted, Russia intensified its attacks in Ukraine over the weekend. The West announced more and stricter sanctions, including blocking some Russian banks from the SWIFT international payment system. Russian President Putin responded by putting nuclear-armed forces on high alert.

Due to that, financial markets opened in a risk-averse mode yesterday, but the selling paused for breath during the Asian session today. Although high-level talks between the two nations ended with no common ground yesterday, the willingness of both sides to continue negotiating may have been seen as a sign of no immediate escalation of sanctions.

As for our view, it remains the same as yesterday and last week. It is too early to say that the worst is behind us, that stricter sanctions will not be imposed, and that no other nation will be militarily involved. Therefore, we stick to our guns that even if the current relief bounce continues for a while more, there is a decent chance for stock markets to experience another round of selling. In other words, we still see the risks as tilted to the downside.

Now, with regards to the FX market, the ultimate loser is the Russian ruble, which plunged as much as 30% after the West imposed new sanctions against Russia, with USD/RUB hitting a record of 120 before clawing back some losses to 101, after the Russian central bank hiked interest rates from 9.5% to 20%.

This was an emergency move to support the currency, as due to the latest sanctions, the Bank cannot intervene by selling foreign currencies. Among the majors, the ones suffering the most appear to be the euro and the pound, while the traditional risk-linked Aussi, Kiwi, and Loonie have not been hurt that much.

The main reason could be that the crisis is driving energy and other commodity prices up due to supply disruption concerns. As commodity-linked assets as well, these currencies stayed relatively supported.

Speaking about the Aussie, overnight, besides headlines surrounding Russia and Ukraine, we also had an RBA monetary policy decision. The bank kept all its policy tools untouched as was widely expected. At the same time, in the accompanying statement, officials maintained their commitment to keeping supportive monetary conditions, repeating that they will not increase rates until actual inflation is sustainably within the 2-3% target range.

They also added that “the war in Ukraine is a major source of uncertainty,” leaving no room for participants to accelerate their tightening expectations. And yet, the Aussie continued climbing higher. As we already mentioned, the only reasonable explanation may be that it draws support from the rising energy and commodity prices.

S&P 500 – Technical Outlook

The S&P 500 cash index opened with a negative gap yesterday but hit support at 4260 and entered a recovery mode after that. At the time of writing, the index is very close to the 4392 barrier, marked by Friday’s high, but still below the downside resistance line drawn from the peak of Jan. 4. Thus, even if the recovery continues for a while more, we see decent chances for the bears to jump back into the action.

The selling could start from near the 4435 barrier, or the aforementioned downside line. This may result in another slide towards the 4260 zone, marked by yesterday’s low, or the 4220 territory, marked by the low of Jan. 24. If neither zone is able to stop the fall, then we could see it extending all the way back down to the low of Feb. 24, at 4105.

In order to abandon the bearish case, we would like to see a strong recovery above 4525. This may confirm the break above the aforementioned downside line and perhaps see scope for advances towards the 4595 zone, which provided strong resistance on February 2nd and 9th. If investors are not willing to stop there, then we may see them pushing towards the 4677 zone, marked by the high of Jan. 16, the break of which could trigger extension towards the 4745 or 4773 zones. Slightly higher lies the record peak of 4817, which hit on Jan. 4.

AUD/USD – Technical Outlook

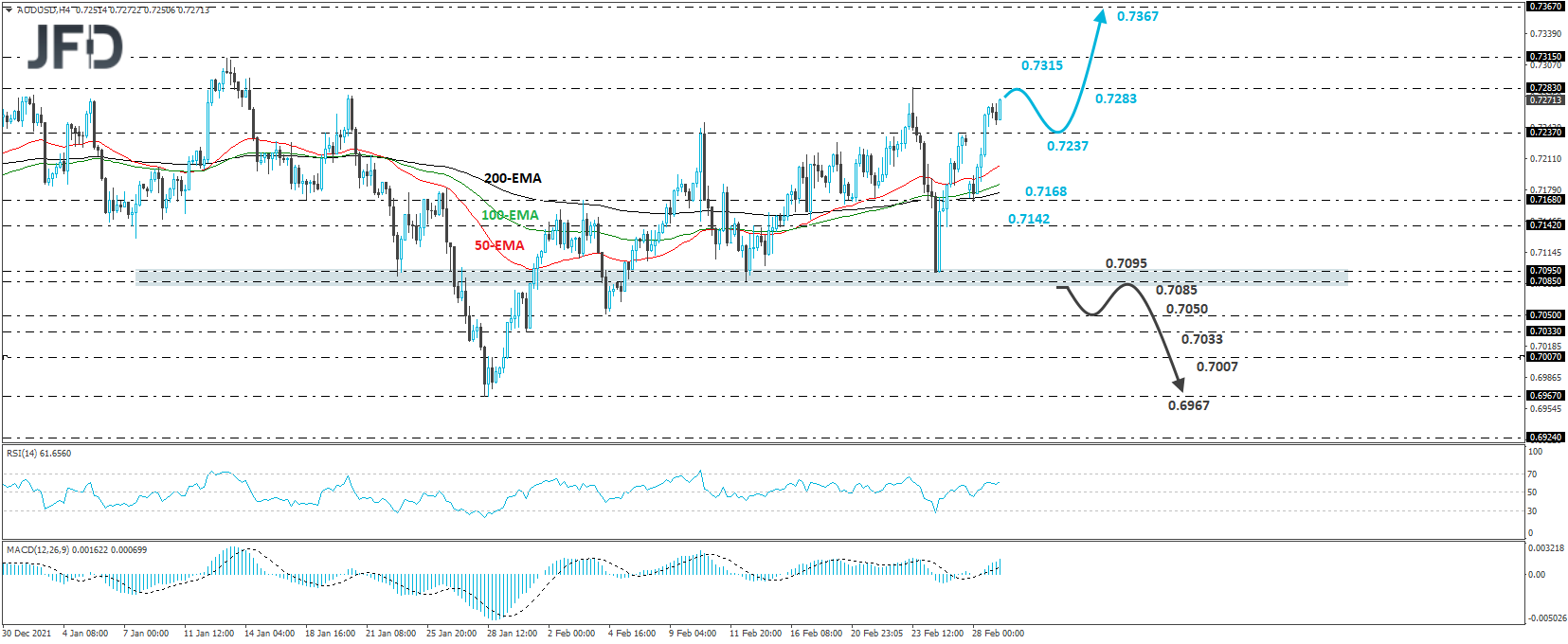

AUD/USD also opened with a negative gap yesterday, but hit support at 0.7168, and then, it started to march north. The rate overcame Friday’s peak of 0.7237, and now, it is very close to the peak of last Wednesday, at 0.7283. Despite the latest risk aversion, the most recent price structure still suggests higher highs and higher lows, with a potential break above 0.7283, confirming a higher high on the daily chart. Therefore, we will consider the near-term outlook to still be cautiously positive.

As we already noted, a break above 0.7283 will confirm a forthcoming higher high and perhaps allow advances towards the peak of Jan. 13, at 0.7315. If the bulls are not willing to stop there, then a break higher could carry larger bullish implications, perhaps setting the stage for extensions towards the peaks of November 15th and 16th, at around 0.7367.

On the downside, we would like to see a clear and decisive dip below the key support zone of 0.7085/95, marked by the lows of Feb. 14 and 24, before we start examining whether the bears have gained full control. This could initially open the path towards the low of Feb. 4, at 0.7050, or the low of Feb. 1, at 0.7033.

If the bears do not want to stop there, we could see them diving towards the 0.7007 zone, the break of which could carry extensions towards the low of Jan. 28, at 0.6967.

As for the Rest of Today’s Events

During the European session, Germany’s preliminary inflation data for February are coming out, with both the CPI and HICP rates expected to have drifted further north. Specifically, the CPI rate is forecast to inch up to +5.1% YoY from +4.9%, while the HICP one is to have risen to +5.4% YoY from +5.1%.

From Canada, we have the GDP numbers for Q4 and December. The annualized QoQ rate is expected to have risen to +6.2% from +5.4%, but the monthly one for December could have slid to +0.1% from +0.6%. At its latest gathering, the BoC decided to keep interest rates untouched at 0.25%, at a time when the financial community was expecting a hike.

In the statement accompanying the decision, it was noted that the Council expects rates to increase and that the overall economic slack is now absorbed, which means that they are more likely to hit the hike button tomorrow.

Therefore, with that in mind and also taking into account the upside surprise in the CPI numbers for January, we doubt that a slowdown in economic activity for the month of December will be enough to prevent officials from pushing the hike button tomorrow. After all, for the quarter as a whole, the economy is forecast to have improved.

Elsewhere, we have the final Markit manufacturing PMIs for February from the Eurozone, the UK, and the US, and as is usually the case, they are expected to confirm their preliminary estimates. From the US, we also get the ISM manufacturing index for the month, which is forecast to have risen fractionally, to 58.0 from 57.6.