Well, there’s just no doubt about it. I have a lot more fun with down markets than up markets. Last week was a total kick. Today was all about defense.

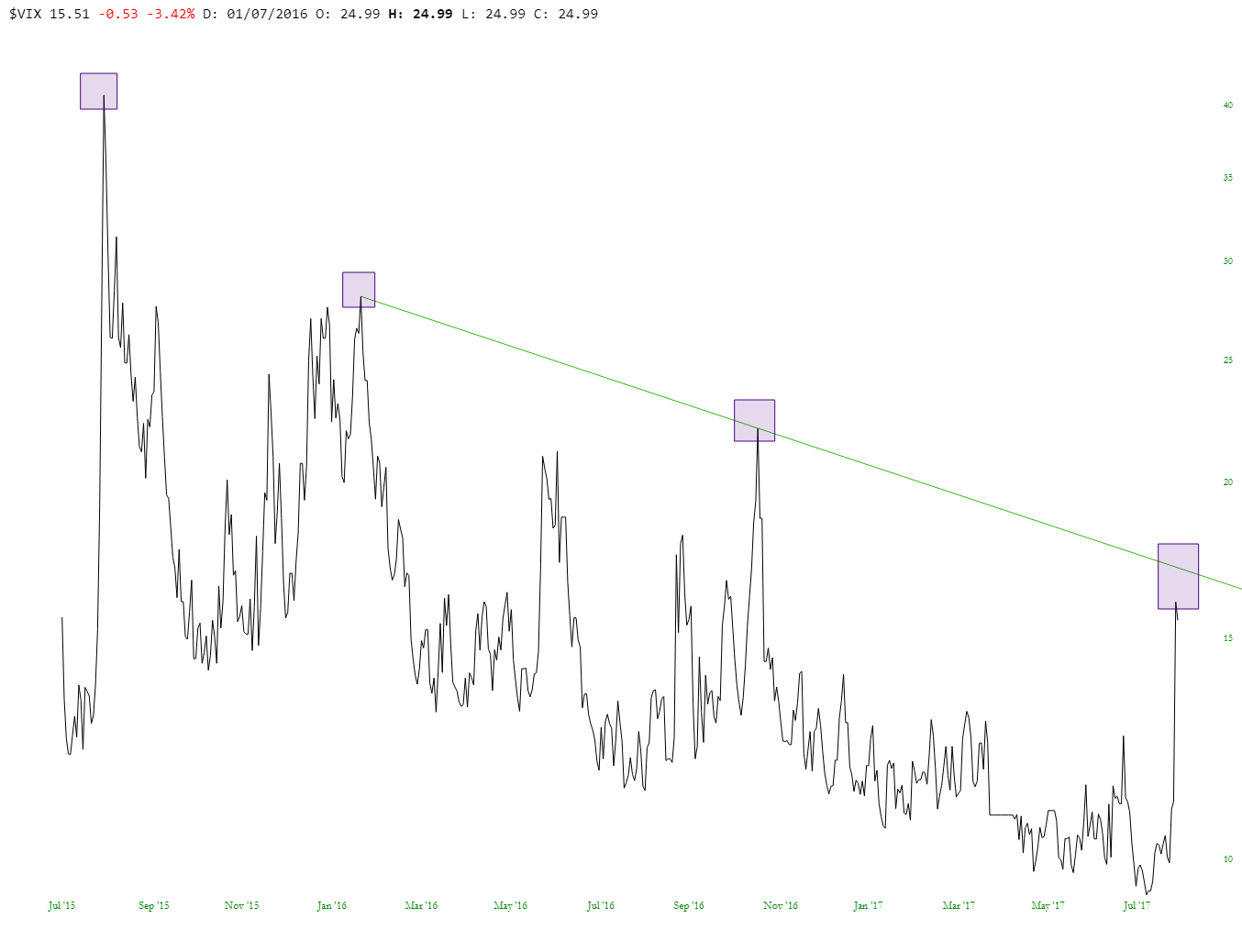

It’s no shock, though. As I mentioned repeatedly last week, and during the weekend, this brief “shock spikes” in the VIX tend to vanish quickly. Until a missile actually explodes somewhere, it looks like everything is calm once more.

I still think the market is dangerously lofty, however. Looking at the Russell 2000, we are in a tremendous multi-year pattern, mashed right up against its resistance (as always, click the image for a bigger,easier-to-read version).

The MidCaps tell much the same story.

Now, I realize markets like Indonesia don’t seem germane to stocks in the good old U S of A, but worldwide markets DO matter, particularly when assessing their relative position vis a vis long-term patterns – – – and one look at Jakarta says the same thing to me: “top of a wave”:

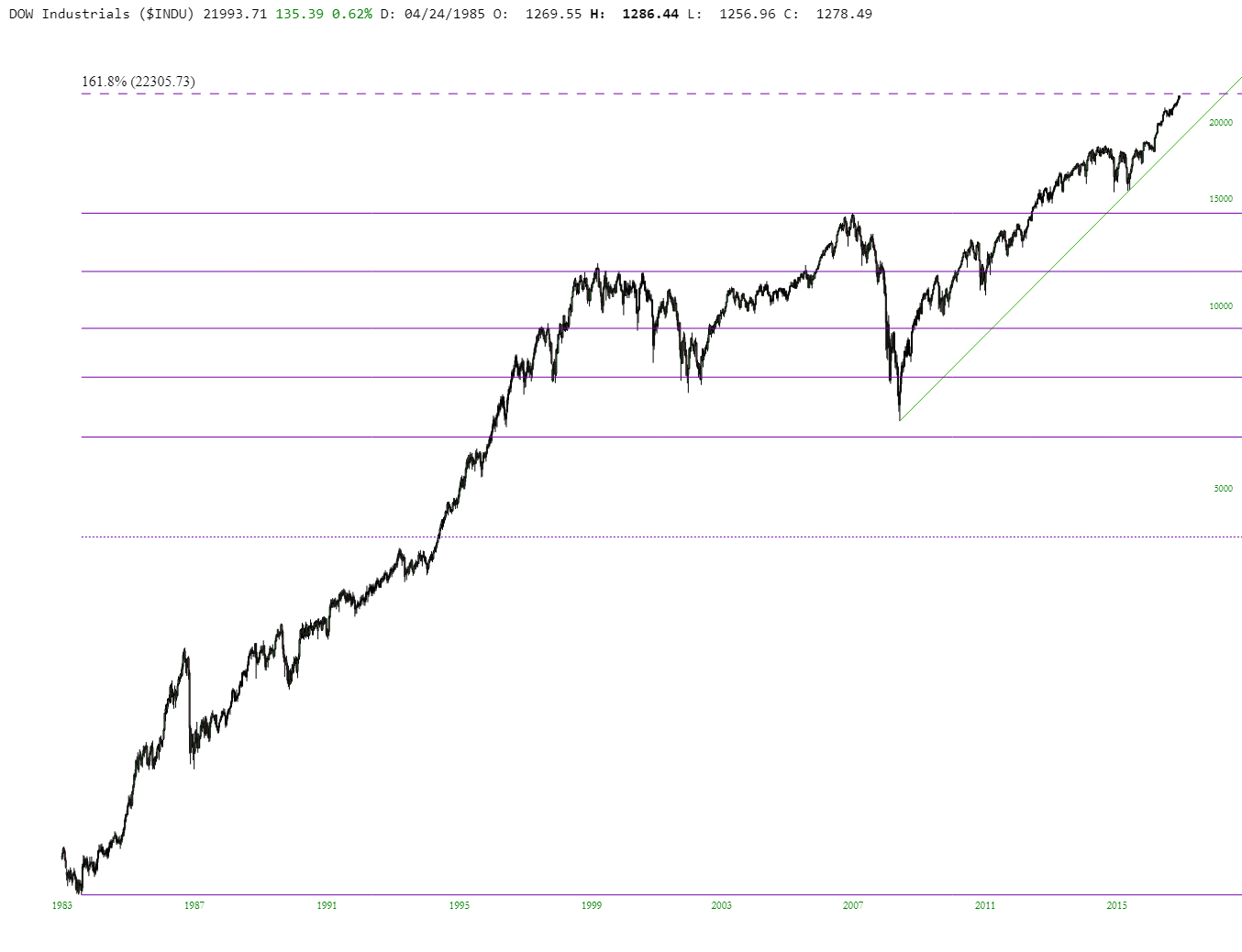

The Dow has been a monster for the past 18 months, and I can’t see how anyone could argue this being a buying opportunity. Hey, this ain’t bitcoin, ya know!

Hopping overseas again, take note of how the German market (by way of the DAX) has a failed bullish breakout. This strengthens my view that the global top is in.

Oh, and indulge me one more international market – – Amsterdam, which looks awfully like Jakarta’s: lofty, prone, and in the first phases of weakness (which started the past couple of weeks).

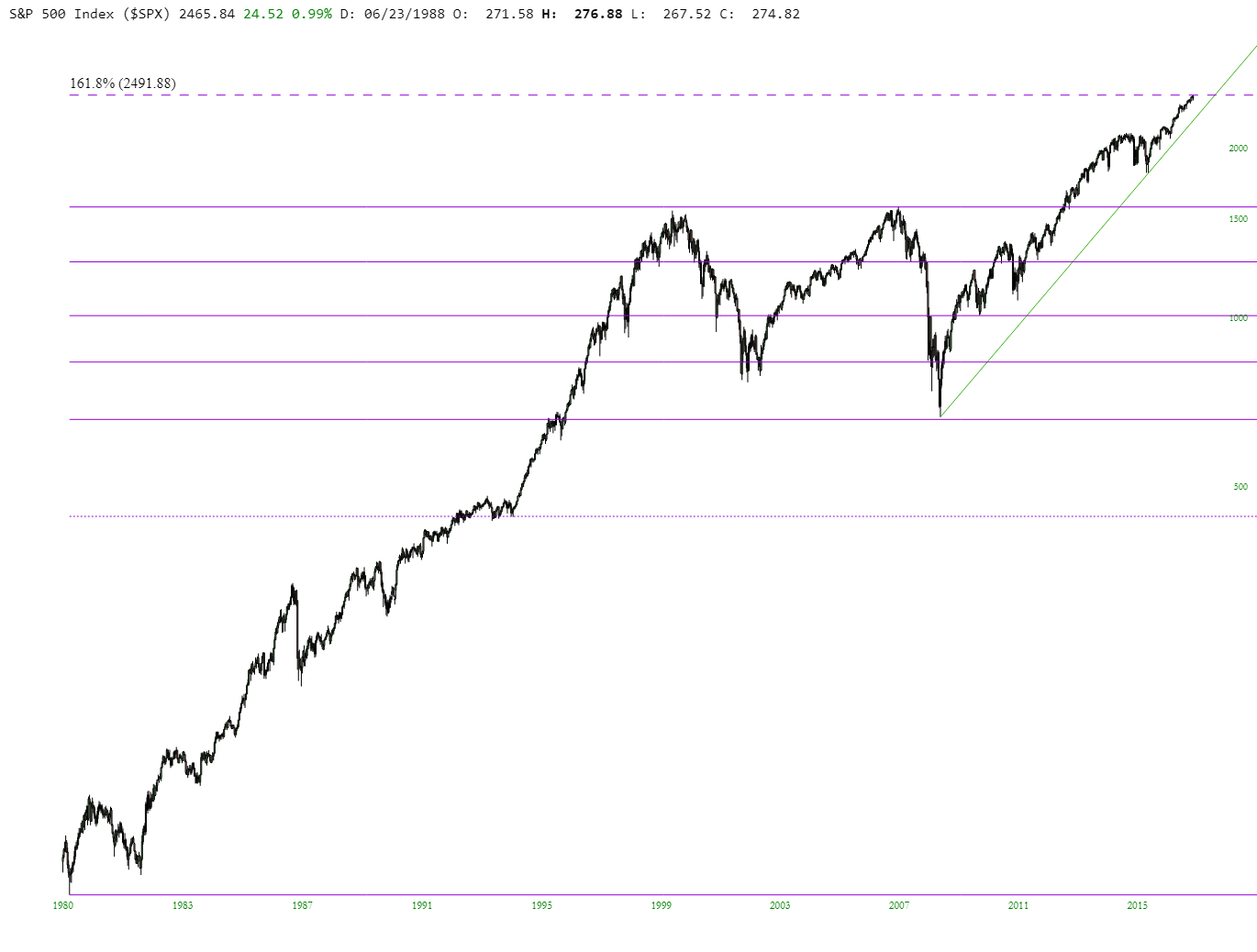

And, just to wrap it up, the good old S&P 500, whose Fibonacci target will hopefully stand firm. This is one of my favorite charts these days.

I gave back a minority of the profits I made last week. It’s no fun to lose ground, but that’s part of the game. I see as I’m typing this that strength in the ES and NQ continue. Let’s see it that sticks through the end of Tuesday’s regular session.