Are the traps set for U.S. Yield seeking investors?

Treasuries, High Grade Corporates, Utilities, REITs, and MLPs have all been terrific assets to own and many have even rivaled the returns of the major equity indexes from the 2009 lows. Great returns + Lower historical volatility have led to significant inflows over the past 5 years. So as you saw last week, when investors decide to change direction and reallocate, the selling pressures can add up to more extreme moves.

But they said Bonds would be less Risky?

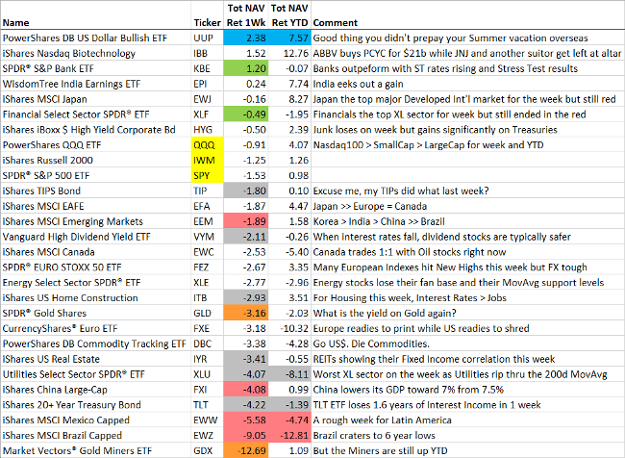

The (ARCA:TLT) ETF yields about 2.60%. So last week it lost 1.6 years of income. In 5 weeks, it has lost 4 years of income.

Not to be outdone, low-risk Utility stocks joined the selling…

The (NYSE:XLU) yields about 3.3% so it lost 1.4 years of income last week. In addition, it ripped through its 200 day moving average which is never a healthy sign.

The U.S. Dollar remains a one-way, high-speed bullet train…

As Europe moves into QE to aid its economy and the U.S. moves towards tightening because of its strengthening economy, the US dollar continues to gain. Someday in the future these new dollars might find their way into bonds, but last week they just wanted to enjoy higher short-term yields in the cash markets.

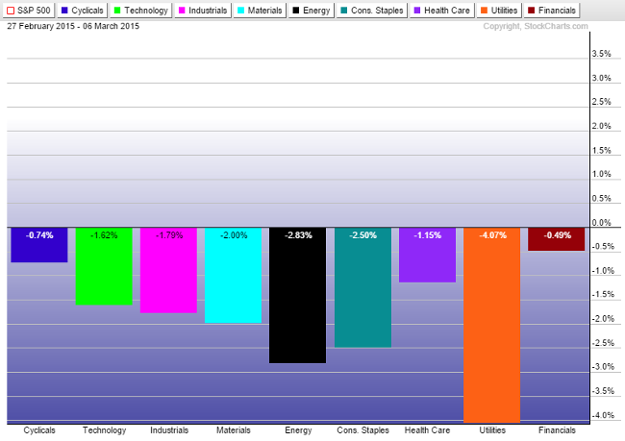

On the week, the Yield-sensitive Utility stocks led the way lower. No XL sector registered a positive return.

More broadly last week, U.S. Equities > International Equities and Stocks > Bonds…

The most significant catalyst to last week’s market movement was the Friday jobs report…

The February jobs report, showing a 295,000 gain in nonfarm payrolls, about 60,000 more than predicted by economists, plus a dip in the unemployment rate to 5.5% from 5.7% in January, evidently was enough to convince the markets that a June Fed rate hike is now likely. The June fed-funds futures contract was pricing in a 70% probability of a move to 0.25% to 0.5% at Friday’s settlement, up from 48% the day before, according to the CME. By September, the probability is 82% of a hike, with a 22% chance of two quarter-point hikes by then

Most signs continue to point to a mid-year rate hike by the Fed…

Federal Reserve Bank of Richmond President Jeffrey Lacker said Friday he is looking to the central bank’s mid-June policy meeting as the most probable time to raise short-term interest rates. Given the performance of the economy and very robust improvements in the job market, “June has to be on the table,” Mr. Lacker told a Sirius XM (NASDAQ:SIRI) satellite radio program. He explained that as long as the economy meets his expectations, “June would strike me as the leading candidate for liftoff” in moving short-term interest rates off their current near-zero levels… The official also indicated that he favors moving away from the Fed’s current pledge to be “patient” with rate rises, saying he’d like the wording to be struck from the FOMC statement in order to give officials more flexibility to respond to economic data. Pointing to the Fed’s mid-March meeting, he said, “I think the upcoming meeting in a couple of weeks, just how we characterize the outlook for policy is going to be front and center” in deliberations

Even more difficult to bet against Consumer Stocks that can control wage pressures…

@larry_kudlow: Ave. hourly earnings y/y =2%. Plus agg. hours worked =3.3%. So wage income = 5.3%. Less flat CPI = 5.3% real worker income. Consumer boom?

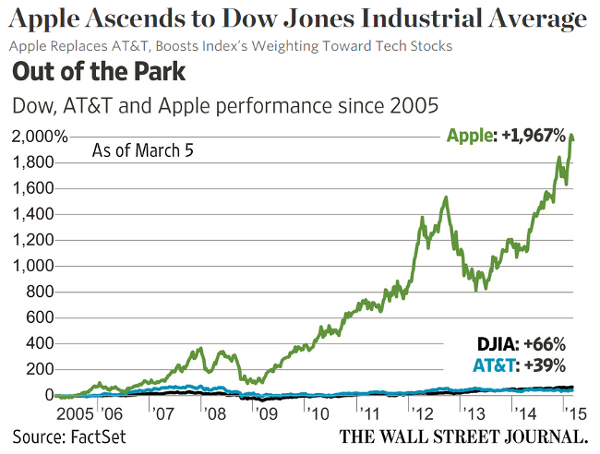

The Dow Committee is now hoping for acceleration in global consumer paychecks…

Apple (NASDAQ:AAPL) stock has been one of the market’s monster performers in recent years, posting an annualized total return, reflecting price gains and dividend payments, of 36% over a decade. The company boasts one of the most recognizable and respected consumer brands in the world. A galaxy of blogs cover every move by the company and its executives. “Apple is the clear choice for the Dow Jones Industrial Average, the most recognized stock market measure,” said David M. Blitzer, chairman of the index committee at S&P Dow Jones Indices.

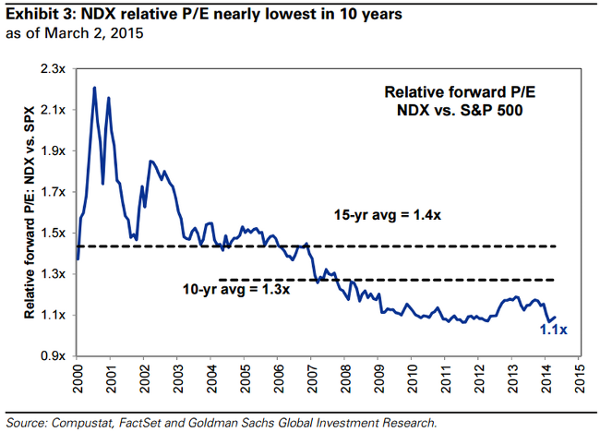

How long will Large Cap Tech be on sale?

Apple is 14.8% of the (NASDAQ:QQQ) ETF and it is a cheap stock. Biotechs are 11.5% of the QQQ ETF and they are not cheap. But since Technology = 58% of the QQQ ETF, it pulls the relative P/E multiple down to very attractive levels.

But maybe you shouldn’t worry about Biotech valuations…

AbbVie (NYSE:ABBV) has agreed to acquire Pharmacyclics (NASDAQ:PCYC) for $21bn in what people involved in the negotiations described as one of the most competitive bids for a biopharmaceutical target in recent history. Chicago-based AbbVie made a late swoop to outbid Johnson & Johnson (NYSE:JNJ) and a third rival with an offer of $261.25 per share in Pharmacyclics. AbbVie said the $21bn deal would be paid roughly 58 percent in cash and the remainder in its shares. It remains unclear who the third suitor was. The fierce bidding war for a biotech company highlights the pressure pharmaceutical companies are under to replenish their pipelines as patents expire on blockbuster drugs and competition from generic drugmakers intensifies

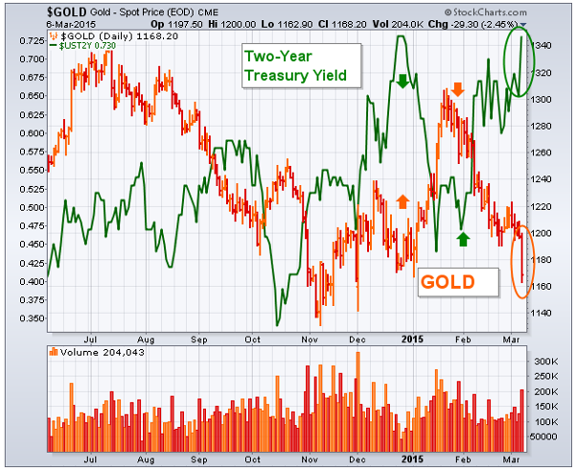

Gold hates this move higher in the U.S. 2-Year Treasury yield and the US dollar. Will the metal be tarnished until the Fed gets behind the curve?

Nice sale Warren!

Meanwhile in the oil patch, Exxon Mobil (NYSE:XOM) suffers its lowest closing price in 16 months…

How low can Crude Oil prices fall if there is nowhere else to store it?

In a world awash in crude, oil producers and traders are facing a billion-barrel conundrum: where to put it all. U.S. crude-oil supplies are at their highest level in more than 80 years, according to data from the Energy Information Administration, equal to nearly 70% of the nation’s storage capacity. A U.S. storage hub in Cushing, Okla., is expected to hit maximum capacity this spring. While estimates are rough, Citigroup Inc. (NYSE:C). believes European commercial crude storage could be more than 90% full, and inventories in South Korea, South Africa and Japan could be at more than 80% of capacity. The danger of running out of places to stash crude: Some analysts predict prices, already down 50% since June, could spiral even lower as producers sell oil at a discount to the few remaining buyers with room to store it.

Hopefully the Bond investors at least got to visit beautiful Colorado…

A Colorado oil producer is giving debt investors a lesson in the risks of lending to companies that staked their future on the U.S. shale boom. Less than seven months after raising $175 million in a junk-bond offering, American Eagle Energy Corp. said Monday that it wouldn’t make its first interest payment on the debt. Instead, it hired two advisers — Canaccord Genuity Group Inc. and Seaport Global Holdings LLC — to negotiate with bondholders on a plan to restructure its debt, according to three people with knowledge of the situation who asked not to be named because the matter is private. The holders of the notes are left to consider how to maximize recovery of their investment, either by giving the company more time to try to become profitable or by pushing it into default. With the price of U.S. crude down 52 percent since July, American Eagle and other small energy producers with significant debt loads are struggling to service obligations to creditors who were willing to lend them money just a few months ago.

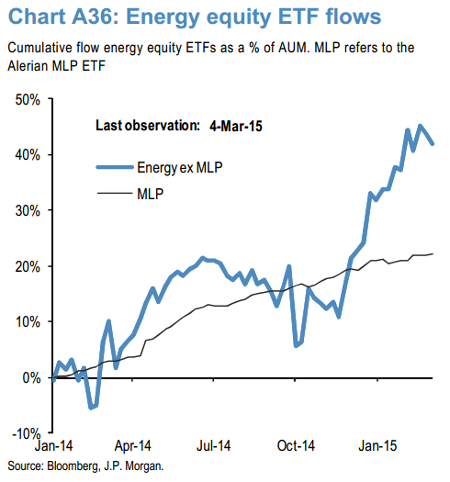

A look at flow data suggests that investors are increasing their exposure to Energy stocks…

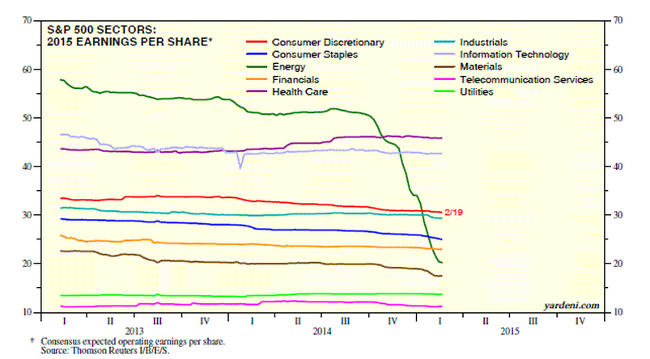

And while we have seen the S&P 500 earnings reductions for Energy, we have yet to see increases across other Sectors who will benefit…

A great chart from Ed Yardeni’s blog. The strong U.S. Dollar is adding some pressure to earnings, but as lower energy cost gains ripple thru spending and cost lines of the rest of the S&P 500, expect those sector earnings estimates to be lifted through 2015.

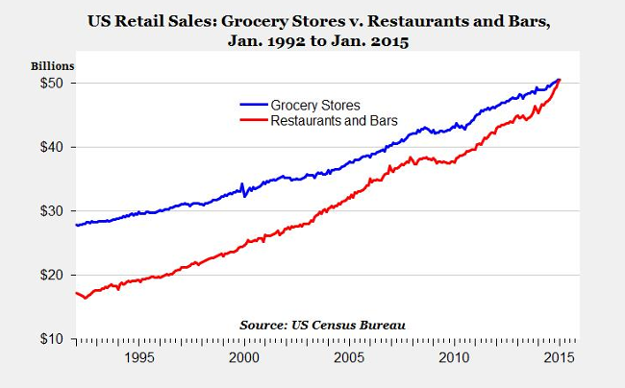

One sign of a stronger consumer is more eating away from the home…

@Mark_J_Perry: HISTORIC: For the first time ever, US consumers spent more on food at restaurants/bars in Jan. than at grocery stores

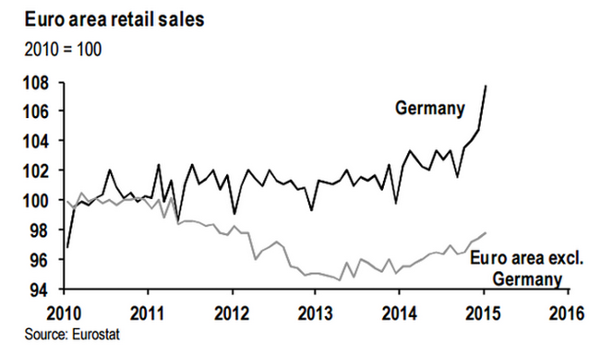

Speaking of a stronger consumer, Germany is looking great…

@RichardBarley1: Euro area retail sales: Germany leading, but rest following too. Chart from JP Morgan:

Stan Druckenmiller putting chips down on the European Consumer…

KELLY EVANS: What are the European names that you’re particularly exposed to– and long here then?

STAN DRUCKENMILLER: You know, a few months ago we started buying the– I would say global consumer brands who are primarily stable in nature like– Unilever (LONDON:ULVR) or Pernod Ricard (PARIS:PERP) or L’Oréal. But recently we’ve shifted into more cyclical names like Volkswagen AG ST O.N. (XETRA:VOWG), Bay.Motoren Werke AG ST (XETRA:BMWG), Airbus Group (PARIS:AIR). When you get the – you get the tailwind of – the euro having gone from 140 to 120, which will give them an earnings push in addition at a lower energy. And they are great consumer brand names in and of themselves.

KELLY EVANS: And you’re not worried about the weak euro eroding in that position?

STAN DRUCKENMILLER: No, the weak euro is actually quite positive, because we hedge all our stocks so it gives you an earnings tailwind.

Warren also placing chips on Euro Consumers while at the same time borrowing in Euro at irrelevant interest rates…

@rationalwalk: Buffett is buying a small European motorcycle gear company and issuing some Euro debt. Draw your own inferences.

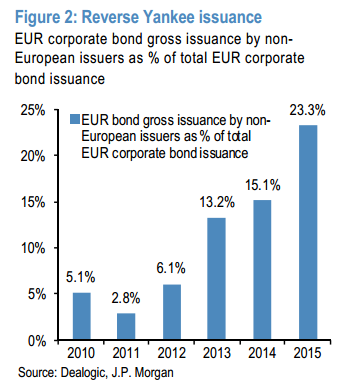

Berkshire Hathaway (NYSE:BRKa) not the only non-European company issuing debt in Europe at nil interest rates…

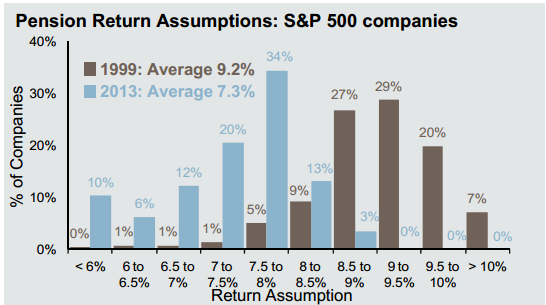

With a surging US dollar, very, very low Interest Rates, and ugly Commodity returns, how can actuaries and accountants budget 30 year pension return assumptions of 7%+?

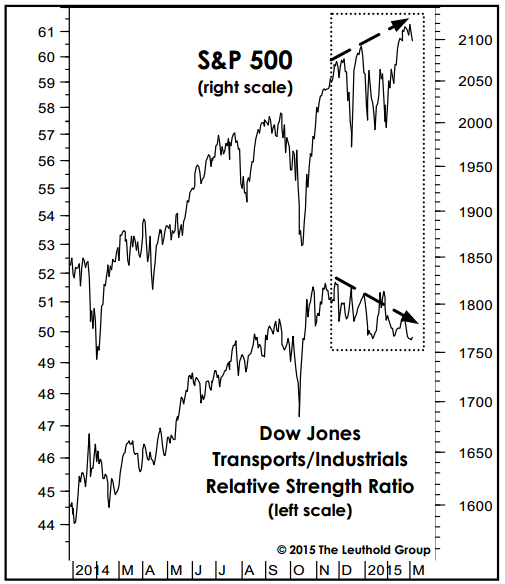

If you are looking for signs of a top in U.S. Equities, here is a good one for you…

The Leuthold Group points out that 14 of the last 16 Bull Market peaks have occurred when Transports underperform for 6-12 months.

Another reason for last week’s sell-off in Risk…

The markets do not like uncertainty. They also tend not to like a lack of checks and balances in Washington D.C. Secretary Clinton has been the clear front runner to be the next POTUS. Email-gate has thrown a basket of tacks on her smooth ride into the U.S. Presidency and thus some FUD into the U.S. Equity markets. The market will be watching closely for either a definitive response from Team Hillary or they will start sizing up the rest of the field

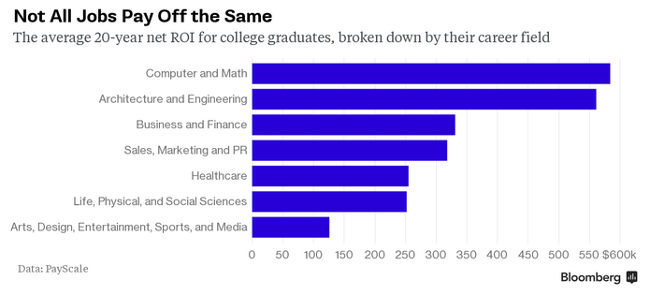

A chart to save for when your kids come to a fork in the road…

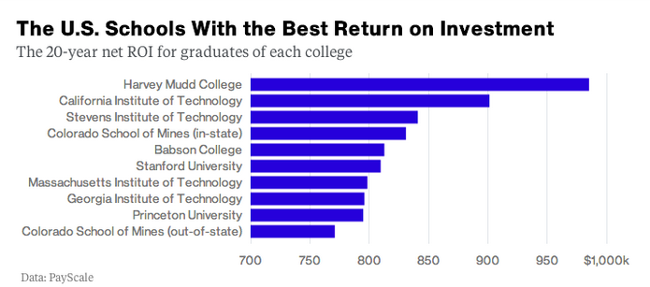

And another for when they begin to look at which Colleges to apply to…

If you like the ideas Blaine Rollins shares each week in the 361 Capital Research Briefing…

Then you should learn more about how he incorporates these ideas in the new mutual fund he is managing, the 361 Global Macro Opportunity Fund. Contact 361 Capital or your advisor for additional information.

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, 361 Capital is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of 361 Capital.