Things tick along in markets with little fanfare; the NASDAQ and S&P both registered gains on the final day of trade last week, but the Russell 2000 took a small loss—though not enough to reverse the breakout.

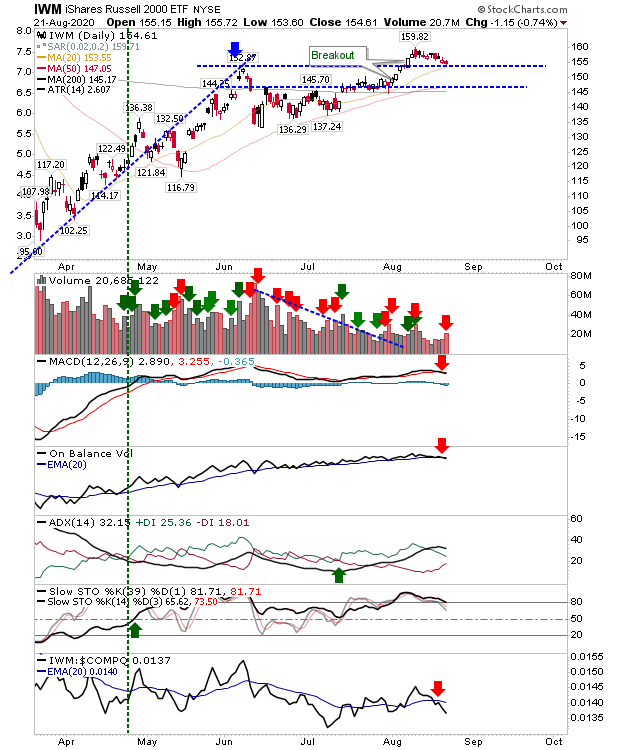

The small loss in the Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) was also came with registered distribution, but overall volume was light—so probably not too damaging. To compound the weakness there were 'sell' triggers in the MACD and On-Balance-Volume to go with the ongoing underperformance of the index relative to both the S&P and NASDAQ.

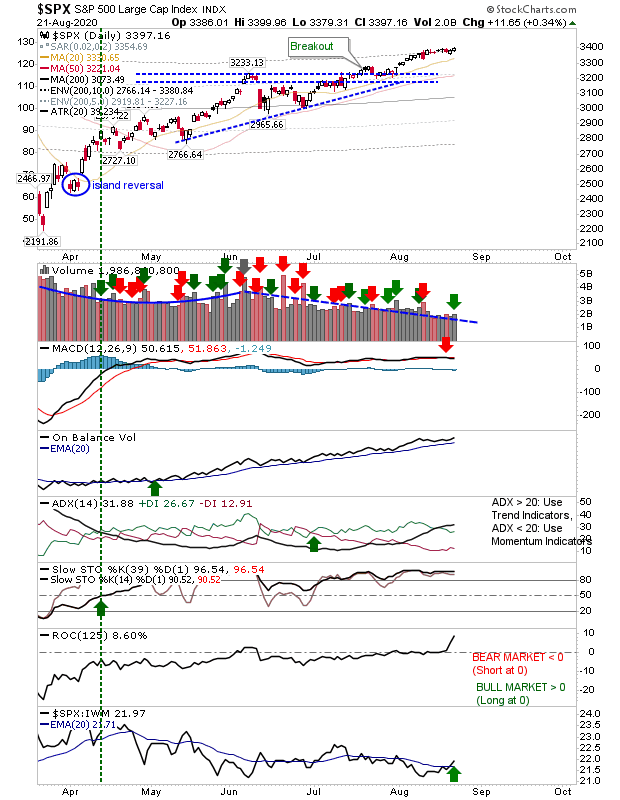

The S&P registered a small accumulation day, but the gain didn't fend off the MACD trigger 'sell' from earlier last week. However, one indicator which did kick off strongly in bulls' favor was Rate-of-Change (ROC); after weeks around zero there was kick towards +8.6%.

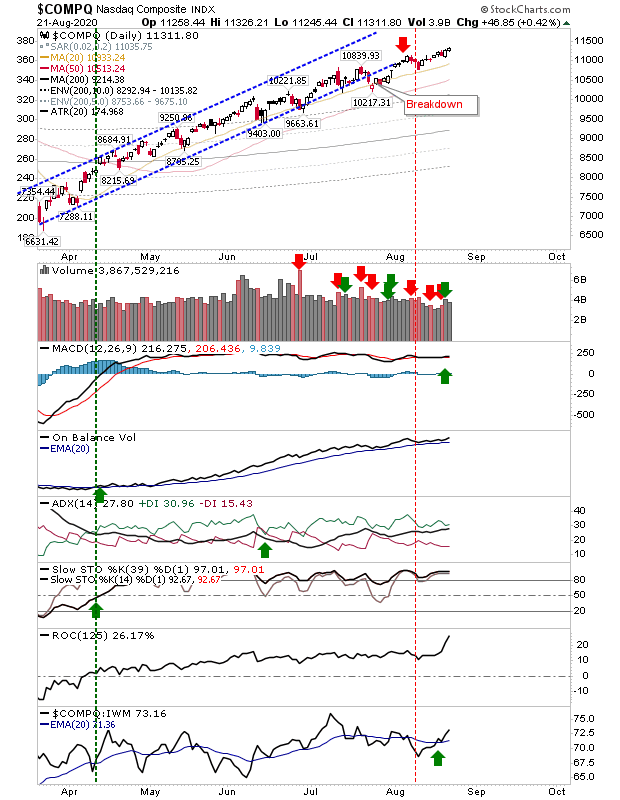

The NASDAQ also registered a surge in ROC, but it's already well above the bullish zero line. The MACD is bullish along with other technicals.

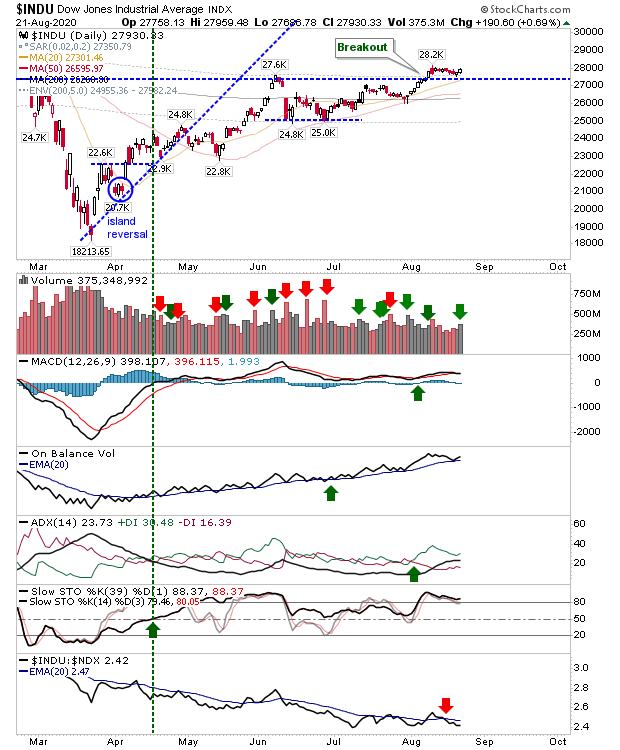

The one index which may offer buyers a trade is the Dow Jones Industrial Average. There was a bounce off breakout support which also coincided with a successful test of the 20-day MA. Other technicals are green although the MACD is on the verge of a 'sell' trigger—but there should be enough for bulls to work with.

Going forward, buyers maintain an edge but for how long can it continue? Until we see a more pronounced turn in technicals, particularly the long standing accumulation trends in On-Balance-Volume, then further price gains look likely.