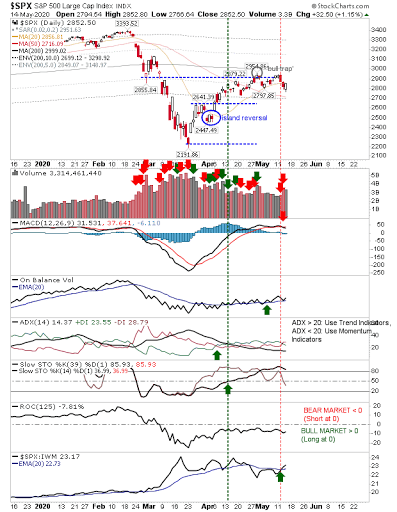

Tuesday's action marked the failure for the first challenge of the April swing high; volume climbed to register as distribution as profit takers struck the market in force. Yesterday saw some stabilization of these losses, but buying volume was down on recent selling, so it remains to be seen if this is the making of something more substantial.

The S&P is lingering around its 20-day MA. Yesterday's buying ranked as a bullish piercing pattern but the strength of this candlestick requires an oversold condition, which is not the case here.There is also the MACD trigger 'sell' to consider, although other technicals are bullish.

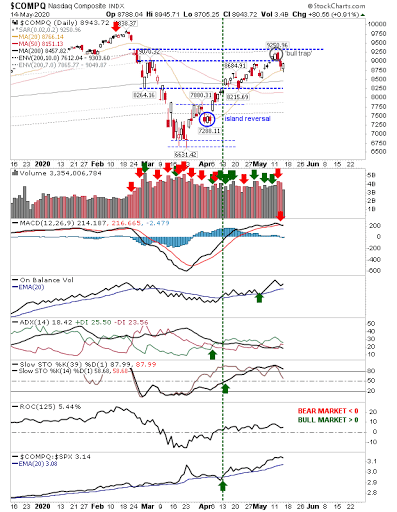

The NASDAQ similarly found support at its 20-day MA, coming as it did off a new 'bull trap.' There is a MACD trigger 'sell' to work off, but other technicals are bullish. A negation of the 'bull trap' would also mark a break into the February gap down—the last real marker for the Covid bear market. The easier path may be down, but there is a buying opportunity here with a stop below the 20-day MA.

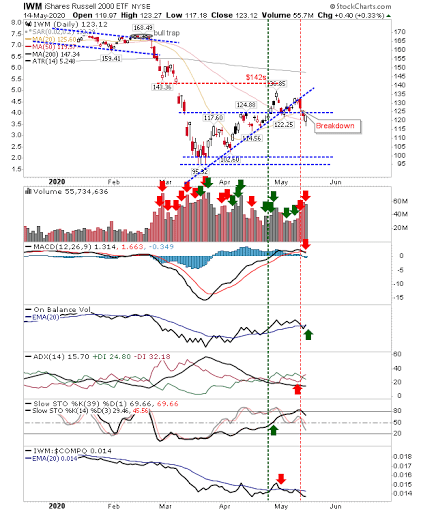

The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) managed to make its way back to support. So while it technically hasn't lost support it did make a temporary move below it. Volume was light too. Technicals are mixed; bullish Stochastics and On-Balance-Volume offset by bearish ADX, MACD and relative performance to the NASDAQ and S&P. However, it did start yesterday's rally from its 50-day MA.

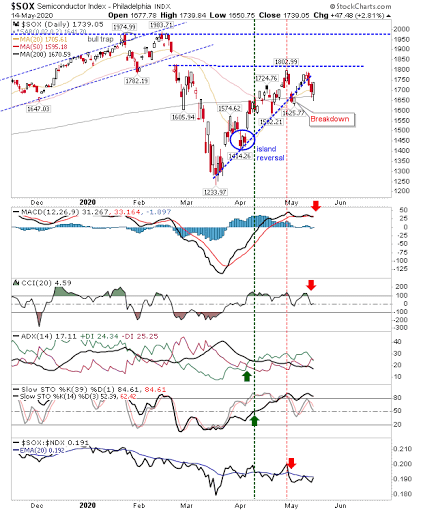

The Semiconductor Index was perhaps more impressive. It finished with a wide bullish engulfing pattern after a successful test of its 200-day MA. This is a more bullish launch pad than the aforementioned indices, although it's not without its bearish markers with 'sell' triggers in the MACD and CCI.

Going into today, there is an interesting confluence of support tests; there is the NASDAQ and S&P bouncing off their 20-day MAs, the Russell 2000 off its 50-day MA and the Semiconductor Index off its 200-day MA. In addition, there are strong bullish candlesticks to go with yesterday's buying. This should be a scenario for easy end-of-week gains, but we will see how the market does later today.