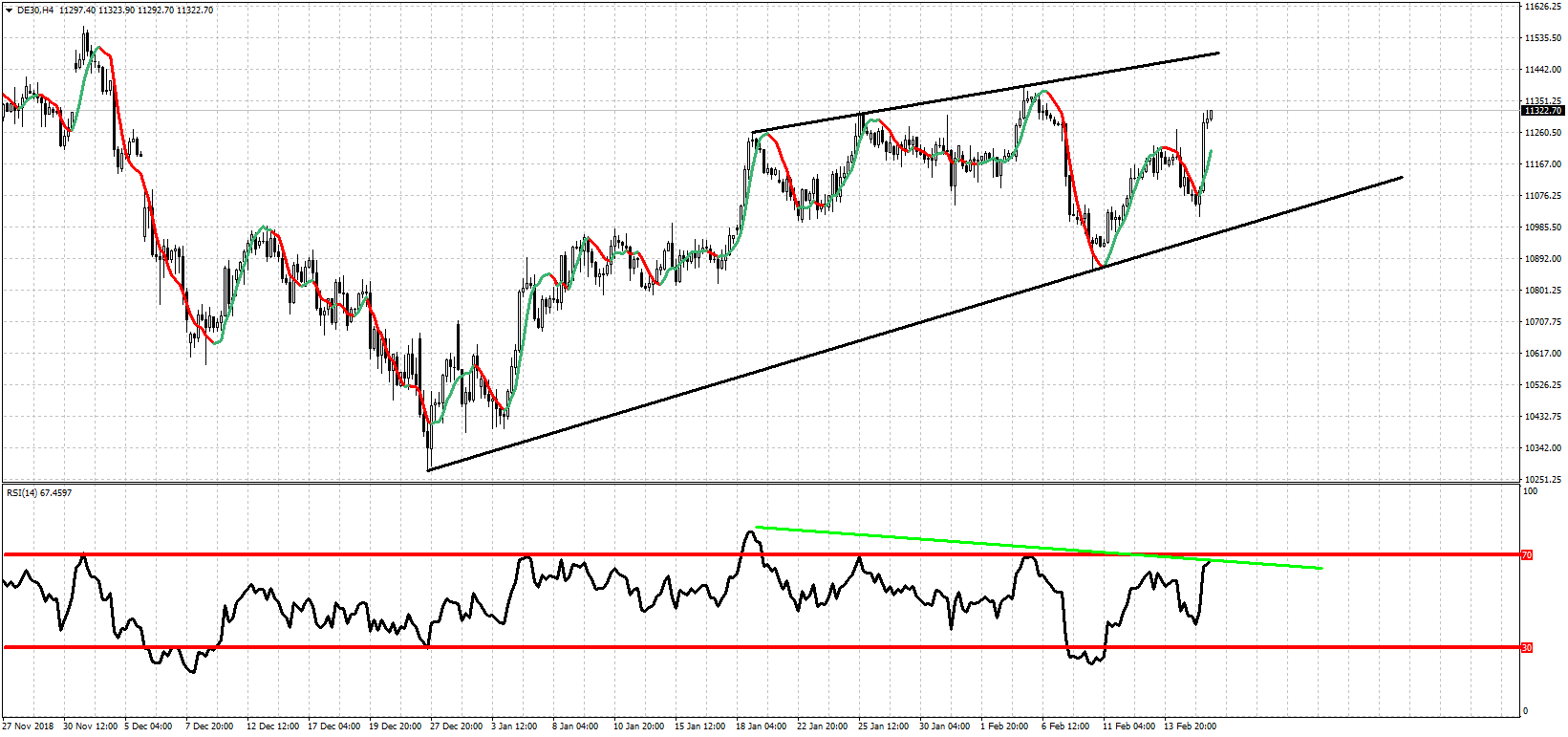

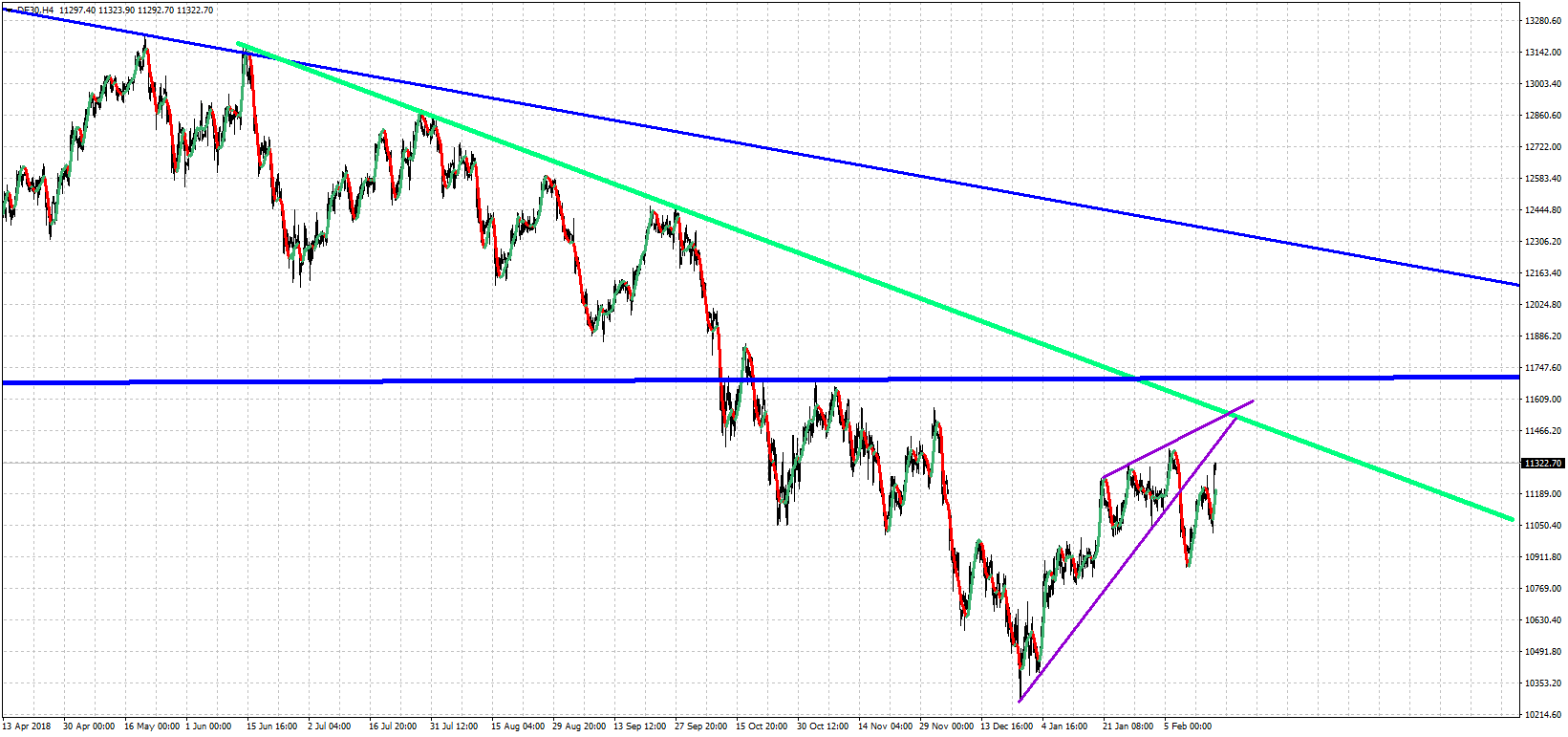

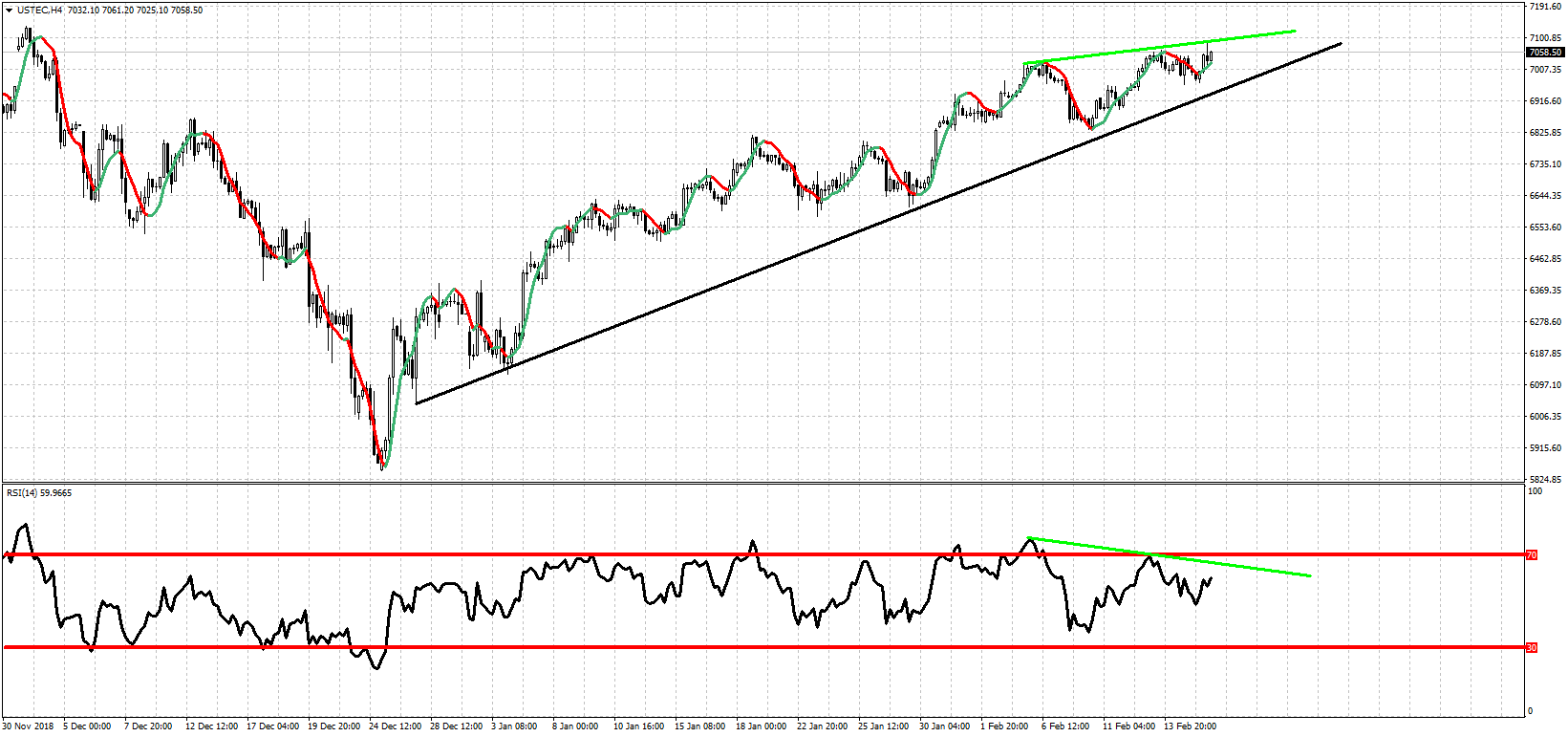

11400-11420 short-term target for a top, back test of broken Trend line and also challenge of long-term downward sloping trend line since June 2018 highs.

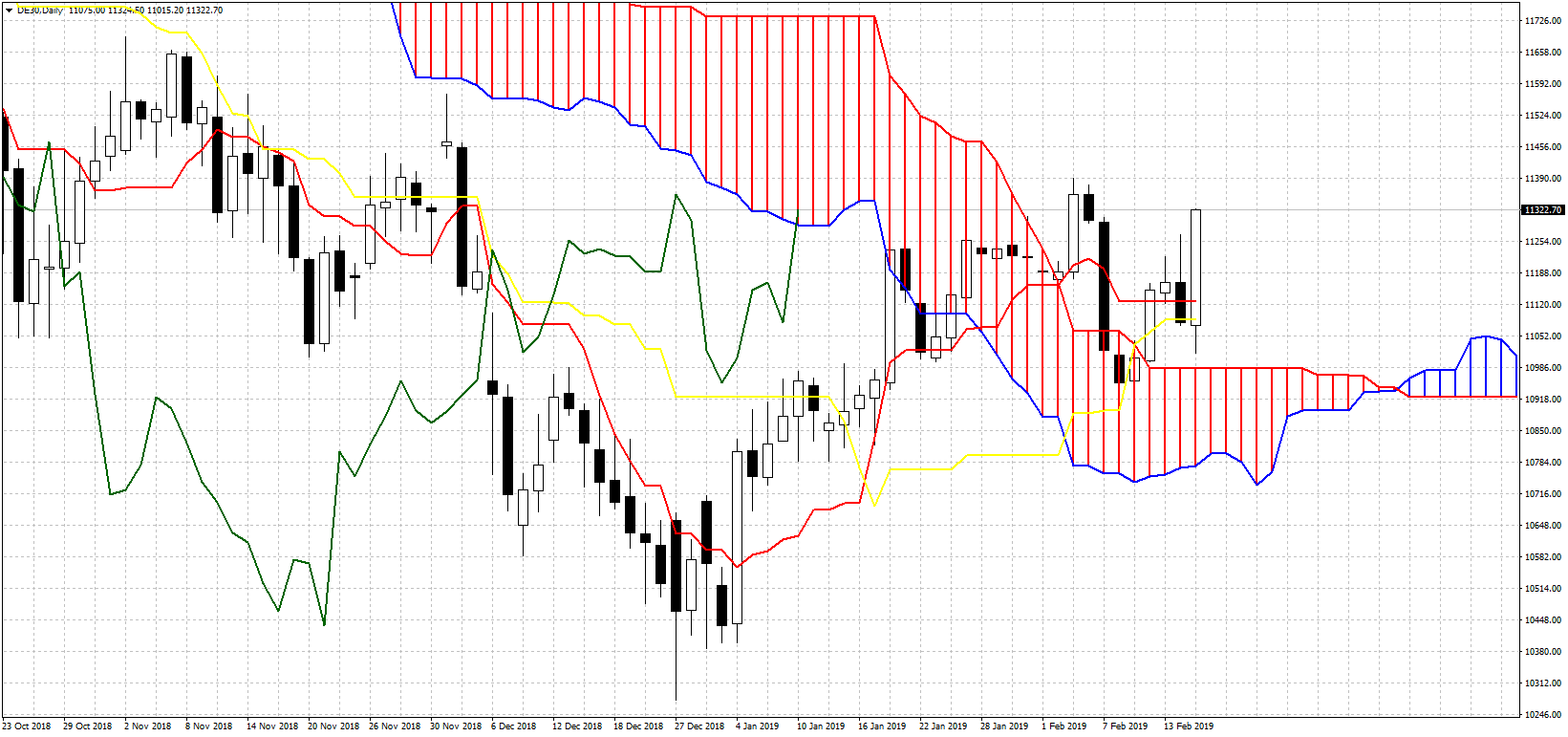

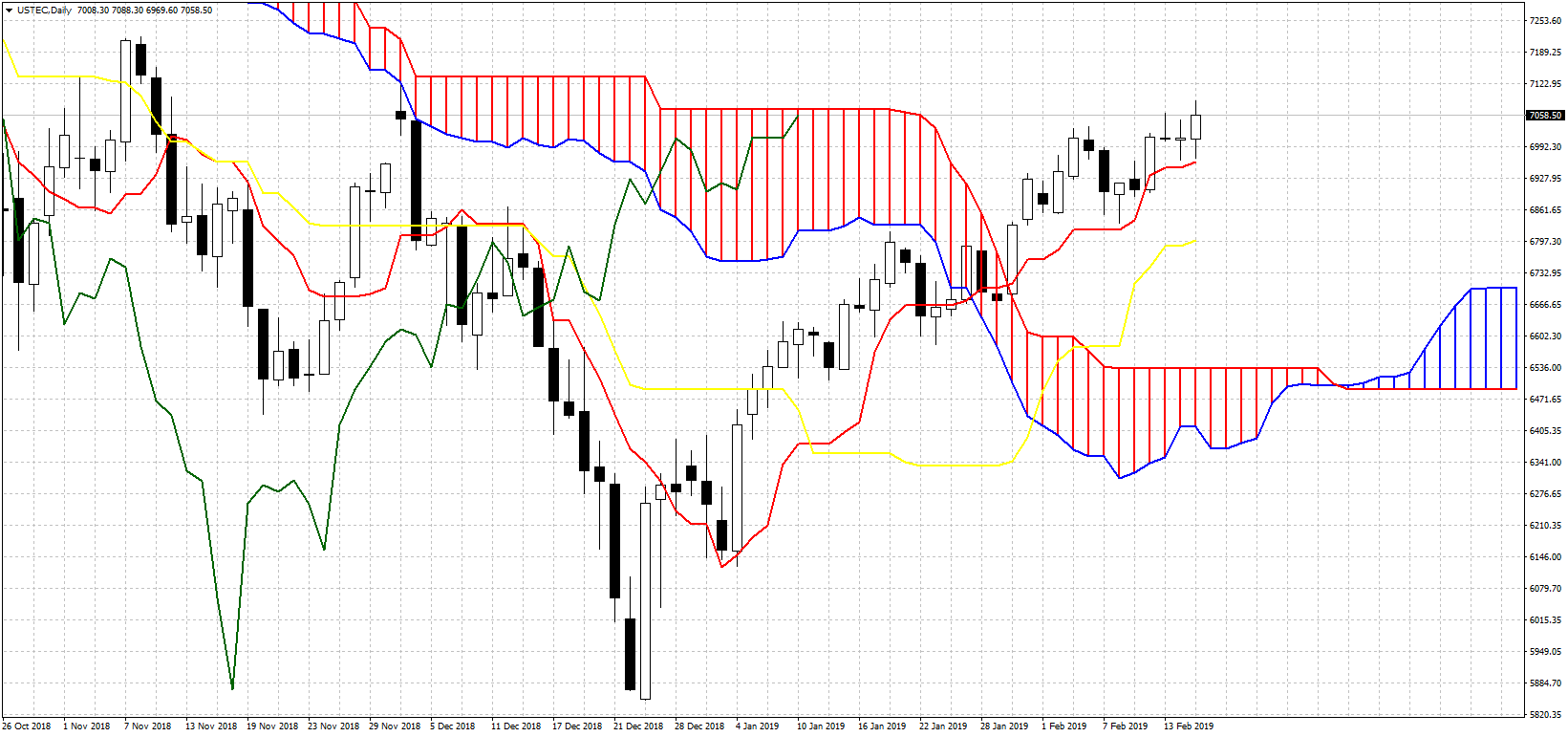

Signs of RSI bearish divergence. Key support at 10980. Coincides with upper Kumo (cloud) boundary.

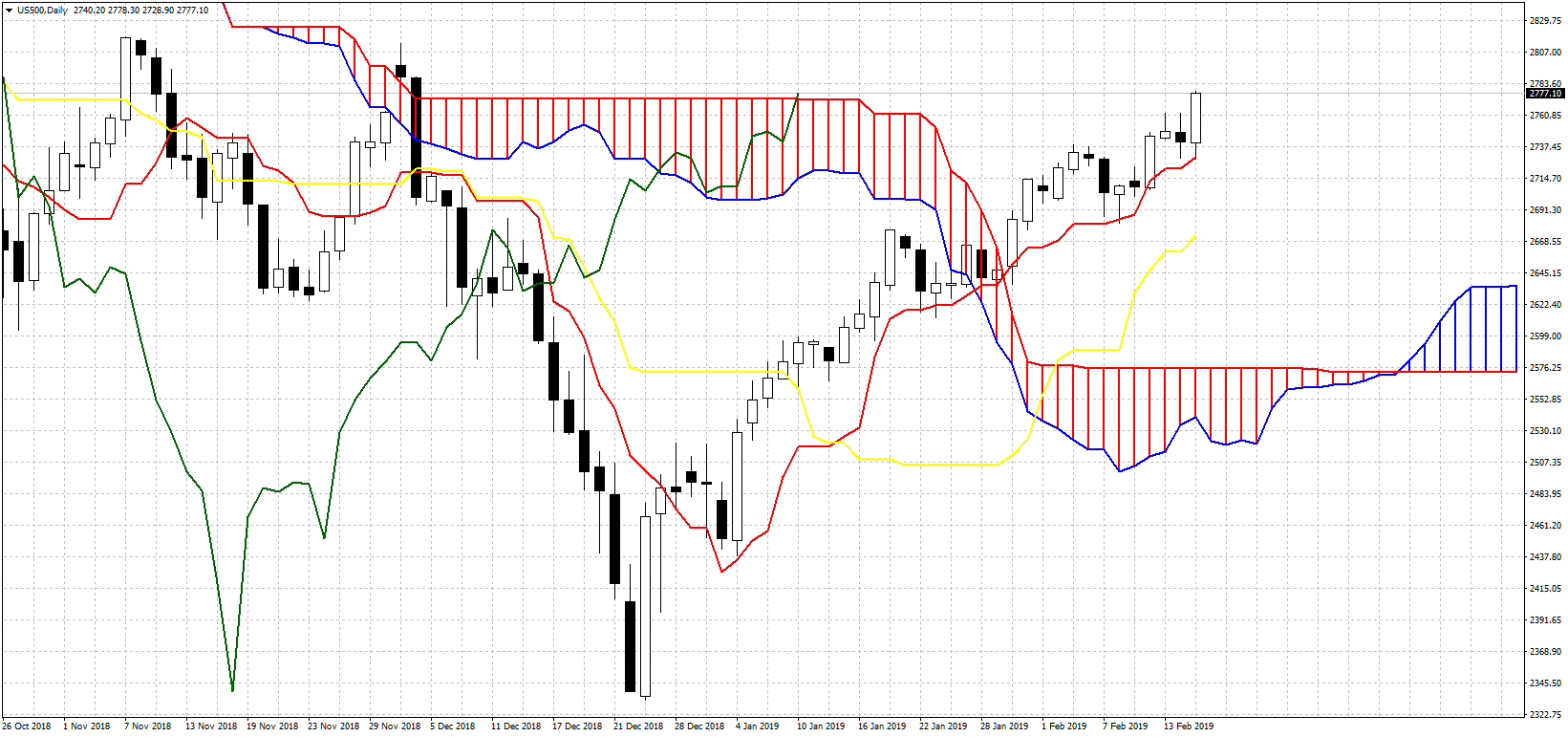

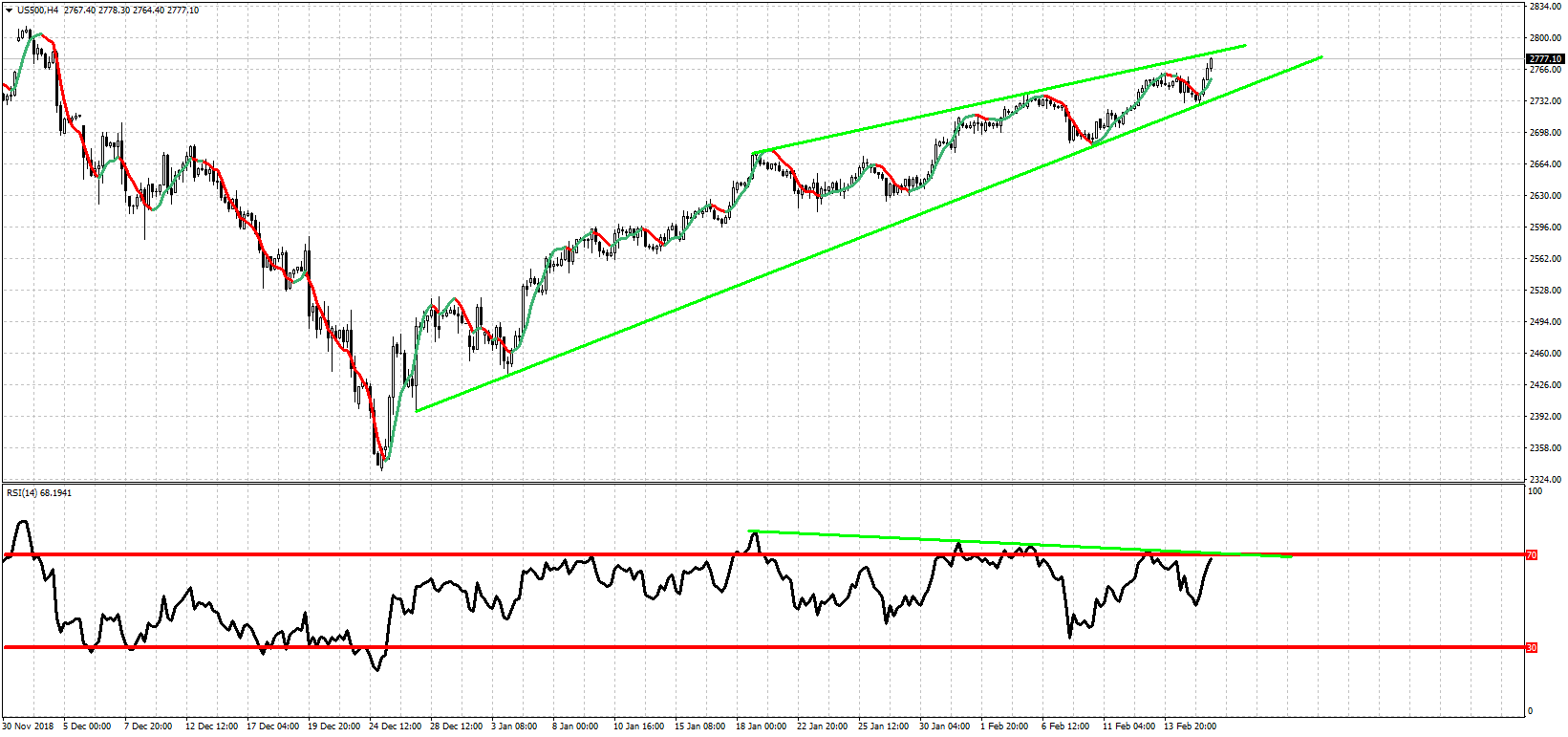

Continues to rally making higher highs and higher lows. Will the bearish RSI signs be confirmed? will we see a pull back and a back test at cloud support around 2600-2570?

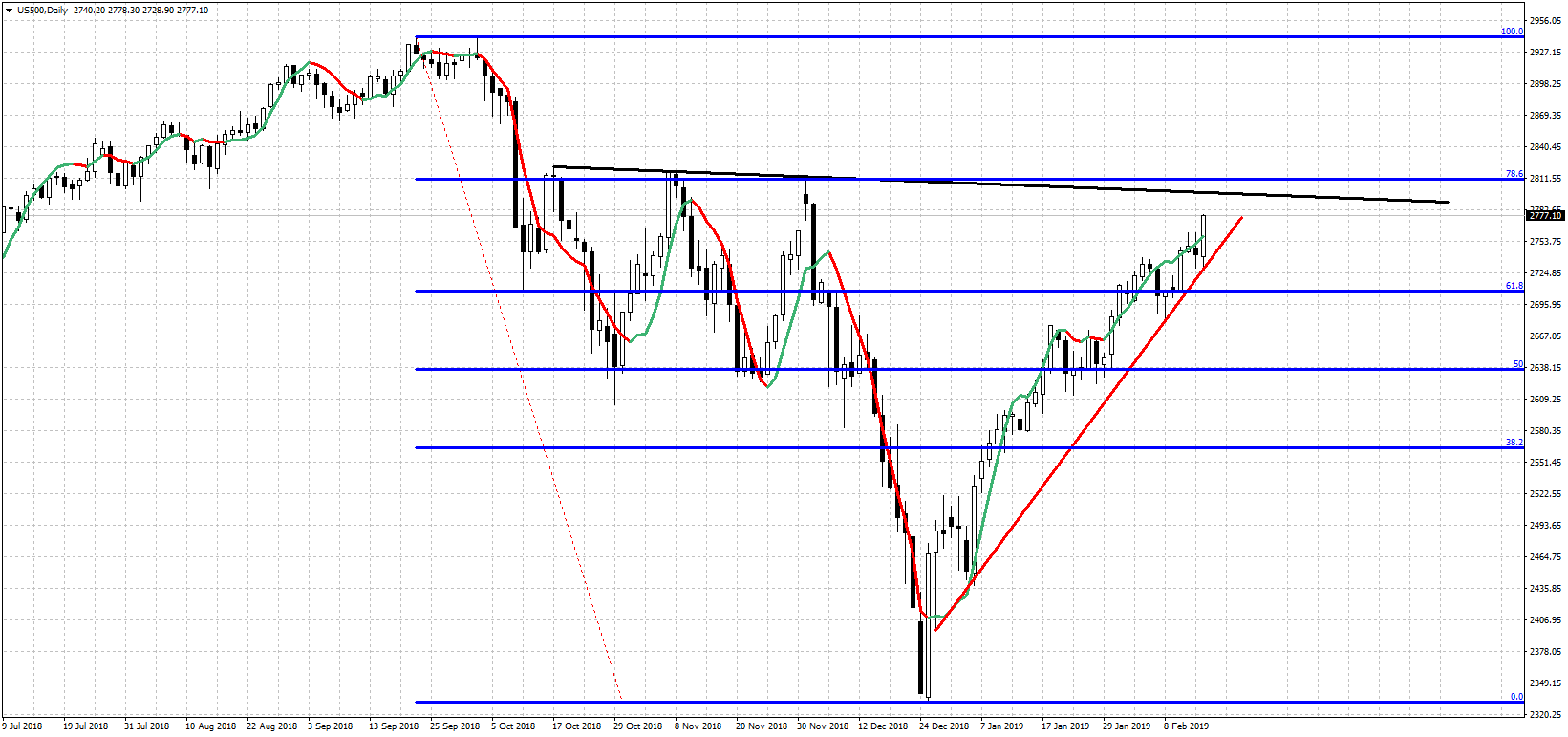

Next important resistance is at 2810-2800 and support at 2730. Loss of 2730 implies pull back has started. I do not see much more upside potential at this time. I’m positioned for a pull back.

Similar to SPX. Expecting a pull back towards cloud support here as well.

Upside target is at 7175. Support is at 6980-6960.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.