US stocks pull back

US stock market pulled back on Tuesday as the House of Representatives passed the tax bill. The dollar weakened further despite rising housing starts: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.3% to 93.483. The S&P 500 lost 0.3% to 2681.47 led by real estate and utility shares. Dow Jones industrial average slipped 0.2% to 24754.75. The Nasdaq composite index fell 0.4% to 6963.85.

European stocks fall as German sentiment slips

European stocks retraced lower on Tuesday weighed by declining German business sentiment. Both the euro and British Pound extended gains against the dollar. The Stoxx Europe 600 lost 0.4%. Both the German DAX 30 and France’s CAC 40 dropped 0.7%. However, UK’s FTSE 100 gained 0.1% to 7554.09. Markets opened mixed today.

Asian markets mixed

Asian stock indices are mixed today. Nikkei rose 0.1% to 22891.72 as the yen fell against the dollar. Chinese stocks are lower: the Shanghai Composite Index is down 0.3% and Hong Kong’s Hang Seng Index is 0.2% lower. Australia’s ASX All Ordinaries rose 0.1% with Australian dollar steady against the greenback.

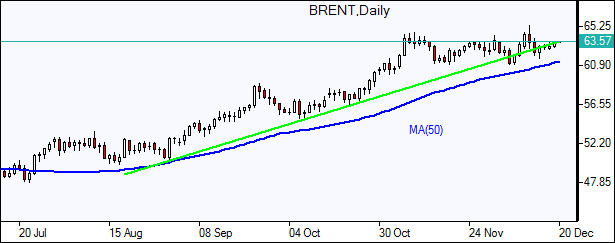

Oil higher on expected US crude draw

Oil futures prices are edging higher today on expected US crude inventory drawdown. The American Petroleum Institute industry group reported late Tuesday US crude stocks fell by 5.2 million barrels to 438.7 million. Prices rose yesterday supported by North Sea pipeline outage: February Brent rose 0.6% to $63.80 a barrel Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.