Last week, there was an opportunity for shorts to attack the returning bounce back to the channel (which was stopped by Thursday's breakout). Now, there is an opportunity to build on breakouts and re-establish rising channels.

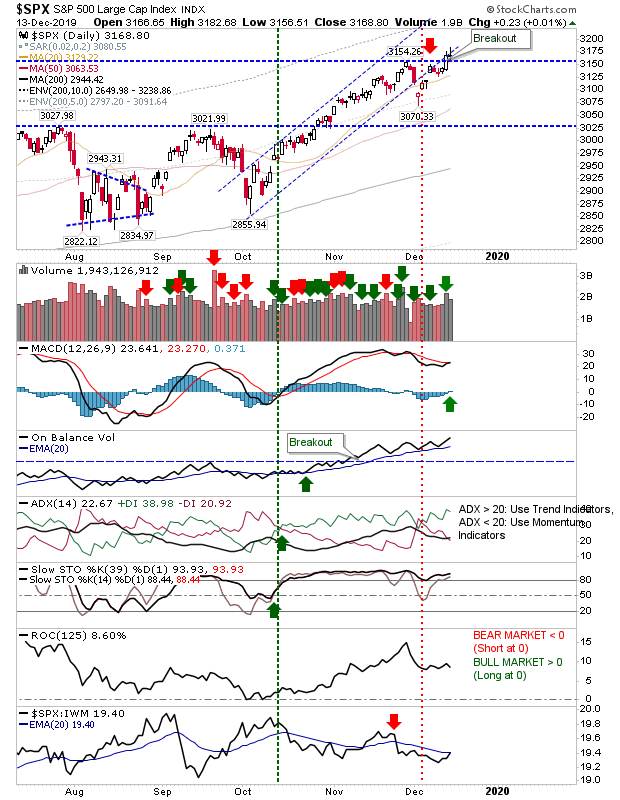

The S&P returned a MACD trigger 'buy' with relative performance against the Russell 2000 on the verge of a new 'bullish' crossover.

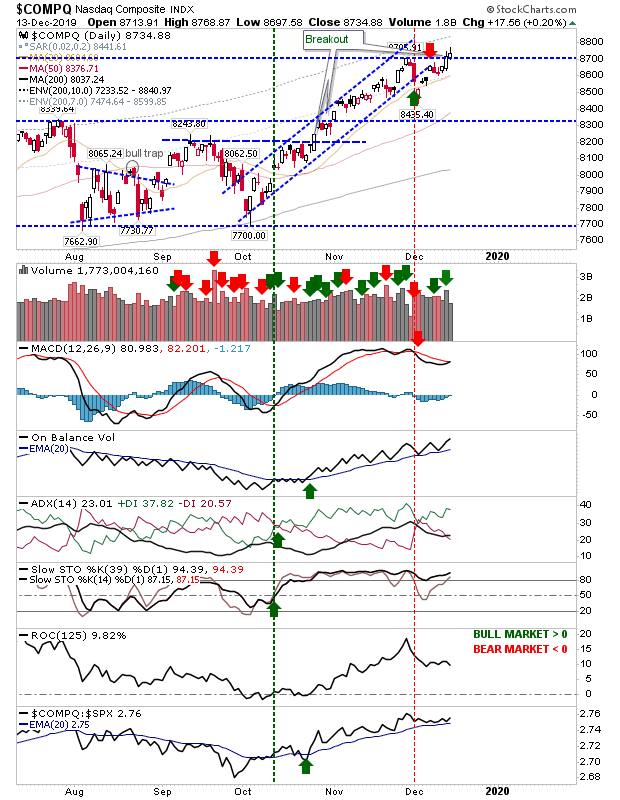

The NASDAQ edged a breakout but it's still waiting for a new MACD trigger 'buy' as all other technicals remain net positive.

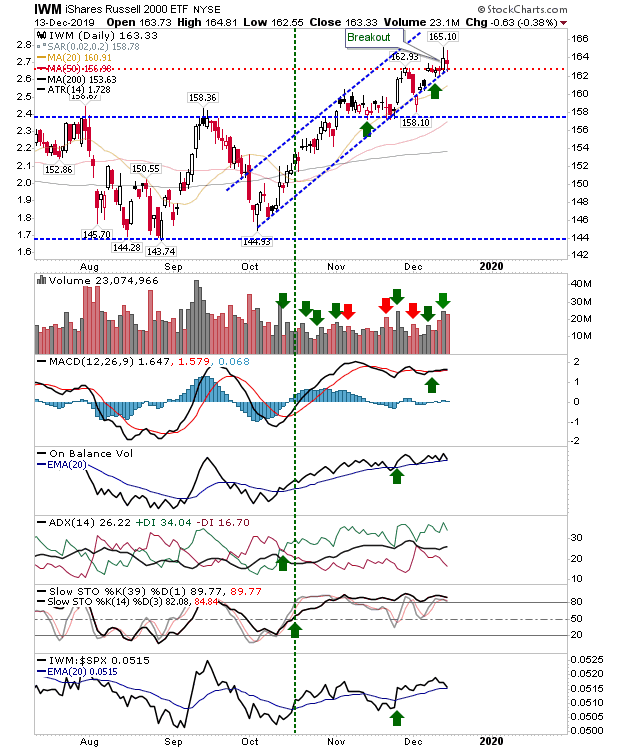

The Russell 2000 (iShares Russell 2000 ETF (NYSE:IWM)) was the only lead index to close lower on the day, but remained above breakout support. The MACD has flat-lined but On-Balance-Volume is still trending higher despite an upcoming 'sell' trigger in the latter index and the aforementioned relative performance switch against Large Cap Indices.

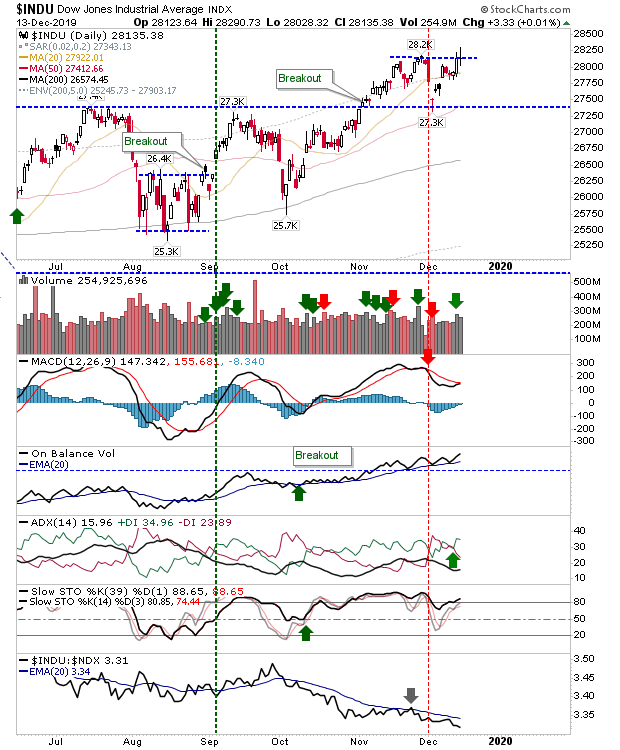

The Dow Jones index hasn't yet broken higher but is well placed to follow the action of the S&P.

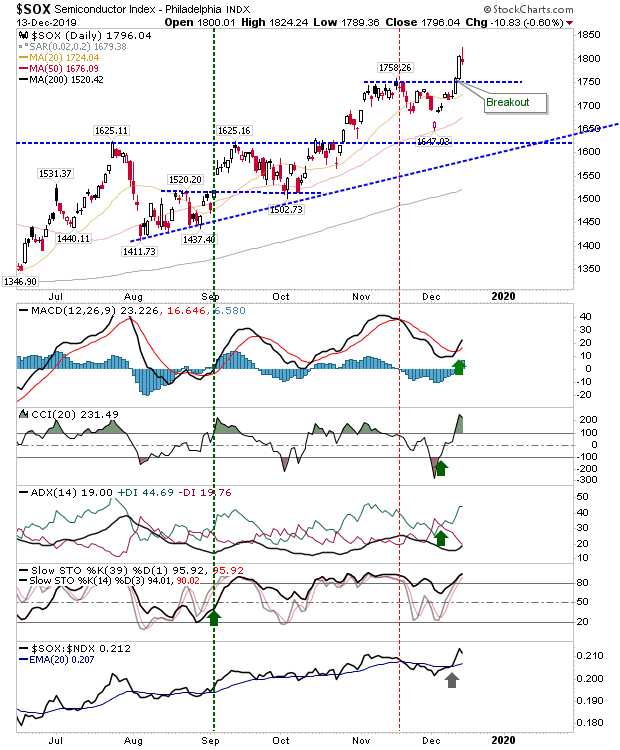

The Semiconductor Index had already put in two solid shifts on Wednesday and Thursday, so Friday was about holding those gains. The breakout has removed the broadening wedge as a pattern, so now it's just a question of building off new support of 1,755.

For Monday, with Christmas approaching it will likely be a relatively quiet week. I would be looking for the Semiconductor Index to lead and bring the NASDAQ higher; this in turn will help the S&P and Russell 2000. Seasonal factors again looking good for here into January 2020.