One of the main talking points from economists and strategists last week was the growing divergence in economic trends between the US and many other developed and emerging economies.

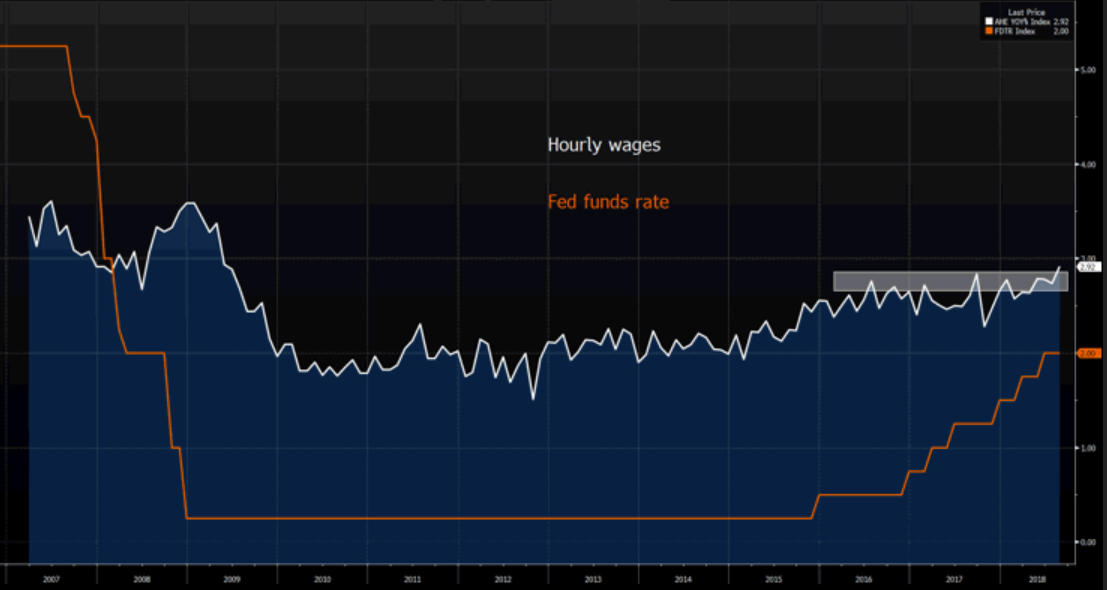

Germany especially has been touted as the economy which best represents this divergence, detailing poor factory orders and industrial production through the week. At the same time, we have seen such strong US data points, with ISM services and manufacturing blitzing expectations, portraying an economy pushing GDP growth of just north of 3% in Q3, although the NowCast models of the Atlanta or St Louis Fed running at 4.4% and 4.3% respectively. Growth is one aspect, but all the talk on Friday was on the 2.9% increase in average hourly earnings, which came in at the strongest pace of growth since May 2009, and as we can see from the Bloomberg chart has broken out above 2.8%, which has been a ceiling in wages for the last two years.

Slack in the labour market is abating at seemingly every payrolls report, and there is evidence the Philips Curve could actually be working. Albeit, the translation from a tight labour market to wage growth is taking its time.

It's not surprising that the USD index found buyers on Friday, closing up a modest 0.4% but threatening to push through supply into 95.56. USDJPY was well bid through trade pushing off a session low of ¥110.38 into a high of ¥111.28. However, if traders wanted to express a view on the USD it was aimed squarely at the AUD and to a lesser extent NZD, with AUD/USD hitting a low of $0.7094, with the technical target range of $0.6850 to $0.6880 still very much in play. The twin concerns of a slowing China and a risk-off feel to global markets keeps the momentum on these pairs to the downside. Also note the bullish key outside day reversal in USD/CNH potentially also a factor, and we will need to see a higher high to confirm this reversal today and where a weaker Chinese yuan will only further reduce importers purchasing power.

This Thursday’s US core CPI could be the final piece of information the USD bulls are craving here, as the wind is already in the USD's sails, and the market has shown its sensitivity to US CPI on a number of occasions of late. On Friday we also get US August retail sales report, and a beat on the consensus of 0.4% would also be helpful, especially if the ‘control group’ element (these are the goods that feed directly into the GDP calculation) comes in hot as well, and should cement growth expectations nicely above 3% for the Q3 print.

Interest rate pricing has naturally moved in-line with the beat in US wages, as well as the beat in headline job creation of 201,000 jobs in August. There has been a decent sell-off across the fixed income curve, with the US 10-year Treasury gaining six basis points (bp) to 2.93%, although a push through the August highs of 3.01% seems a tough slog and this could offer the bonds bulls a compelling entry point. The US 10-year ‘real’ (or inflation-adjusted) Treasury yield has pushed up to 83bp and is eyeing a test of multi-year highs of 92bp. A break here will not incentivise further USD buying, but will be a green light for gold sellers to build on what is already a fairly punchy net short position – so expect the relationship between real yields and gold to pick up. It won’t do any favours for EM either, at a time when emerging markets (EM) assets can’t find a friend and outflows from EM funds are gaining momentum.

However, it’s the rates market that also interests, and clearly US rates would have had a bigger reaction if it weren’t for the fact the market is on watch for Trump to announce $200b in additional tariffs, but now we hear he has his sights set on the balance of trade and a further $267b in tariffs. That said, the fed funds future did sell-off in payrolls and are currently price in 18bp of hikes for the December meeting - putting the probability of a hike in September and December above 70%. Eurodollar futures sold off across the curve, with the difference between December 2018 and December 2020 widening 6bp, and we can see that in this two-year period the rates market is pricing 39bp of hikes, which is still not even two hikes.

Today’s Asian trade will make fascinating viewing, not just because of the moves in the currency markets, but because implied volatilities in DM markets are on a gradual rise and this has significant implications how invested certain funds can be. The leads are hardly compelling for the open, especially with the S&P 500 having printed a lower high and low for six consecutive days now, and we see the daily chart holding the 7 August highs, where a break of 2863 would attract increased short interest.

S&P 500 futures have opened largely unchanged this morning, in-line with a quite FX open, while crude futures have opened a touch

higher. The ASX 200 looks destined for an open around 6125 at this stage, which will put the index on track for a seventh straight day of losses - a move which is certainly rare. I am happy to hold off trading the open today as there is no discernible read here, and while we are getting towards ‘oversold’ levels, with the market internals showing 26% of ASX 200 stocks closing at four-week lows and just 34% closing above their 20-day moving average, we are not at that point where contrarian trades look a higher probability. Moves in Nikkei, Hang Seng and mainland China markets matter here, as could today's PBoC CNY fixing.