Current Position of the Market

S&P 500: Long-term trend – The bull market is continuing with a top expected in the low 3000s.

Intermediate trend – Is this an intermediate-term top? Perhaps not yet!

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts, which discusses the course of longer market trends.

Market Overview

Well, it finally happened! After failing to reach its expected high in the 2900s, and with little advance warning, the index started a decline that was proportional, in style, to its recent advance, except for the fact that the last re-accumulation pattern at 2840 did not produce the expected advance to its projection target.

Even the first phase of its correction (which met a projection based on the available count, before starting to consolidate) looked like another consolidation in an uptrend. It was not until Friday that the market’s intention became obvious.

So what does this 1100-point, 5-day drop in the Dow (two third of which took place on Friday) forecast for the near future? Just a hiccup or something more?

Both from a cyclical and projection standpoint, this could turn out to be just a fairly short correction in an uptrend, with a new high following in the next few weeks or, at least, some re-test of the high. It will depend on how the market behaves in the next few days.

There was little distribution at the top, and therefore nothing to help forecasting a protracted decline. With regards to the SPX, after the count from the initial pattern was exhausted at 2819, the next congestion phase formed quickly over the following two days, and when the dam broke early on Friday, the reservoir emptied all at once, and by the end of the day there was little left in it.

I suspect that what is left will take us a little lower on Monday morning, after which we can start an oversold rally. After this rally, we could re-test the low and even proceed lower before attempting to resume uptrend.

If, after the retest, or after a move slightly lower, we fail to see some strength returning, that will be the time to be concerned that a decline of larger magnitude has started.

This opinion is based on the belief that the market will obey the current cyclical rhythm, which does not call for anything really (I mean really) serious to take place until the end of the year, although more large scale volatility cannot be excluded before then.

Chart Analysis (These charts and subsequent ones courtesy of QCharts)

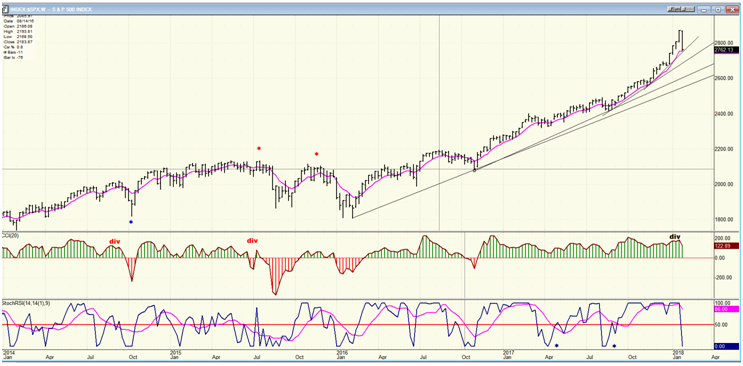

SPX weekly chart

In support of my opinion, I offer the weekly chart of the SPX. There is nothing on this chart which suggests that we have made an important top. Normally, this is preceded by some price deceleration, such as in the two former instances I marked with a red asterisk.

It is a characteristic of tops to be rounded, while lows are sharp and climactic, as exemplified by many of the lows on this chart. You will also notice that not a single trendline, even the steepest one, has been broken. Of course, probably some will be in the course of the correction, if it persists. We’ll have to see!

But the best evidence comes from the indicators. The CCI is still way up in the green and does not sport any obvious negative divergence; as it did in the two instances which preceded protracted corrections. The SRSI is more volatile and often drops to the bottom of its range, but only to come right back up. It can do so with only minor corrections in the index. But if it remains below the zero line for an extended period of time, that’s another story!

Is this analysis of the weekly chart a conclusive proof that we have not started an important correction? Definitely not! Only the market can do that over a period of time. I am only calculating the odds based on past behavior.

SPX hourly chart:

I’ll skip the daily chart and go directly to the 60m one. Last week, I discussed the value of P&F charts versus bar charts. As an example, I showed the small green pattern of accumulation at the top, which was smaller than the one at the bottom, but which had a greater potential count than the latter.

Well, that turned out to be an unfortunate example because that potential (which would have taken us past the 2900 level) was never realized. Instead, the index started to roll over, gapped down, and could not get back in an uptrend before falling out of bed.

There are more examples on this chart that reassure us that we are not going to keep on going lower - at least not right away. Look at where we stopped on Friday: right on trend line #1, which coincides with the 233-hr MA to provide decent support at the end of Friday’s decline.

The count does extend a little lower, and the Globex did continue down to 2755, which is not a coincidence since Globex traders are also aware of P&F projections and usually observe them. There was only minor relief of the downside momentum at the end of the day, so the lower count range (given to subscribers) looks like a good target for Monday’s low.

Finally, positive divergence appeared for the second time last week in the CCI. The first time only led to additional distribution and lower prices. It could be more predictive of a rally, this time.

On the other hand, the A/Ds were still extreme at the end of the day, so there is no bullish support there. I have repeatedly commented, mostly in my daily updates, about the odd A/D behavior (with a potential negative implication) of the past few weeks. If there was any kind of warning for this spontaneous decline, this had to be where it manifested itself.

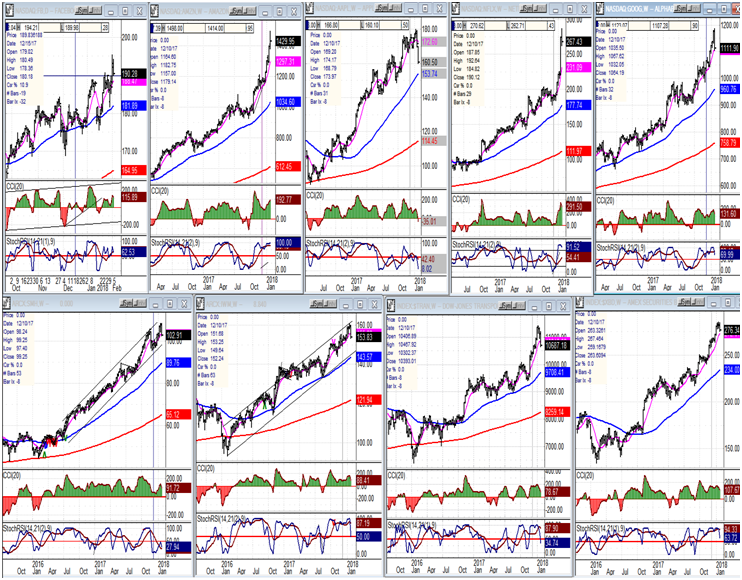

An overview of some important indexes (weekly charts)

I switched to weekly charts to compare these indices to the weekly SPX chart above. Most indices look like the SPX, except for Amazon (NASDAQ:AMZN) (second, top), which is stronger.

The only FAANG showing the possibility of having made an intermediate top is Apple Inc (NASDAQ:AAPL), which formed a congestion pattern of several weeks, briefly broke above it, and then sliced right through it! This is suggestive of an intermediate top, but this pattern does not appear in any of the others, or in the SPX.

PowerShares DB US Dollar Bullish (NYSE:UUP) (dollar ETF)

UUP may have completed the third wave of its new decline. If so, a short consolidation extending outside the narrow channel should be followed by one more wave on the downside before a more reliable low point is reached.

GDX (NYSE:GDX) (Gold miners ETF)

GDX made a brief new high, but was not yet ready for an extension of its uptrend, and consequently pulled back sharply into the 6-week cycle low which is due next week.

If it can stabilize in the next few days, it should make an attempt at resuming its uptrend, although more cycles - which could invert - lie ahead. This possibility makes a forecast based on cycles more complicated, and we will have to rely on the P&F chart and the indicators to determine the trend going forward.

USO (United States Oil Fund (NYSE:USO))

USO has totally ignored the market correction, meaning that it should be analyzed individually, and apart from the overall market. It has a good projection target of 15.00 and may therefore consolidate for a little while before proceeding higher.

Summary

Last week, mainly on Friday, SPX and the market in general experienced the sharpest and most spontaneous correction in quite a while with little, if any, warning.

For reasons stated in the above analysis, I feel that the bias does not favor the start of an intermediate correction at this time, and that more evidence will be needed if this is the case. It does not mean that after a brief oversold rally we cannot see slightly new lows before the index regains a more solid footing and attempts to resume its uptrend - perhaps reaching a new high, or at least re-testing the current high.