OTHER VOICES

In recent posts on rising bond yields and a bull/bear eye test, we noted rising bond yields are typically associated with bull markets and an improving economic outlook. From time to time, it is helpful to hear the message from other sources. From MarketWatch:

How big of a headwind do high rates really represent? According to equity analysts, not big at all. In fact, they may even be a positive. Despite the recent turbulence, historically, “equities have gained significantly in periods of rising rates,” wrote Jodie Gunzberg, managing director and head of U.S. equities at S&P Dow Jones Indices, in an email. “Since 1971, the S&P 500 has gained about 20% on average in rising rate periods, has gained 8 of 9 times and has gained nearly 40% twice, with less than a 4% loss for its worst rising rate period.” Gunzberg’s analysis evaluated the benchmark U.S. index on a total-return basis.

From CNBC:

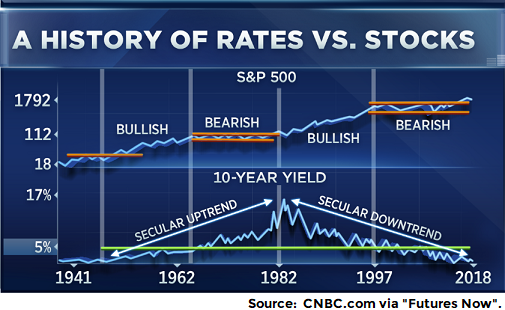

"I want everybody to sit back, relax and let's look at this history," Acampora told CNBC's "Futures Now" on Tuesday. He picked out a chart that he says proves the case.

"Stare at the lower left-hand corner of that chart carefully," said Acampora. "Look at the years between 1948 and 1962. Guess what — rates started turning up. Look at the chart up above it, the stock market went up. In other words, you can have rising stock prices with rising interest rates."

"There'll be a lot of volatility," added Acampora. "But, the secular bull market is alive and well. I think you've got years left even with rising rates."

S&P 500: NORMAL PULLBACK

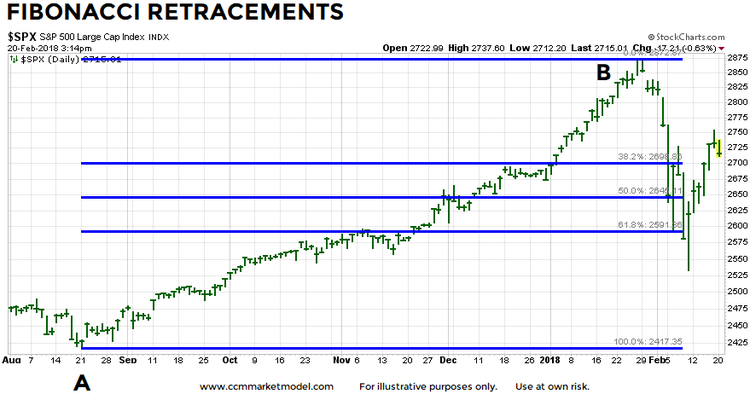

Fibonacci retracements help us understand what a normal pullback typically looks like within the context of an established uptrend. Even if we examine a relatively short timeframe dating back to August 2017, the S&P 500 remains near the typical retracements of 38.2%, 50.0%, and 61.8% of the prior A to B move. If the trend remains in place, we would expect the S&P 500 to eventually make a higher high above the previous high, which is what bullish trends do by definition.

If the levels above fail to hold in the coming days and and weeks, the bears will have taken a small baby step in relation to the bigger picture evidence outlined in the video below.

WHY EVERYTHING YOU KNOW ABOUT STOCKS AND BONDS IS ABOUT TO CHANGE

This week's video asks what can we learn about the stock market's long-term risk-reward profile by studying three charts: (1) S&P 500 vs. 30-YR Treasuries, (2) Value Line Geometric Index, and (3) the NASDAQ.