Grey market financing reflating Chinese equities?

Asian markets opened strongly on the back of a good showing in US markets overnight. The US dollar rallied as CPI came in above expectations, seeing many currencies in the region give back their gains from yesterday. Asian markets did begin to ease off slightly in afternoon trading. Although, the Nikkei looked set to see another over 1% gain.

US CPI had a very strong showing with core CPI (ex-food and energy) rising 1.9% year-on-year, up from 1.8% the previous month and tantalisingly close to the 2% target. Increases in rent-related prices and education services accounted for the bulk of the uptick in core CPI, while airfares dropped less than expected. In the headline number, food prices saw a noticeable 0.4% month-on-month increase and with the broad-based rise in soft commodities lately, this looks set to continue. If price pressures can hold onto these gains next month, the likelihood of a March 2016 rate rise looks set to solidify, although 2015 still looks like it will stay off the table for now.

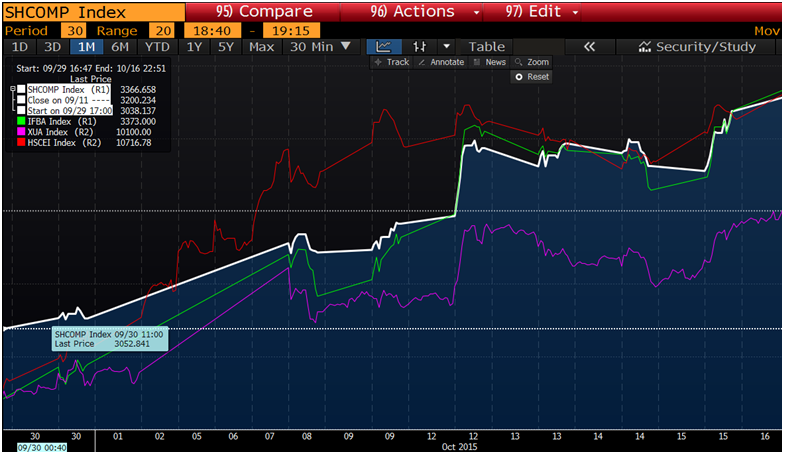

Chinese equity markets are starting to see some solid gains again, the Shanghai Composite is up 9.3% since the beginning of October. There has been some rallies based on expectations for state-owned enterprise reform, particularly as the 13th Five Year Plan comes together. But it also seems Chinese authorities are possibly easing up on grey market financing. China’s outstanding margin financing has risen 5.6% since the start of the month and looks to have bottomed. As an interesting corresponding statistic, Chinese entrusted loans saw their biggest monthly addition in September since December 2014. As we approach the business end of the year for China to achieve its 7% growth target, this loosening of grey market credit could be set to continue and correspondingly buoy the mainland equity markets.

White Shanghai Composite, green CSI 300, purple FTSE China A50, red Hang Seng China Enterprise Index

China outstanding margin financing

China’s monetary data for September continued to see strong growth with Total Social Financing (the broadest measure of money supply) increasing 13.8% year-on-year from 13.4% the previous month. New loans jumped back after easing in August, with RMB 1050 billion new loans added in September from RMB 810 billion in August. Entrusted loan issuance also saw a noticeable jump up to RMB 244 billion from RMB 120 billion the previous month. Entrusted loans (loans between companies) have been tightly controlled in recent times and have traditionally been a key financing avenue for Chinese property developers. Concerns about the slowing Chinese property market have seen a loosening of housing loan down payment requirements, but we may also be seeing a loosening of entrusted loan issuance restrictions.

ASX

A strong performance in US markets overnight provided a noticeable boost to the ASX in trading today. Although there does appear to be some strong resistance coming in for the index around the 5300 level, and given that we may see the index move back down into the 5100 level in trading next week. China’s Q3 GDP numbers on Monday are likely to be a market mover.

The banks were having a very strong day on the index in the wake of Westpac’s capital raising. AX:WBC continued its trading halt, but the banking sector as a whole was up 0.8%.

Materials were the worst performing on the index, down 0.2%. N:RIO’s slightly higher than forecast output was not necessarily well received by the market as its stock fell 1.1%. But news of higher than expected coal sales and analysts bumping them up to “outperform” saw White Haven Coal’s (AX:WHC) jump 10.8%.

Ahead of the European open we are calling the FTSE 6395 +57, DAX 10165 +100, CAC 4720 +45, IBEX 10223 +122, MIB 22423 +206