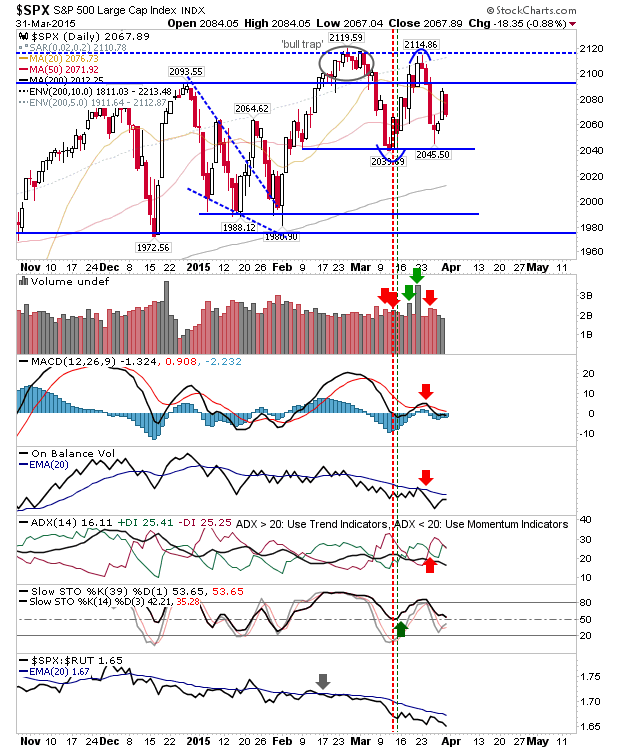

Large and Small Caps traded inside Monday's range yesterday, closing lower against Monday's higher close. While Monday's buying hasn't been totally eliminated, it will have put a dent in bullish confidence. Watch for follow through selling today.

While the S&P closed above the 20-day and 50-day MA on Monday, yesterday it closed below each of these MAs. Technicals only require a stochastic drop below the bullish mid line to turn net bearish. Relative performance against the Russell 2000 also accelerated downward.

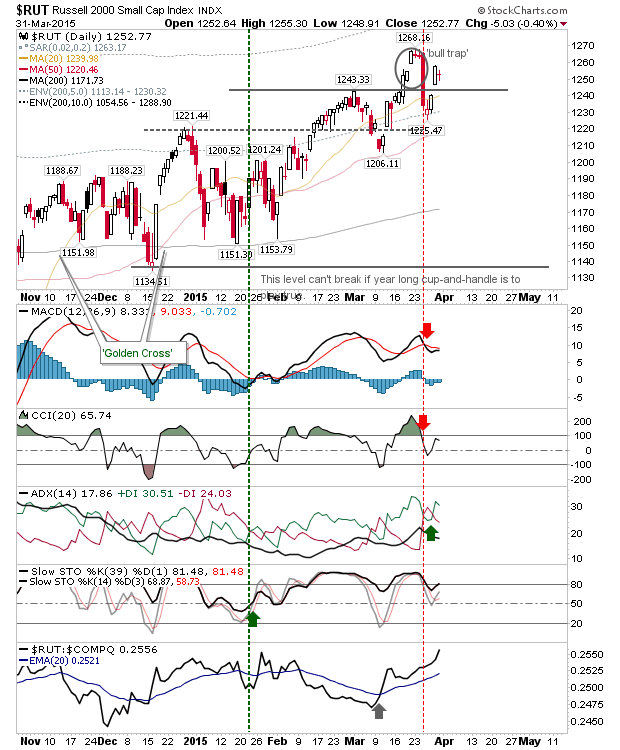

The Russell 2000 closed with a bearish harami doji, and as a result it's struggling to negate the 'bull trap.' Of the indices, Small Caps remains strongest relative to the Large Caps and Tech indices.

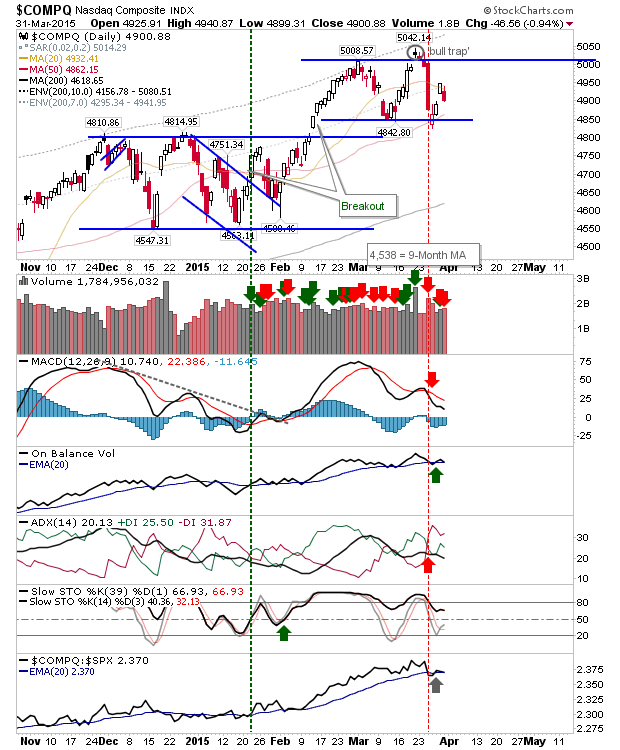

The NASDAQ pushed itself into Monday's gap, opening up the possibility for a retest of the double top neckline. Volume climbed to register a distribution day.

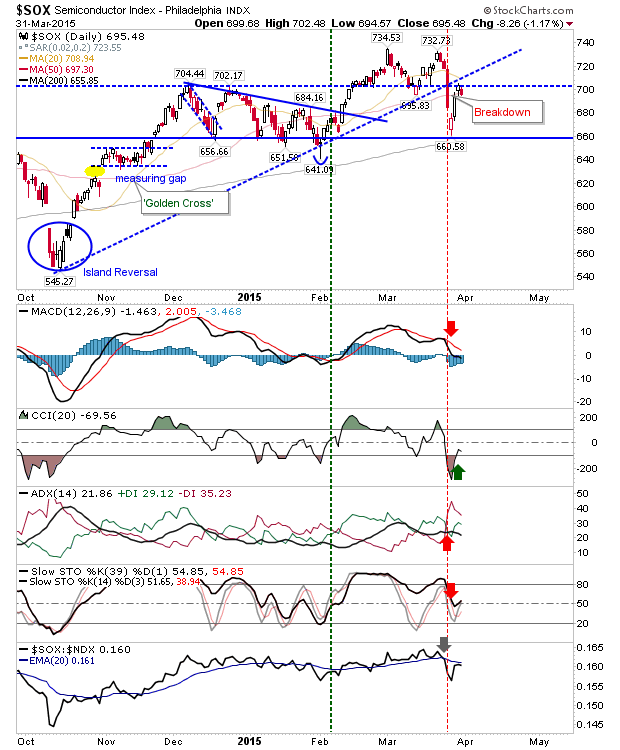

The Semiconductor Index previously confirmed a trendline breakdown, but has since rallied back to the trendline and prior resistance at 700 in a possible shorting opportunity. A push below the 50-day MA would probably confirm.

Today is likely open to additional losses with the March swing low the target. It may be more difficult for bulls to stage a return to Monday's highs.