- The emergence of China’s AI start-up, DeepSeek has triggered a positive feedback loop into the Hang Seng Index.

- Mixed consumer spending and weak factory activity in China suggest deflationary pressures are likely to persist.

- Momentum and trend have turned positive for the Hang Seng Index in the medium term.

This is a follow-up analysis of our prior report, “Hang Seng Index: Transforming into a medium-term bearish trend despite improving Services PMI from China” dated 8 January 2025. Click here for a recap.

Since our last publication, the Hang Seng Index has declined and started to reverse upwards in the middle of January after it almost hit the first medium-term support zone of 18,430/17,990 (printed a low of 18,671 on 13 January).

Hang Seng Index Outperformance Over Major US Stock Indices

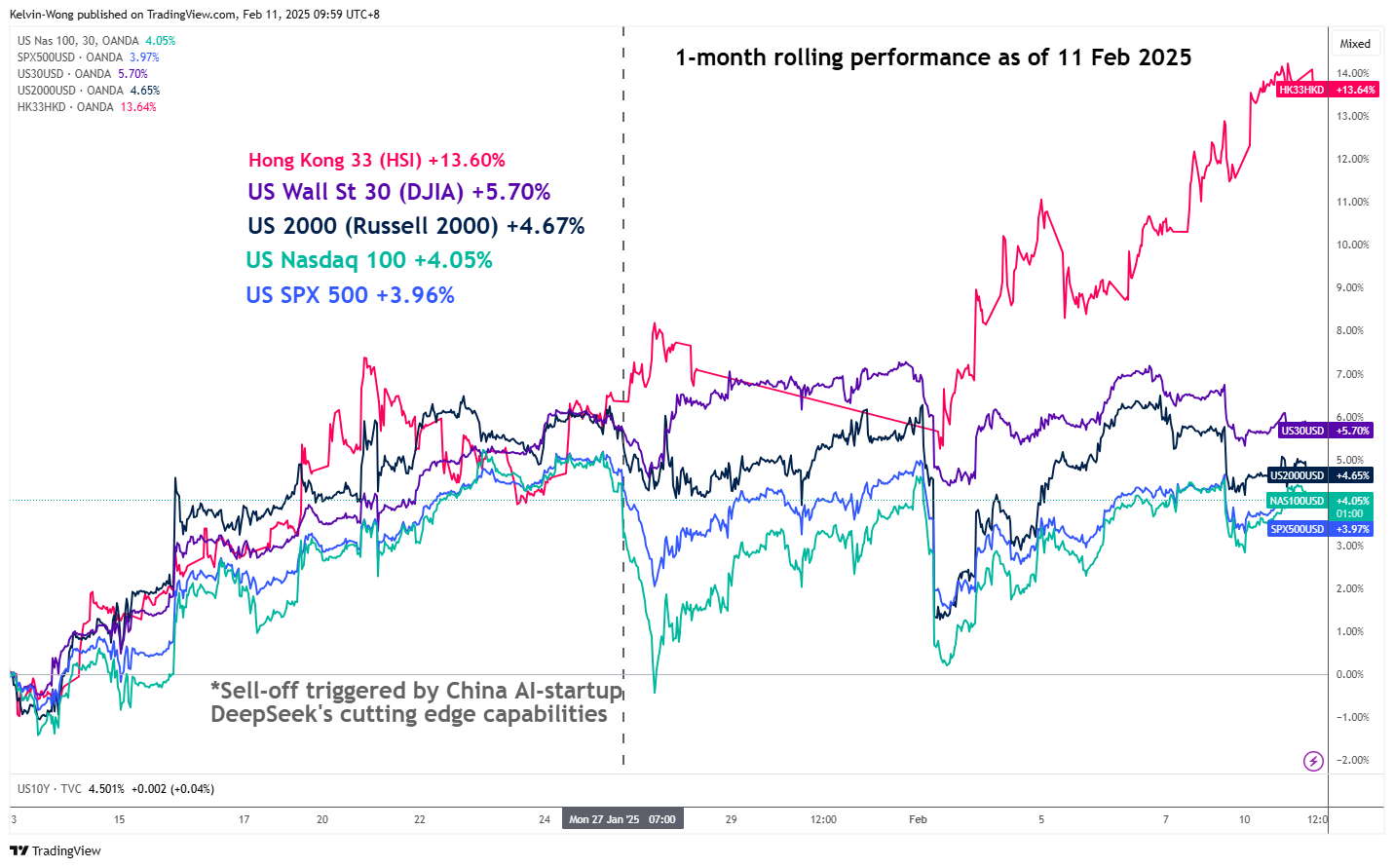

Fig 1: 1-month rolling performances of Hong Kong & US major CFD stock indices as of 11 Feb 2025 (Source: TradingView)

Interestingly, Hang Seng stock indices (a proxy for international investors and traders to get exposure to China equities) have outperformed the major US stock indices on a one-month rolling basis at this time of the writing according to the prices of contract for difference (CFD) stock indices on these markets offered by OANDA.

The Hong Kong 33 CFD stock index (a representation of the Hang Seng Index) has started to outperform against the gravity-defying major US CFD stock indices. which have ridden on the tailwinds of the “Artificial Intelligence (AI) induced high productivity” theme play in the past year.

Based on a one-month rolling performance basis, the Hong Kong 33 CFD stock index has recorded a gain of 13.60%, three times more than the average return of 4% seen on the technology mega-cap heavy US Nasdaq 100 and US SPX 500 CFD stock indices over the same period (see Fig 1).

Several catalysts drove the recent positive performance of the Hang Seng benchmark stock indices (Hang Seng Index, Hang Seng TECH & Hang Seng China Enterprises Index) in the recent four weeks. Firstly, the emergence of a relatively under-the-radar China AI start-up, DeepSeek that operated based on open-source large language models that can perform almost on par with current generative AI leader OpenAI at significantly lower operating costs without much dependency on higher-end and pricey US-based Nvidia’s graphics processing unit (GPU) semiconductor chips.

Hence, market participants have started to reprice the earnings growth expectations of the US mega-cap technology stocks that are trading at lofty valuations over China Big Tech AI equities that have now developed cutting-edge technology capabilities at lower costs despite US trade barriers and sanctions on higher-end semiconductor hardware towards China.

Secondly, it is related to geopolitical factors. Trade War 2.0 is different from Trade War 1.0 enacted in January 2018 in terms of coverage as this time round it involves major trading partners of the US, on top of the ongoing US-China rivalry.

Countries that have a significant trade surplus with the US will be at risk of being targeted by Trump’s trade tariffs policy; the European Union, Japan, South Korea, and ASEAN export-dependent countries such as Vietnam, and Malaysia.

Hence, long-term allies of the US hit with trade tariffs may be swayed to “join” China’s sphere of influence, which in turn, drives foreign fixed asset investment inflows into China that may benefit China’s economy in the long run.

Deflation Risk Persists in China

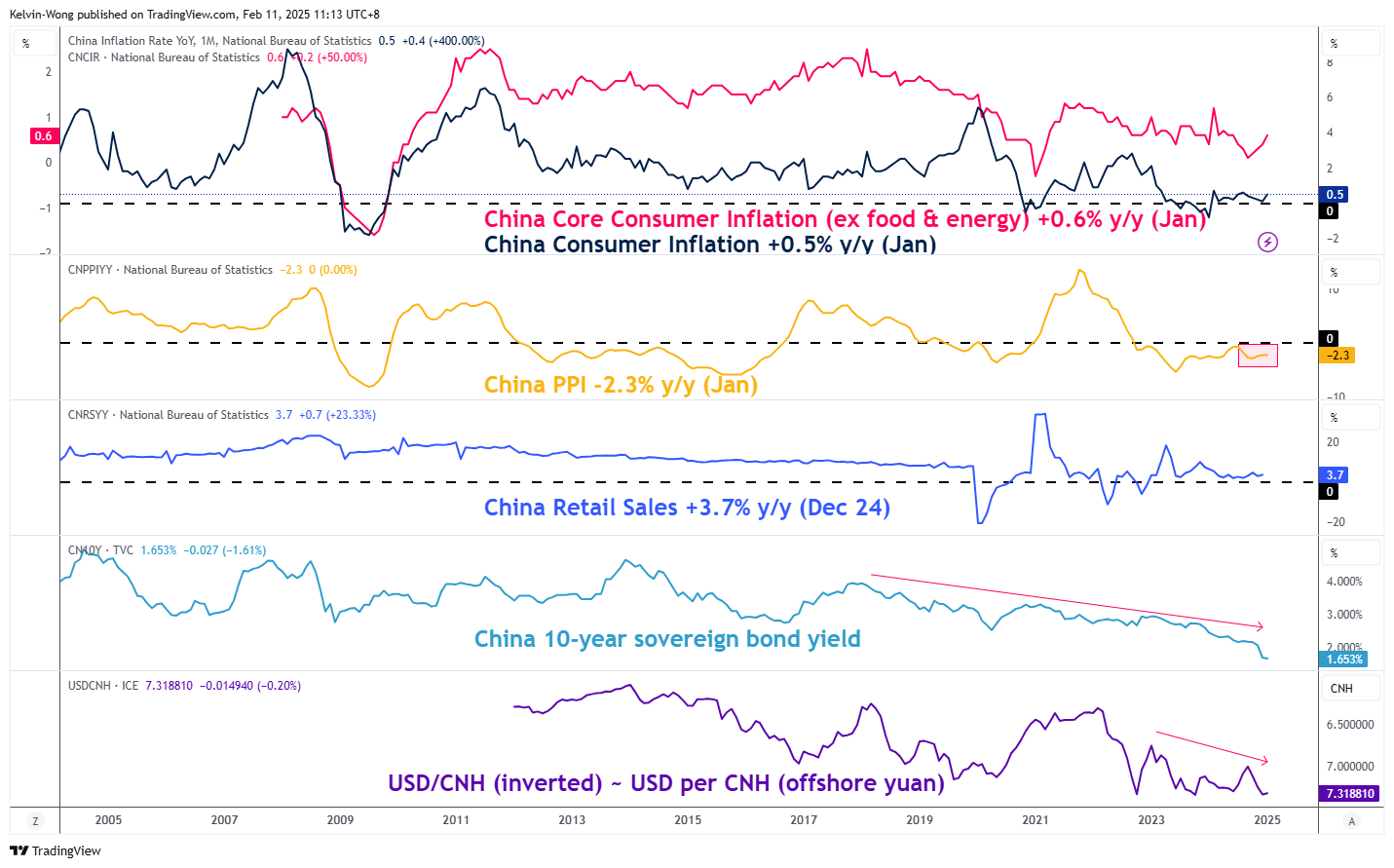

Fig 2: China’s consumer inflation & PPI trend as of January 2025 (Source: TradingView)

China’s latest consumer inflation for January has accelerated to 0.5% y/y, its fastest rate of increase in five months, core inflation excluding food and energy rose at a slightly higher rate of 0.6% y/y while producer price deflation persisted as the producer price index continued to languish at -2.3% y/y in January amid weak factory demand (see Fig 2).

In addition, the offshore yuan (CNH) continued to face downside pressure against the US dollar The USD/CNH has rallied back up from a nine-week low of 7.2344 and is trading at 7.3120 at this time of the writing with its October 2023 high of 7.3750 coming into view.

Therefore, deflationary pressures persist in China unless policymakers are willing to implement direct stimulus measures to jolt up consumer and business sentiment.

Hang Seng Index Has Traded Above Its 50-Day Moving Average

Fig 3: Hang Seng Index medium-term trend as of 11 Feb 2025 (Source: TradingView)

The price actions of the Hang Seng Index surpassed its 50-day moving average on 20 January and retested it on 23 January before it staged a rally of 9.6% to a close of 21,522 on Monday, 10 February.

In addition, the MACD trend indicator has continued to accelerate upwards above its centreline above a prior bullish divergence condition. These observations suggest that the Hang Seng Index is likely to have transformed into a medium-term (multi-week to multi-month) uptrend phase.

Watch the 19,700 medium-term pivotal support and a clearance above 22,690/23,240 may see the next medium-term resistance zone coming in at 24,400/980 (see Fig 3).

On the flip side, failure to hold above 19,700 jeopardizes the bullish tone for another round of corrective decline to retest the next medium-term support zone of 18,430/17,990 (also the 200-day moving average).