Last week investors were whipsawed with financially and emotionally taxing news and price action.

Yes, I'm referring to the news of President Biden proposing a doubling of the capital gains tax.

The market reaction was swift, decisive, and ugly, but as you'll read below, there was a silver lining.

And the capital gains tax news was just the beginning…

- Goldman Sachs (NYSE:GS) released a note saying the "reopening trade has peaked." Some areas of the market seem to agree, but others do not.

- Bitcoin certainly "peaked" with the biggest reversal and selloff since it was trading around $5,000, but there are indications that it may be time to get bullish.

- According to Factset, 25% of S&P 500 have reported earnings with 84% beating their earnings estimates and 77% beating their revenue estimates. While this sounds like good news, it may not be. We'll find out soon as this coming week is one of the busiest of earnings season.

- The market's rebound from the capital gains tax hike news led to an interesting division between the assets and indexes that recovered and those that didn't.

- And there's more!

The SPY, QQQ and IWM didn't close substantially higher or lower, but…

If you're listening to the message of the market, last week's price action has an important message that may reveal what to expect in the coming weeks.

And… If you were listening to Mish's MMM Premium trade alerts last week, you were handed a beautiful trade in TAN that was as easy as gently scooping a goldfish out of its one-quart bowl when nobody's looking!

Mish jumped on TAN early in the week, and by Friday it had rallied so much that it found itself on our "Biggest 5-day Movers" scan. As a result, the trade already has a 10% gain in a week, which TAN closed up 6%.

The trade is worth reviewing, and it looks like it has the potential for more upside, so we'll take a look at that too.

As you can see, there's a lot to unpack this week.

The New Normal - Rotation

Trading and investing are easier when everything is going up. That certainly wasn't the case last week.

The market is in a phase of rotation. This can be bullish for the long-term, but it requires patience, active management, a focus on "expectations," and good risk management in the short term.

The biggest rotation theme has been and will continue to be one of "growth versus value." I prefer to frame it as growth versus cyclicals because it's the economic recovery that's driving this rotation.

More importantly, it's the expectation of the economic recovery that's driving this rotation.

The idea of trading or investing based on expectations can be confusing to traders and investors, but this is what you need to do, or you'll always be one step behind the market action.

The Recovery Trade Has Peaked

An example of trading based on expectations this week is Goldman Sachs' pronouncement that the "recovery trade has peaked."

What? All we hear in the media is that economy is about to experience the highest GDP growth in decades! The economy isn't even fully open, and it's opening up more and more every week.

How could we have peaked?

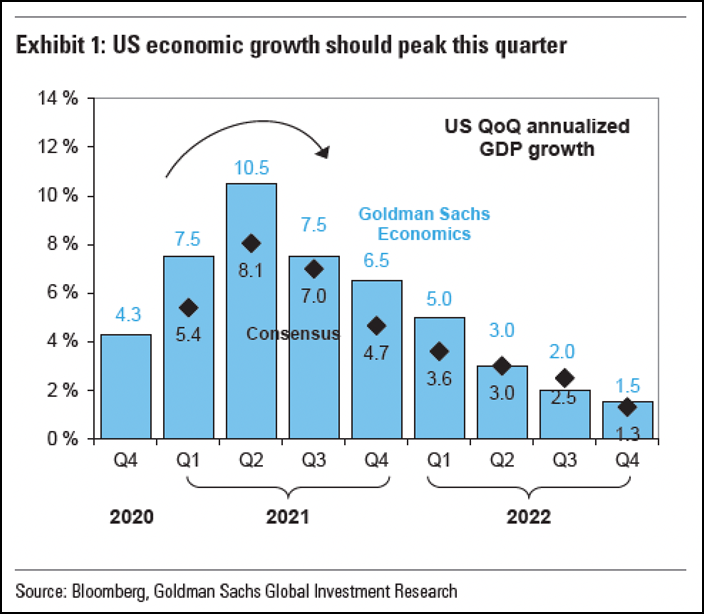

As you can see by the chart below, it's Goldman's expectation that peak growth will be reported in Q2 2021, and then there will be a steady declaration.

Goldman's note included the following chart.

The media and unknowing investors are more focused on Q2 than what's expected to happen next.

Goldman's explanation in their research was as follows,

"Decelerating economic growth is also typically accompanied by sector rotations within the equity market," Goldman strategists including Ben Snider and David Kostin wrote in a note this week.

"Cyclical industries tend to lead the market in environments of positive and accelerating economic growth, but as growth peaks and decelerates more defensive industries typically outperform."

So Goldman expects that the growth rate has peaked and is therefore saying that it's time to trade based on slowing growth rather than accelerating growth.

Of course, this is easier said than done. The market's actual shift or rotation is not always smooth or easy to see starting and stopping.

This is why we're always watching what the market is doing relative to the news, and letting the trends and changes inter-market relationships tell us what the market is focused on.

Additionally, this does not mean the market has to peak.

The rotation that the Goldman strategist is referring to is exactly what ETF Sector models capitalize on for sectors and our NASDAQ and Small Cap All-Stars models capitalize on in individual stocks.

Earnings Announcements May Be Misleading

In much the same way that Goldman is suggesting GDP growth has peaked, the market may be suggesting that earnings expectations have peaked.

Stocks have run up with expectations of companies beating their estimates during this earnings season.

In fact, companies have been beating their estimates.

According to Factset, 25% of S&P 500 have reported earnings with 84% beating their earnings estimates and 77% beating their revenue estimates.

While this sounds like good news, the price action of stocks beating their earnings has been muted or in some cases negative!

This can happen for several reasons.

One example from last week is Honeywell (NYSE:HON). It announced better than expected earnings and revenues, and it raised its forecast for future earnings.

A "beat and raise" report is usually a recipe for a big jump in a stock's price, but HON dropped.

A Barron's article explained this situation as…

The issue for the stock is Honeywell always beats earnings estimates. Beating estimates is never truly a surprise for this company. Over the past 10 years, the company has missed estimates twice, both times by less than a penny.

Wall Street analysts know that beats are coming too.

Honeywell may be a little unusual based on its predictability, but the message is the same. The economic recovery has led to high expectations for earnings reports, and when companies don't meet these expectations investors don't treat their stocks nicely.

Next week is one of the busiest weeks for earning reports with many big names reporting like Tesla (NASDAQ:TSLA), United Parcel Service (NYSE:UPS), Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL), Facebook (NASDAQ:FB), Caterpillar (NYSE:CAT), Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), McDonald’s (NYSE:MCD), and more.

We'll be looking at how these influential companies trade in reaction to how they report and guide relative to expectations.

If there is a significant amount of negative price action following bullish earnings news, then the market is saying that it needs a rest.

If earnings news isn't up to expectations, it's likely to be another very taxing week for the bulls.

Bitcoin Bubble Bursting?

Another area of the market where we can see expectations running a little rich is in cryptocurrencies.

Coinbase (NASDAQ:COIN) went public on Apr. 14, and as the first publicly list crypto exchange, it was expected to fuel the fire of easier and faster adoption of crypto ownership by the masses. This would push Bitcoin even higher.

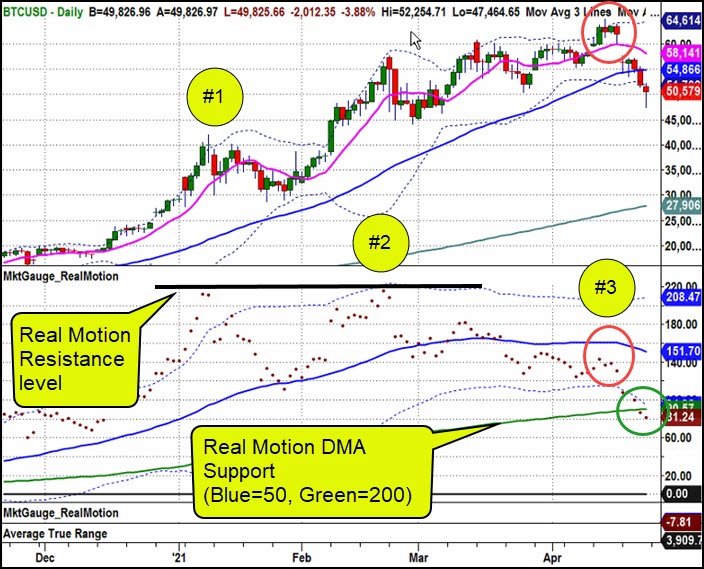

Ironically, as you can see by the chart below, the first day of trading has been COIN's peak and the high in Bitcoin as well.

This is what happens when bullish expectations are overdone.

After more than tripling in value in the last 5 months, Bitcoin topped out with the biggest 1-week decline (-18%) since March of 2020 when it collapsed 30% to below $5,000.

The chart below of weekly percentage moves gives some perspective on how significant an 18% decline has been historically.

The sell-off is not surprising, and now…

There may be some technical reasons to believe that a bottom in Bitcoin is near.

As you'll see in the chart below, our long-term Real Motion (RM) indicator that looks at the 50 and 200-day time frames has done a good job at identifying potential turning points such as:

- In January, it peaked after BOTH the price, and Real Motion traded their Bollinger Band and then traded below them.

- In February of 2021, it peaked out at the black line, which is showing how that was a prior Real Motion peak.

- In April, it had one of the most powerful reversal signals, which is a new high in price with Real Motion trading under its 50 DMA.

Now it's sitting on Real Motion support at the 200 DMA, and both RM and Bitcoin's price are below the Bollinger Band. When they both trade back over these bands, it could indicate a low.

Another reason to suspect that this may near a low is Litecoin and Ethereum have not had as significant of sell-offs. They're both still sitting above or near their February highs.

Until Bitcoin breaks $45,000 in a significant way, I'll characterize this correction as a healthy reduction of overly speculative expectations.

Mish's Trade In TAN Last Week Could Mark A Low

On Wednesday, Mish alerted her Premium members of a buying opportunity in TAN at $82.91 right before it quickly rallied 10% over the next 2 days.

While I haven't asked Mish if Real Motion was the reason for the trade, it certainly supports it.

This was an opening range breakout at the bottom of a 6-week range that's sitting on the 200 DMA with a short-term Real Motion bullish divergence.

The Real Motion divergence is labeled on the chart below, and it's based on the 10 and 50-day time periods.

You can see that the 10-day RM average (magenta) is about to cross the 50-day (blue). This is an indication that momentum has turned up even though it did not appear to have done so based on the price hovering near a multi-month low.

You can also see by the solid black lines that as the price of TAN tested the $81 level in late March and last week, RM (dots) were making higher lows.

Not surprisingly, a more pronounced RM divergence occurred at the top in TAN earlier this year.

The dashed black lines mark the 2 attempts to break the January highs, which coincided with RM trending down so dramatically that the final attempt by TAN to make a new high coincided with a RM chart that had its 10 DMA under its 50 DMA. This is very bearish if price retreats like it did.

It's the same bearish pattern we saw in Bitcoin above.

The bullish divergence currently underway is not as pronounced as the bearish top, so it would not be surprising to see a pullback. So right now is not an ideal time to enter a trade.

Mish's members have already taken some profits.

A pullback to the support at $86 would look attractive. Additionally, a new consolidation pattern at these higher-level could also set up a trade opportunity.

Do Capital Gains Tax Hikes Matter?

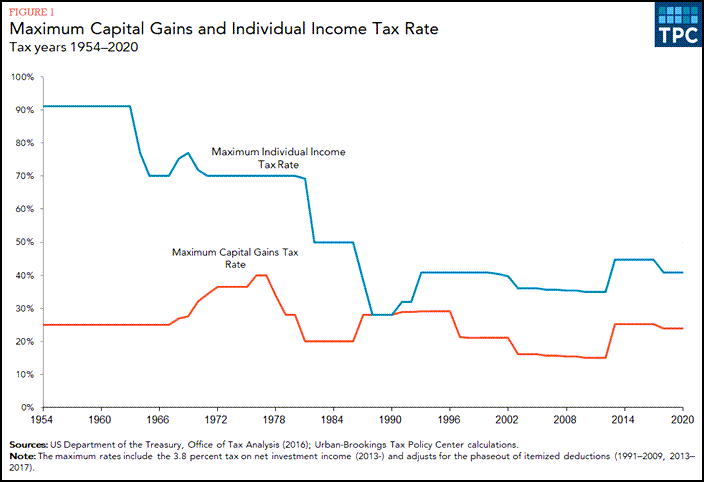

First, here's a little historical perspective on tax rates for capital gains and ordinary income.

If nothing else, the chart above shows that no matter what happens to the tax rates, we've been there before.

Back to the question of, do capital gains taxes matter?

The short answer is, "it depends."

First, we CAN NOT say that expectations of higher capital gains taxes don't have a negative effect on investors' outlook for stocks.

After all, the mere announcement of such a proposal sent the S&P plunging down over 1% in about an hour. Clearly, the market at that moment expected higher rates to be bearish.

That said, we also saw the market bounce right back the following day.

This recovery doesn't mean the negative effects of such an idea are now "priced in." The expectation of higher capital gains taxes will continue to weigh in as a bearish factor in some investor's assessment of the market's potential.

It will also become a common bearish refrain in the media. No one is going to say it's bullish.

This news is likely to repeatedly instigate short-term bearish volatility, but the answer is less clear in the long-term.

What is clear, however, is this topic will generate a lot of persuasive arguments about the potential impact.

For now, here's a more optimistic and empirically grounded argument taken from a recent article in Barron's…

"History shows no discernible correlation between equity valuations and changes to the capital-gains tax rate…

…Research from UBS Global Wealth Management shows that earnings multiples on the S&P 500 can range from roughly 8 times to as high as over 20 times regardless of whether capital-gains taxes are at 15% or near 30%.

Indeed, there is "no relationship between capital-gains taxes and market returns," writes David Lefkowitz, head of Americas equities at UBS. In 2013, for example, the S&P 500 gained 30% even though the capital-gains tax rate rose nine percentage points. In 1981, the tax rate fell about eight percentage points, but the S&P 500 still fell 10%.

The reality is that earnings growth and interest rates are the most important factors affecting stocks, which makes assessing the impact of tax rate changes on stocks difficult. One effect on the market, according to Arthur Weise, chief investment officer of Kingsland Growth Advisors, is that investors may gain interest in growth stocks over value stocks. The reason: Growth stocks benefit from longer-term industry changes, while value stocks are more impacted by the near-term movements of the economy, Weise says.

And holding a stock for that much longer would diminish any negative impact of a higher tax.

We'll leave it up to our models, indicators, and disciplined strategies to guide us toward or away from any such rotation and capitalize on it.

Additionally, for the shorter-term impacts, I'd suggest listening to the market as it sorts it out.

Take what was said above about watching the market's reaction to earnings announcements vs. the expectations and apply it to news about the capital gains taxes increasing.

In short, keep an eye and ear on how the market reacts to the news and the likelihood of higher capital gains taxes. Does it continue to weigh on stocks, or does the market continue to brush it off?

The pattern that develops will tell you what the market is expecting, which I believe is all that matters.

There is one thing we can be certain about.

With higher corporate taxes in the market's narrative, anticipating the market's direction is going to be emotionally taxing.

Fortunately, we (and hopefully you) have the Big View Risk On/Off gauge to provide an objective assessment of the market's expectations for the direction of the trend.

Currently, our Risk On/Off gauge is bullish.

If you're a premium BigView member, keep an eye on this gauge. If you're a premium Alpha Rotation member, then don't forget that you have a Risk Gauge for the QQQ and IWM also!

Here are this week's market action highlights:

- SPY Risk Gauge moved from neutral to bullish.

- IWM breakdown on Tuesday below 2 weeks of consolidation appears to have flushed out weak holders and set up the index to follow though on its immediate reversal higher. Continuation this week would be very bullish. I explained why this might happen in a live Triple Play mentoring session as it was breaking down on Tues.

- Weekly doji's in SPY, QQQ and DIA indicates consolidation with indecision. A break above or below last week's ranges could gain momentum.

- The mid-caps (MDY) broke out to all-time highs!

- Daily Bollinger Band are squeezed in IWM which adds to the likelihood that a breakout in the direction of the major trend will continue.

- TLT has consolidated for two weeks around its 50 DMA and $140 which has been pivotal in the past.

- After a big move last week, XLU pulled back from overbought levels, according to Real Motion.

- There weren't any stand-out moves in any sectors in our basic sector summary suggesting most areas of the market consolidated. However, there were some noteworthy movers in other sectors.

- TAN is on our "Biggest 5-day mover list," and it had an interesting move higher off of its 200 DMA.

The other noteworthy ETF move from our 5-day movers scan is {44788|CORN}} up 9% continuing its melt-up along with many of agricultural commodities reflected in DBA. This is another theme Mish has been keeping front and center in her free and premium services. - IBB is in an interesting setup. The last 2 days have straddled 155 which is also the 50 DMA and top of 3-week range sitting on the 200 DMA. Long-term (50/200) Real Motion looks like it will break down hard if it breaks below 145, but short-term Real Motion suggests a breakout over this week's high could run.

- USO's price action looks like a stable consolidation, but long and short-term Real Motion suggests a break below the 50 DMA and last week's low could begin a significant move lower. XOP, OIH and XLE were all in the scan for the "Biggest 5-day losers and all had similar Real Motion weakness weeks ago, which preceded their 50 DMA break downs that continued last week.

- The MClellen Oscillator broke and rebound back over its 50 line.

- COMPX didn't make a new high in April and has not been able to break important resistance from the 50-day Real Motion average.

- Copper (CPER) broke out of a 7-week consolidation and closed at the highest levels since 2012.

- Lumber (WOOD) broke out from a pattern similar to Copper 2 weeks ago and has been on a tear until it gave back some of its gains this week.

- The Dollar (UUP) continued to break down below its 50 DMA fueled by a strong move up in the Euro (FXE)

- Growth continued its trend over the last serval weeks of outperforming growth as measured by VTV and VUG.