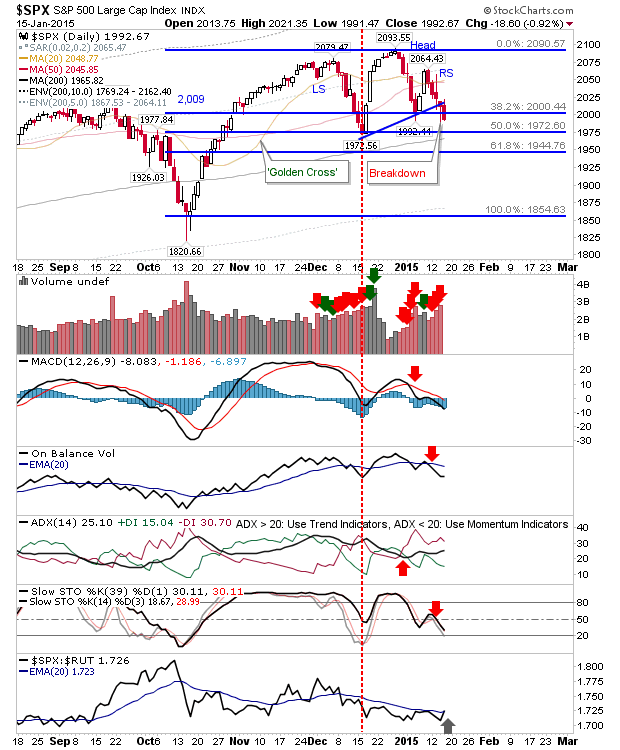

Selling returned for another day yesterday as the rising neckline connecting December and January swing lows in the S&P 500 broke lower. Volume climbed to register a distribution day, continuing a sequence of increased volume selling. The December swing low is the next level of support and is looking like a required test.

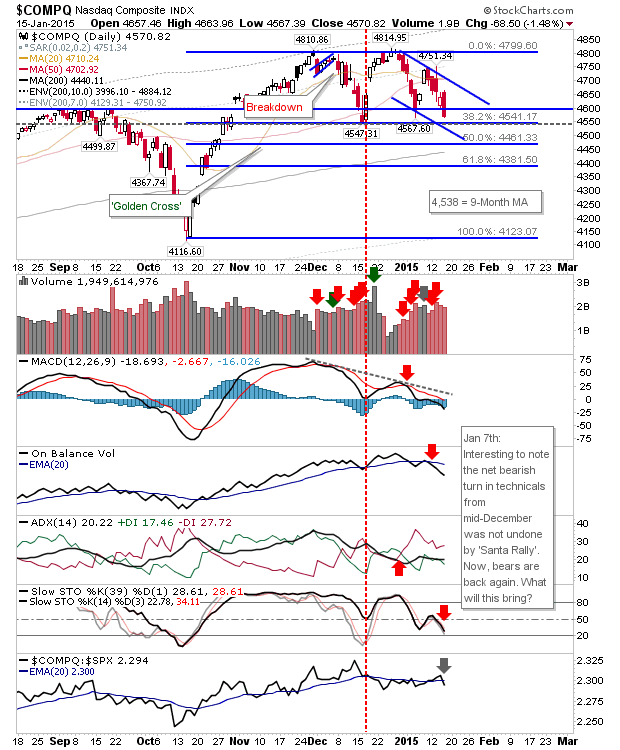

The NASDAQ finished with a bearish engulfing pattern within a falling channel. Support from September's highs is gone, with December's lows next.

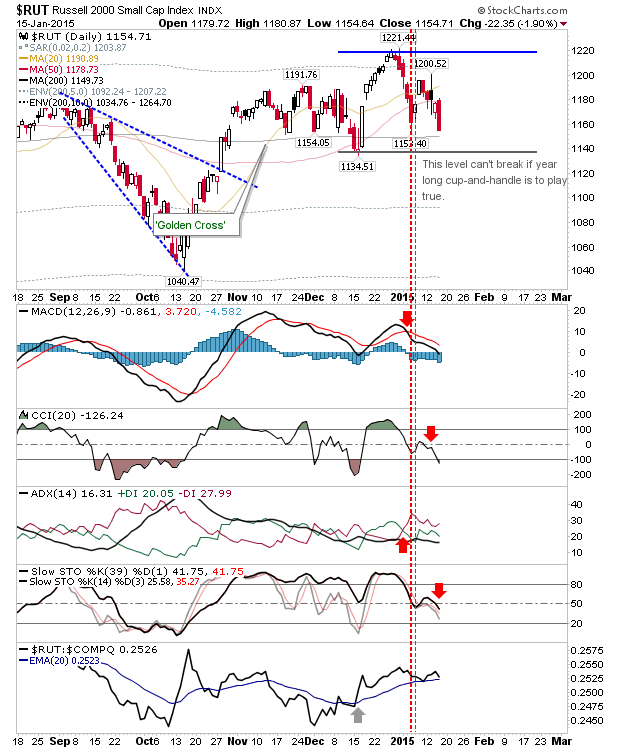

The Russell 2000 lost big too, but losses were contained by handle support and resistance. The 200-day MA is next up on the agenda, but given its flat-lining it's not as important of a test as the December swing low.

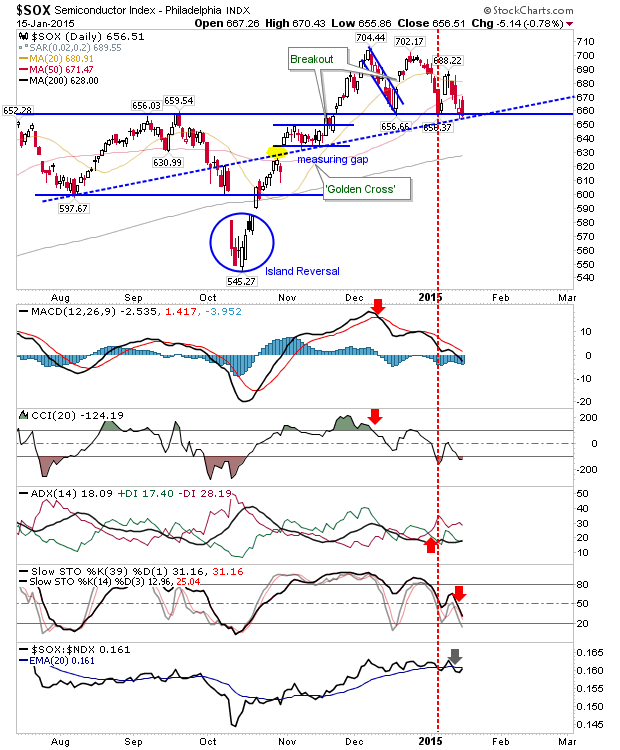

The Semiconductor Index didn't break support or trendline support. Today is a big day for the index.

Today bulls should look to the Semiconductor Index. It has a couple of support levels to work with, although a bounce is by no means guaranteed. Other indices are edging towards further weakness, but given indices have logged five losing days in a row, it's hard to favour a sixth - although yesterday's action points to such.