The S&P 500 finished the day yesterday down about 10 bps, and the Invesco QQQ Trust (NASDAQ:QQQ)s finished the day lower by just 3 bps. But the real story was in the Russell, which continues to get hammered, falling almost 2.8%. The small-cap index traded around resistance all day at 2,175.

S&P 500

There was really not much to say about the S&P 500 yesterday, with the index remaining in the same range it has been in since the middle of February, with the upper end of the range of the Futures at 3,960.

VIX

The VIX also finished the day at 20.7. So the VIX and the S&P 500 futures continue to hang in the 20s and 3,960 regions, as noted so many times previously, as the upper end of the range. It didn’t look great on Friday, but who knows, maybe it is the right call, and this the top.

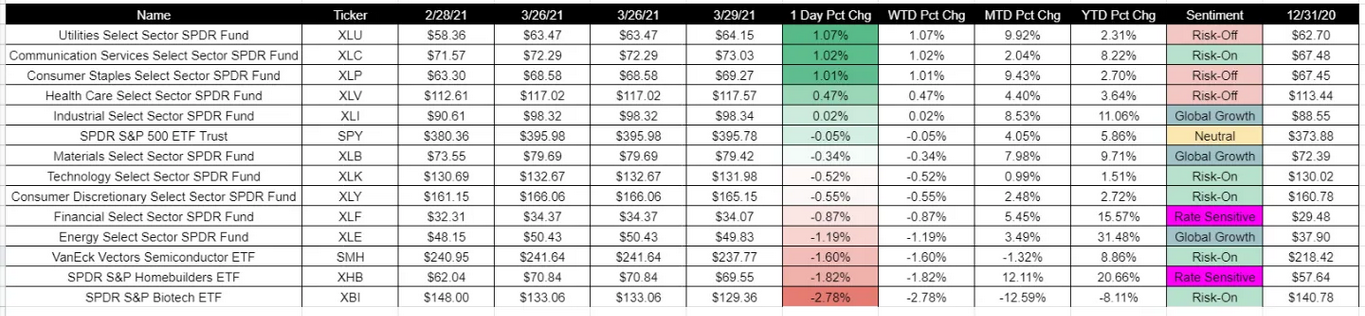

It was hardly a good day with the best performing sectors defensive in nature. Utilities, staples, and health care made up 3 of the top 4 performing sectors. After the communication sector’s beating last week, yesterday's strong performance for the group is hardly noteworthy. If these are the sectors left to perform the best in the market, there will be serious issues.

Options

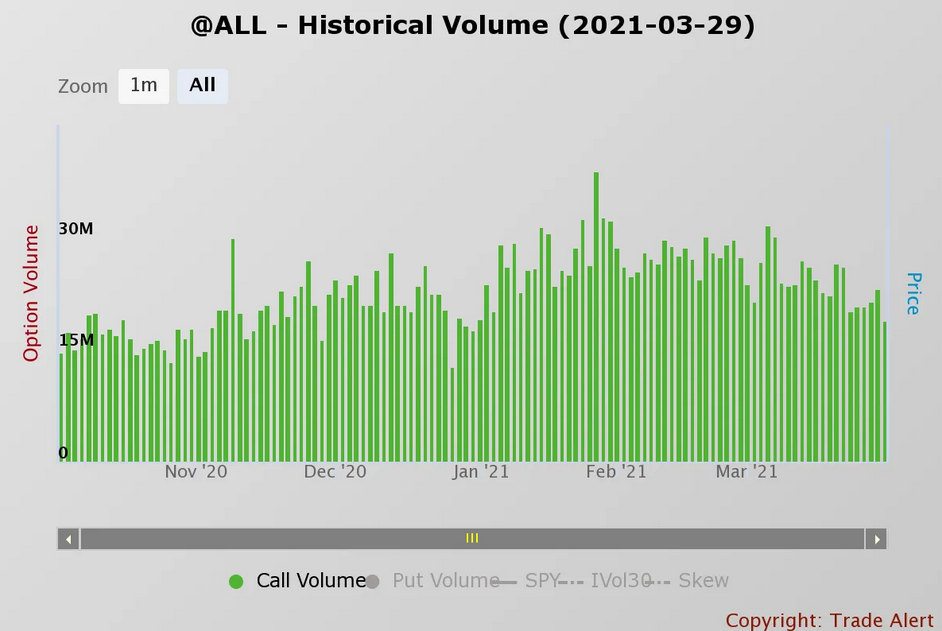

Call option volume continued to dissipate, and as I have said before, this will be a big problem for the NASDAQ and technology names going forward.

Biotech

The SPDR® S&P Biotech ETF (NYSE:XBI) looks scary, with a descending triangle pattern. The next level of support comes around $127.

Costco

Costco Wholesale Corp (NASDAQ:COST) was at an interesting point. The stock had raced off the lows and was close to resistance at $356. The stock went from oversold to nearly overbought in a straight line. Does it breakthrough and race back to the highs, or does it fail and push lower? Tough call; I’m just going to watch.

IBM

Was that a giant inverse head and shoulders on IBM? Does IBM’s stock go up? It hasn’t gone up since 2013! I’m not sure about the up thing, but it certainly looks like a head and shoulder pattern, potentially pushing higher towards $148.

JD

The RMB was starting to weaken versus the dollar, and that is never a good thing for JD.com's (NASDAQ:JD) stock. There was a giant gap that needs some filling down around $67.30.

Apple

Apple (NASDAQ:AAPL) doesn’t look great here, and I think there is a good chance this stock heads to $110, maybe lower.