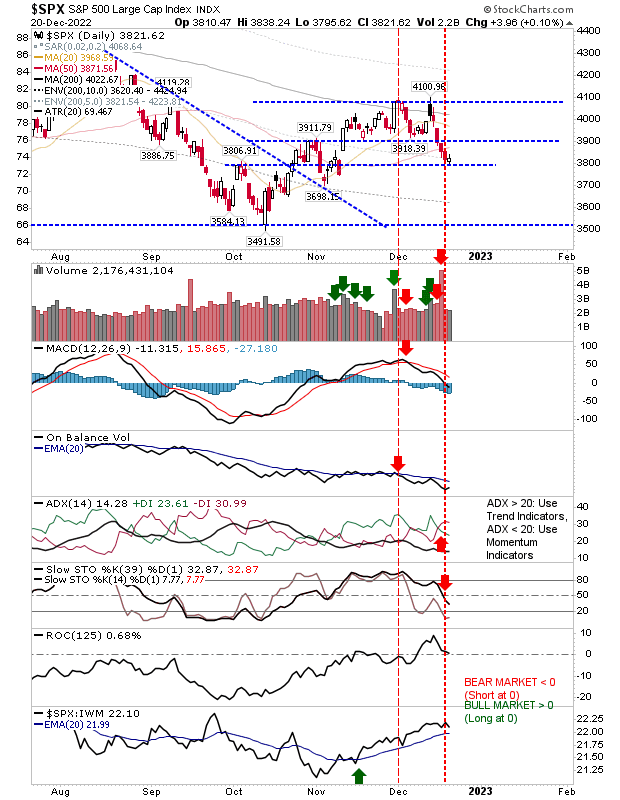

Each of the lead indices has its support levels to defend, and not all are tested at the same time. On Friday, it was the Nasdaq Composite toying with potential trading range support, today, it's S&P 500 500's turn. These support levels are not major areas of demand but a hint to where demand might kick in.

So with that, we have the S&P 500, down-testing neckline support from October with net bearish but not oversold technicals. So, even given the weakening technical picture, there is a good chance we could see a bounce tomorrow, giving an opportunity for an aggressive long trade.

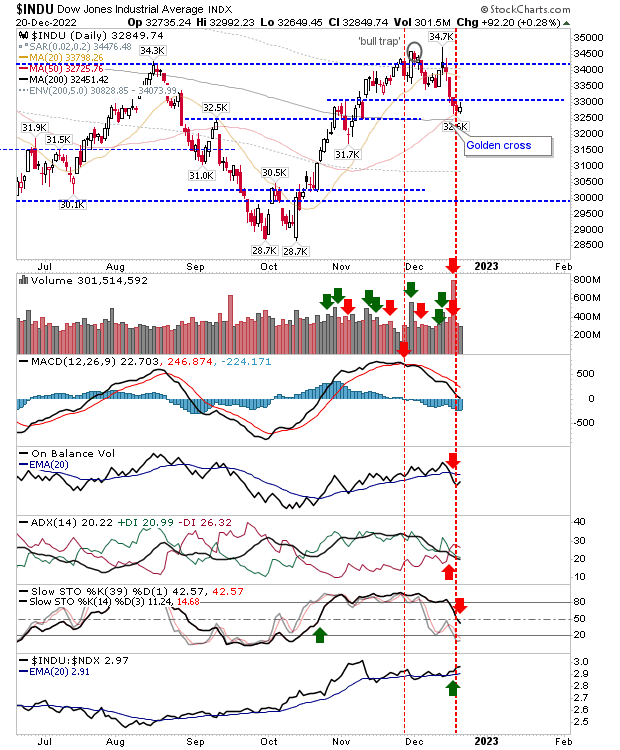

The Dow Jones Industrial Average is successfully testing its 50-day MA. This is another buying opportunity, building off the bullish trend change with the 'golden cross' between the 50-day and 200-day MA.

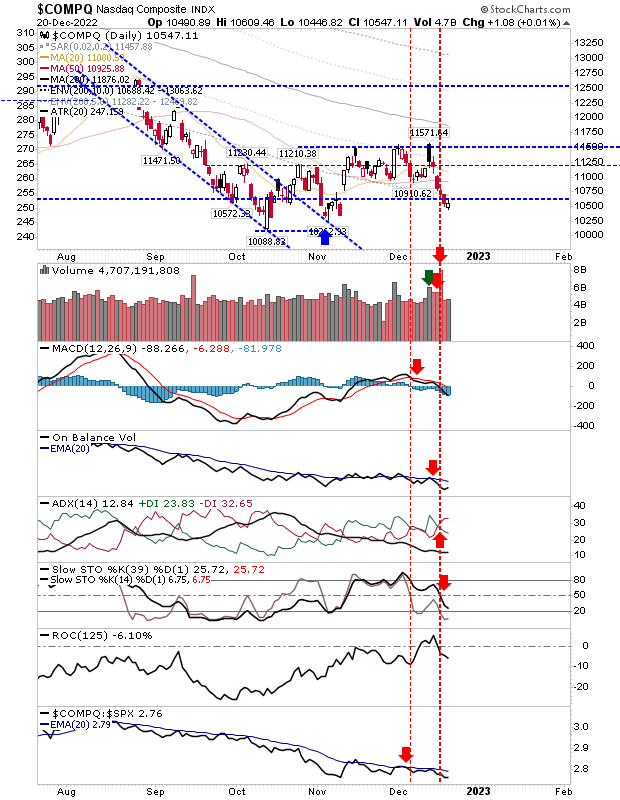

The Nasdaq undercut a support level, leaving it staring at a move back to the October low. Technicals are not fully oversold, but they are net bearish. The index is also underperforming relative to its peers, so it may be slow to get going.

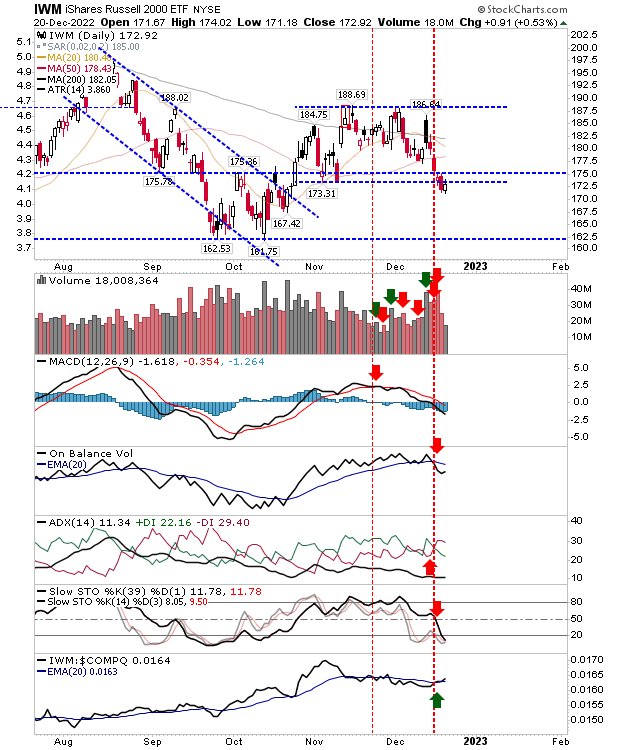

The Russell 2000 is trading just below support on net bearish technicals, but looks oversold. A close above this support would confirm a 'bear trap' and set up a nice playback to $188.

Yesterday's narrow bullish finish offers a decent risk-to-reward ratio (using a stop below today's lows) for a long trade to play into a potential Santa rally.

Next year might be a different story, but you might as well enjoy the now.