It was no real surprise to see indices slow down in their recovery. Across the board doji mark a balance between buyers and sellers.

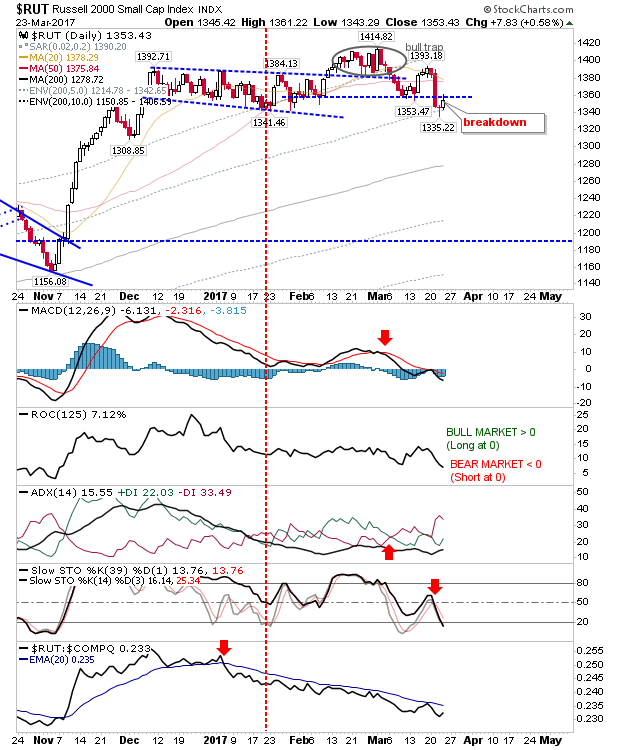

The one index which bucked the trend a little was the Russell 2000. It staged a modest recovery which brought it back to former support turned resistance. However, technicals remain firmly bearish, and will stay this way even if there are additional gains.

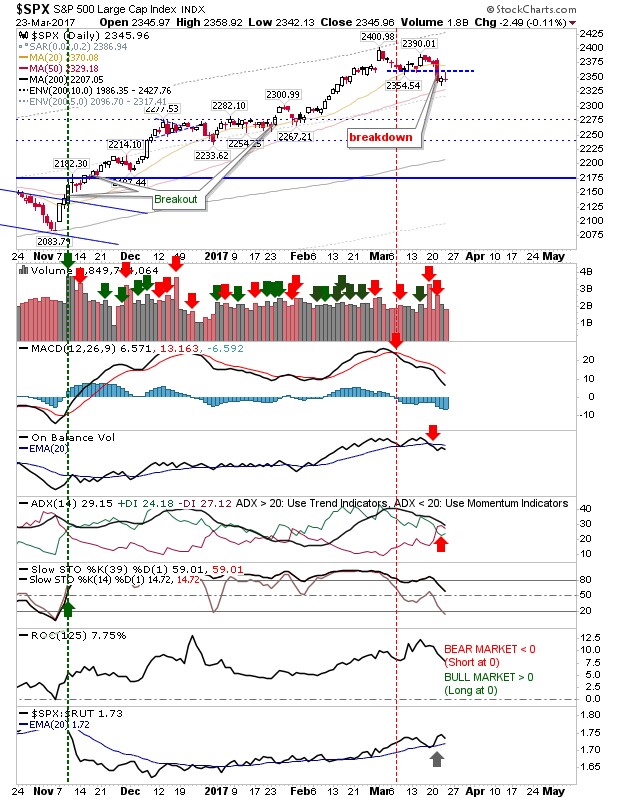

The S&P closed on light volume with a doji below resistance. The narrow intraday trading range offers a low risk opportunity with a break and stop on the flip side. Tuesday's selling suggest bears have the best chance of pushing it lower.

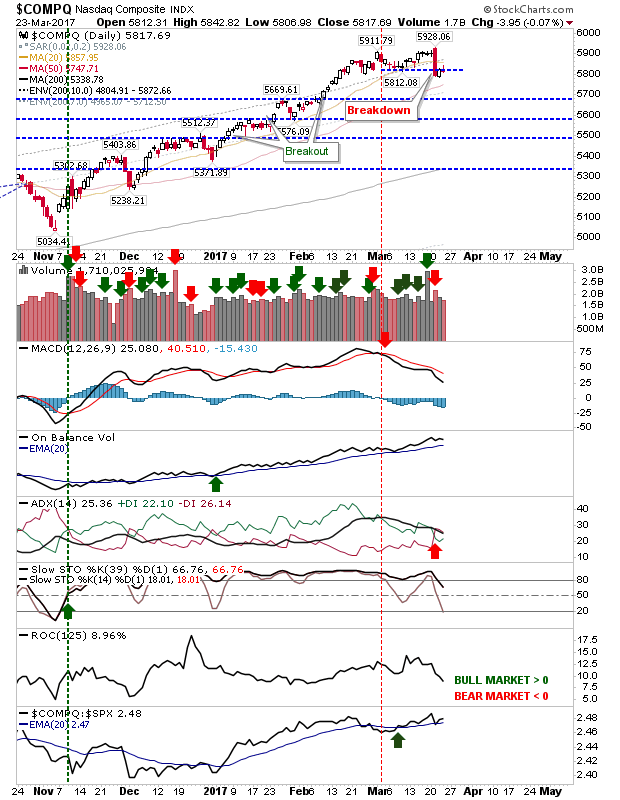

It was a similar story for the NASDAQ. Thursday's doji closed on resistance much like the S&P. The technical picture is a little healthier than the S&P which may make a sell off more difficult to trigger.

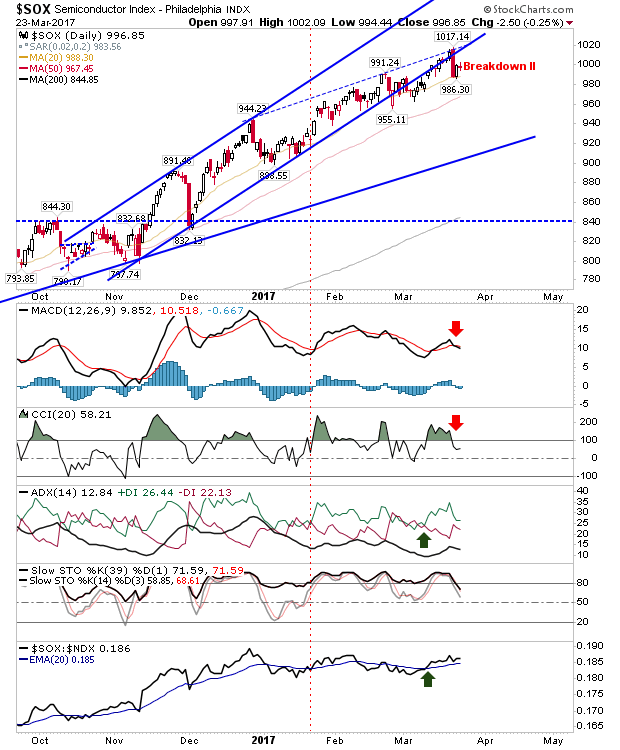

Shorts may also want to look at the Semiconductor Index. A MACD trigger 'sell' plays alongside a 'sell' in CCI. With the index under pressure, a move back to the slower rising trendline would not seem unreasonable at this point.

For Friday, look for bears to twist the knife and try and break Thursday's tight action. Bulls would do well to continue to follow action in the Russell 2000; another day like Thursday (three-in-a-row) would firm up a swing low and offer a basis for further gains.