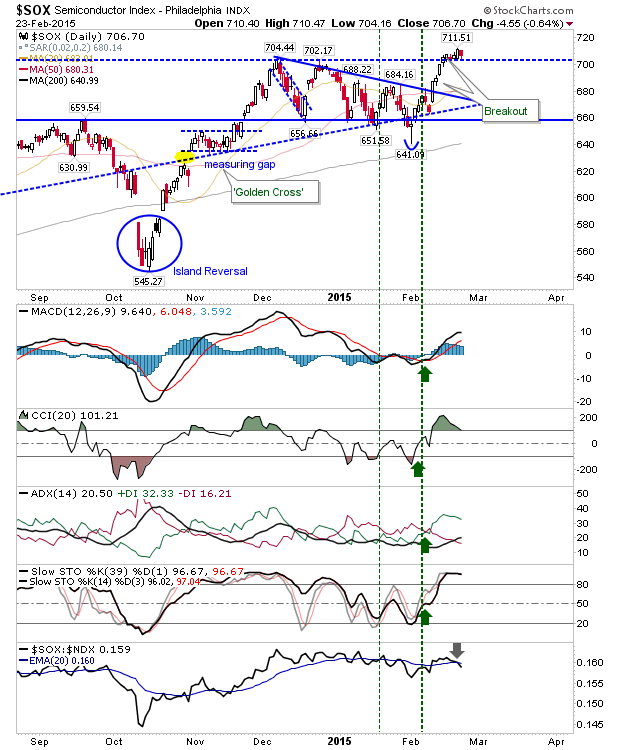

In what amounted to a really dull Monday, indices were able to hold Friday's gains. Anything else to say is really just noise. As part of the noise is a relative shift in the Semiconductor Index, then away from Semiconductor Index, to the NASDAQ. However, the price breakout held.

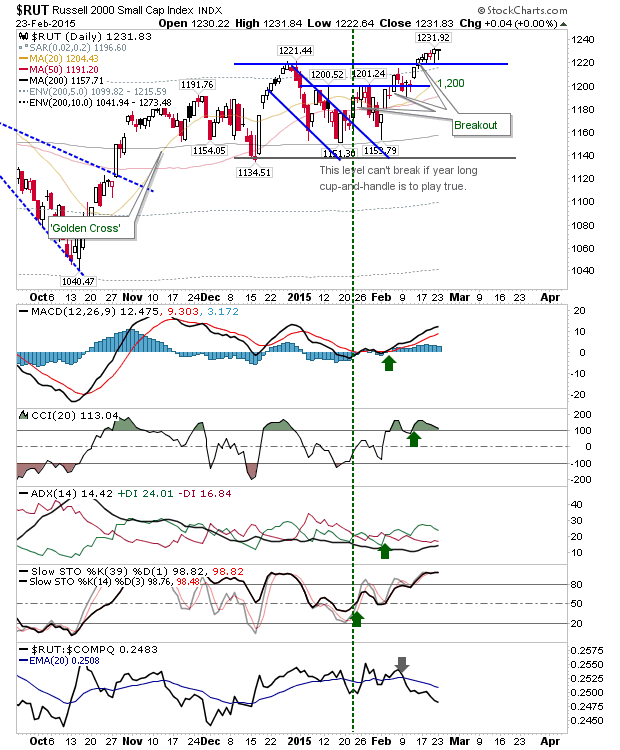

The Russell 2000 probably gave up the most ground intra-day, but finished with a small gain by the close. I'm liking the 'doji' next to the 'bullish hammer'. These aren't reversal candlesticks, but they do mark the presence of demand at support.

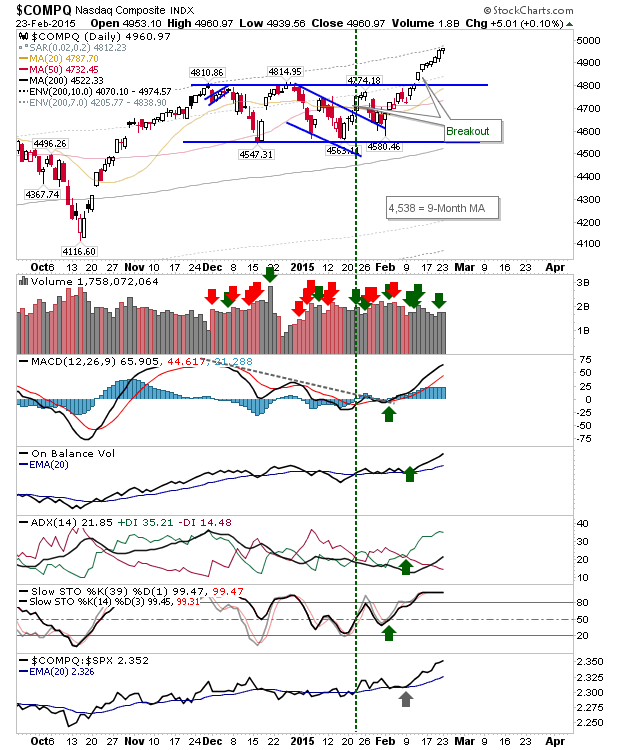

The NASDAQ edged ever closer to the 10% envelope tag. Another gain counts for the ninth gain in a row. At some point, the music will stop, but it hasn't yet. The key level is at 4,810 support.

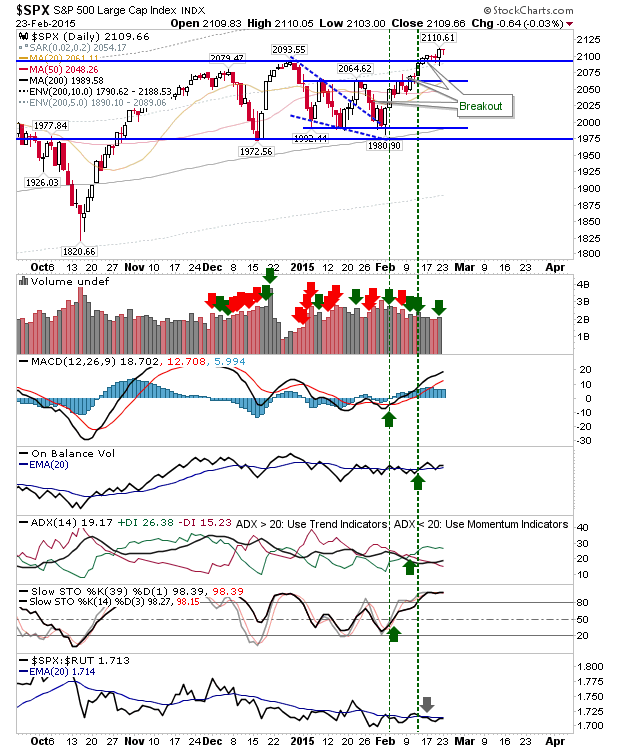

The S&P 500 was like a mini Russell 2000. The index finished near Friday's high and remains nicely bullish.

For today, keep eyeing the bullish plays. It will take a 'bull trap' in indices (a loss of Friday's breakouts), to hand bears control.