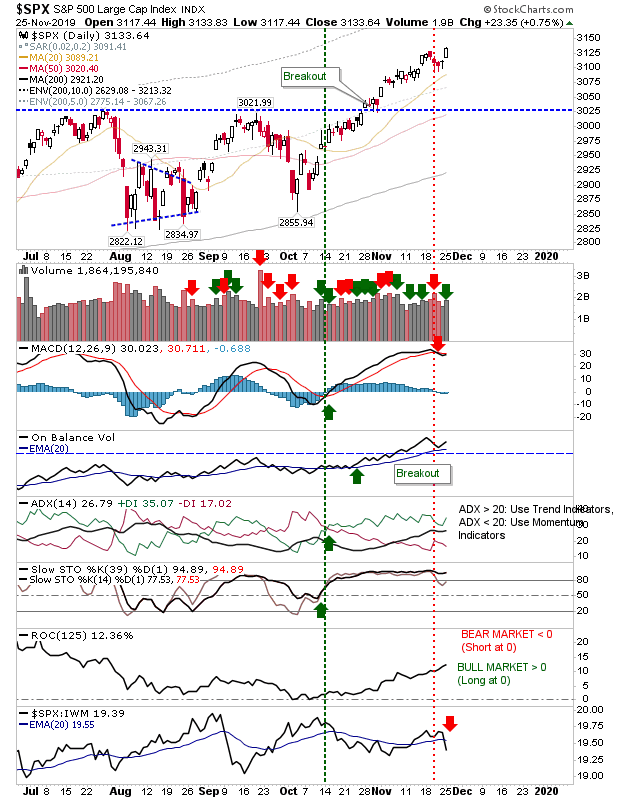

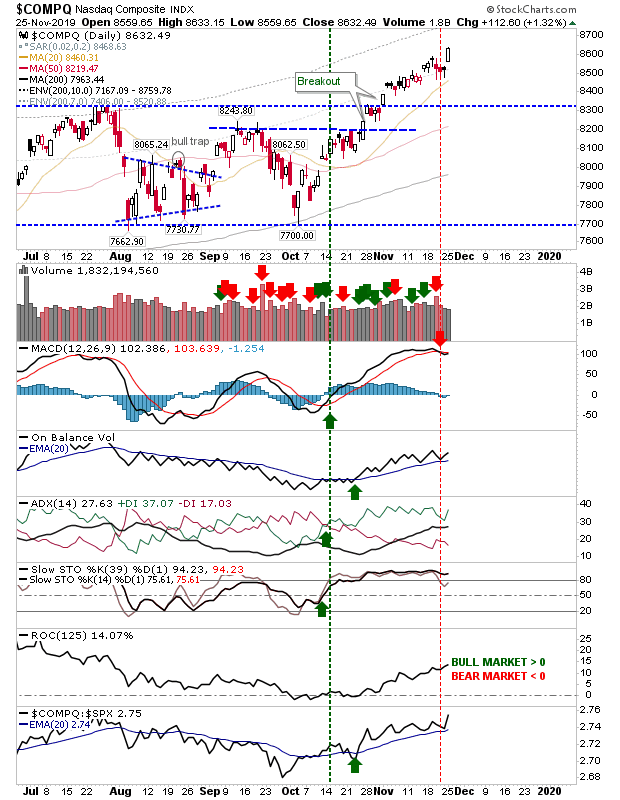

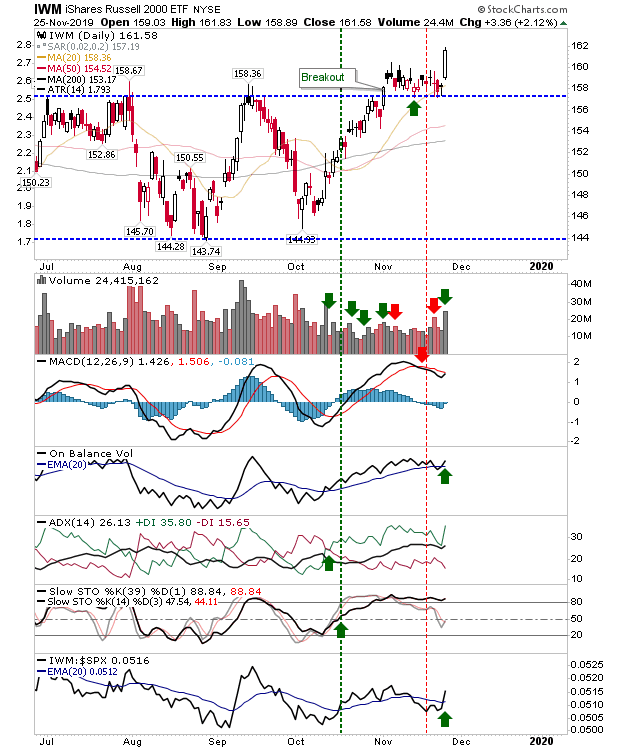

Indices didn't make big percentage moves yesterday, but gains were welcome and followed from morning gaps on higher volume accumulation.

The S&P managed to make a new closing high although it did lose relative ground against the Russell 2000—enough to register as a 'sell' trigger. However, this is bullish for the broader market as money rotates into more speculative issues.

The NASDAQ made a clearer close at highs than the S&P but didn't enjoy the same volume boost. However, relative performance ticked higher (vs the S&P).

The Russell 2000 managed to have the best of the days action. The iShares Russell 2000 ETF (NYSE:IWM) made a gap move on higher volume accumulation, registering a 2%+ gain. This came with a 'buy' signal in On-Balance-Volume and is very close to a new signal in the MACD.

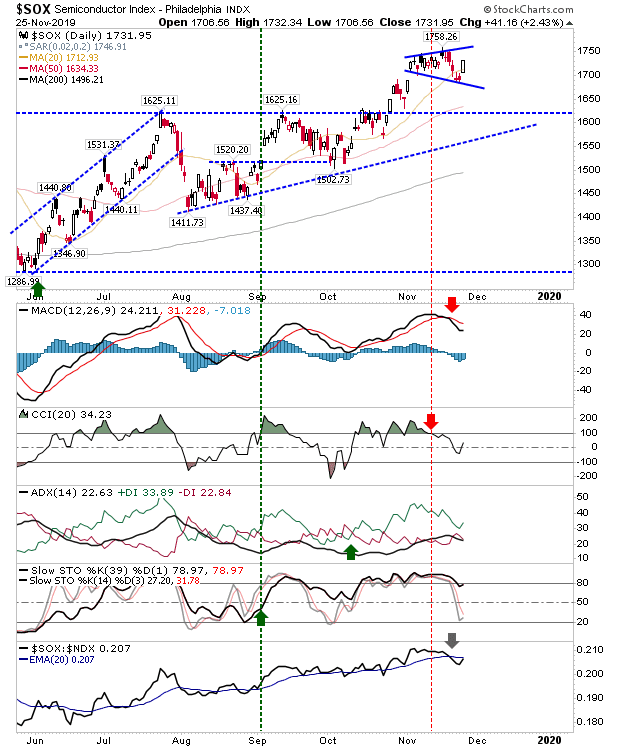

I have redrawn the move in the Semiconductor Index as a broadening wedge. It's not the best pattern to work with but we will see if the 20-day MA proves to be a better measure for support.

It was a good start for Monday and yesterday's buying helps set the tone for the week. With Indices at new 52-week highs we can now consider the doji sequence of last week as a near term support zone, along with 20-day MAs. This should be a good time for breakout stocks heading into the seasonal bullish period.