German investor expectations improved more than expected. Will the EUR/USD continue climbing?

Investor sentiment in eurozone’s largest economy improved: German ZEW investor sentiment index for the country improved to 3.1 in April, up from -3.6 in March. It was better than expected reading of 0.8. Last Friday Eurostat upgraded eurozone’s industrial production for February, reporting a reading of just 0.2% on month decline instead of 0.5% contraction. Better investor sentiment is bullish for euro. While euro-zone struggles to overcome the negative effects of last recession, the opening of new possible trade war front after US threatened to levy tariffs on $11 billion of EU products is a downside risk for euro. Chances are the US and European Union will reach a solution which will not impede transatlantic trade.

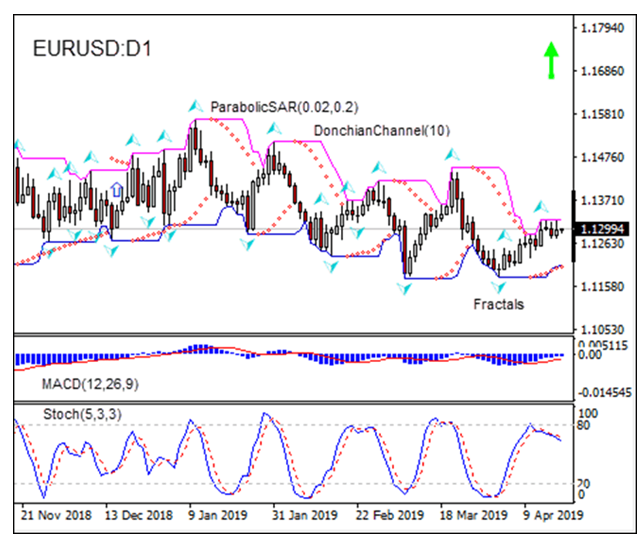

On the daily timeframe EUR/USD: D1 is retracing after it hit a 5-week low at the beginning of April.

- The Donchian channel indicates uptrend: it is narrowing up.

- The MACD indicator is below the signal line and the gap is narrowing, which is a bullish signal.

- The Parabolic indicator gives a buy signal.

- The stochastic oscillator is falling but has not reached yet the oversold zone.

We believe the bullish momentum will continue after the price breaches above the upper Donchian boundary at 1.1323. A price point above that level can be used as an entry point for a pending order to buy. The stop loss can be placed below the lower Donchian bound at 1.1206. After placing the pending order the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop-loss level (1.1206) without reaching the order we recommend cancelling the order: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

Position Buy

Buy stop Above 1.1323

Stop loss Below 1.1206

Market Overview

Healthcare shares drag SP500

Dollar falls despite the narrower trade deficit

US stock market paused on Wednesday weighed by healthcare stocks under pressure in debates for the Democratic nomination for president. The S&P 500 lost 0.2% to 2900.45. The Dow Jones industrial average slipped 0.01% to 26449.54. Nasdaq composite index slid 0.05% to 7976.08. The dollar weakening resumed despite report the US trade deficit fell 3.4% in February to the lowest level in eight months. The live dollar index data show the ICE (NYSE:ICE) US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, slipped 0.1% to 97.01 and is lower currently. Futures on US stock indexes point to lower openings today.

CAC 40 outperforms European indexes

European stocks extended gains on Wednesday buoyed by better than expected Chinese data. The EUR/USD turned higher while GBP/USD continued its slide with euro lower currently and Pound little changed. The Stoxx Europe 600 gained 0.1% led by auto shares. Germany’s DAX 30 rose 0.4% to 12153.07 despite country’s economic growth downgrade for 2019, France’s CAC 40 advanced 0.6% while UK’s FTSE 100 added 0.02% to 7471.32.

Australia’s All Ordinaries Index gains while Asian indices fall

Asian stock indices are mostly down today as North Korea test-fired a new tactical guided weapon. Nikkei lost 0.8% to 22090.12 as yen resumed climb against the dollar. China’s stocks are lower despite a report US and China may sign the trade deal in late May: the Shanghai Composite Index is down 0.4% and Hong Kong’s Hang Seng Index is 0.6% lower. Australia’s All Ordinaries Index turned 0.05% higher with Australian dollar little changed against the greenback.

Brent slides despite US crude inventories drop

Brent futures prices are retreating today. Prices fell yesterday despite report US gasoline stocks fell by 1.4 million barrels while crude stockpiles declined by 1.2 million last week. June Brent crude lost 0.1% to $71.62 a barrel on Wednesday.