I believe the answer is "Yes" and the Russell 2000 is leading the way down. It did it back in 2000 and 2007 and now it's doing it again.

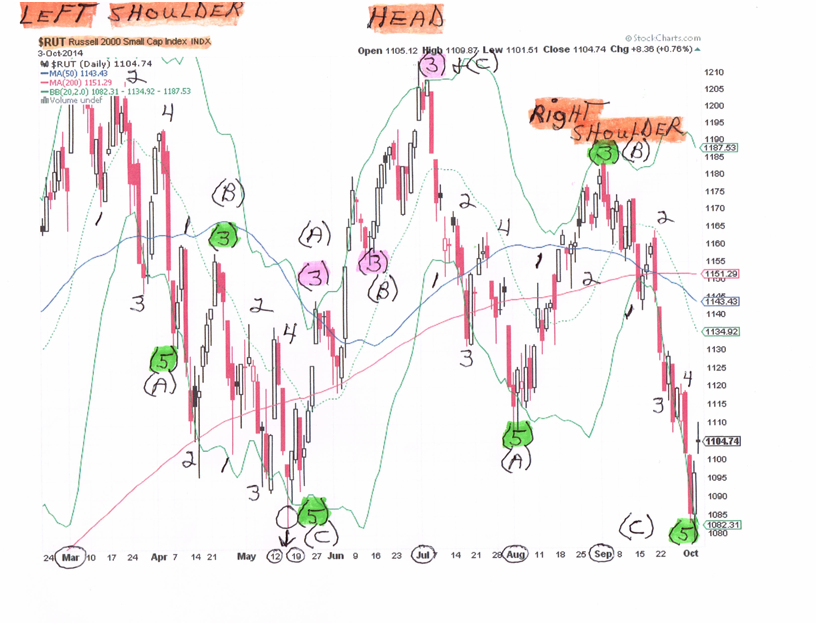

It topped out last March at 1213 level and then created a perfect Elliott Wave bear market pattern of 5 sub waves down, by 3 sub waves up, and finally another 5 sub waves down. That completed about 2 1/2 months later and near the 1080 level. So about -133 points down.

What I find interesting is that there is a 5 year bull cycle that completed on March/2014, and the Russell 2000 hit it perfectly. The other USA common indexes are now 6 months overdue.

Since the May low of near 1080 the Russell 2000 rallied back up and double topped at 1213 and near July 1st. The July top has held and not been broken, while other indexes have created new highs.

Also interesting is that since the initial March/2014 top the Russell 2000 has formed a nice head and shoulders bear market pattern. The left shoulder topped near March 1st, the head topped near July 1st, and the right shoulder topped near September 1st.

When the recent right shoulder was being created the 50 day moving average crossed the 200 day moving average and created the dreaded "Death Cross". When that happens the index is officially in a "Bear Market".

So now the 64 thousand dollar question is when do the other indexes join the bear market party?

I might have an answer! I have noticed that many of the other indexes like the DJI, S&P 500, and the NASDAQ have also been forming their own head and shoulders patterns. The one I like to use as an example is the NYSE, because it has over 2000 stocks and includes stocks of the other common indexes.

When I look at the NYSE I can see that it is also forming a head & shoulders pattern, but it's missing the "right shoulder". Last Thursday my main trading trend completed a major reversal from down to up. It's a "great" trading trend because the other indexes such as the NYSE are still in their bull market cycles, so if it repeats what it has done in the past, it will go almost straight up again with only a few down days. It's also about a month long, so the bulls can party for at least another month.

I believe the right shoulders are now starting to be formed on the other common USA indexes. Again this new main trading trend should last about a month before it tops out and completes the new right shoulder. Since we reversed up last Thursday - 10/02/2014, I predict that we could officially start the new bear market near the beginning of next month, November/2014.

There still is a chance that the main trend reversal last Thursday (10/02/14) was a "head fake" and we could still have more downside before we get the official reversal. If that happens I will have "revise" my bear market prediction.

It will be devastating for a lot of traders that thought the bull party would never end, but for other traders that are ready and waiting, it will be another "golden" opportunity.