Market Brief

After yesterday’s volatile European and US session, FX markets are calmer today. US consumer confidence rose to 92.6 in December but below expectations of 93.9. US equity markets fell slightly on the news but perhaps more as a function of end of year profit taking rather than real fundamental concern. European sovereign bond yield continue to gyrate. German 10-Year bund yield fell to a record low of 0.54% while Italian and Spanish 10-year bond yields fell below 1.9% and 1.6% respectably. Greek sovereign bond continued to climb now up over 50bp yesterday above 9.0%. Clearly the Greece January election has the markets spooked and running for quality.

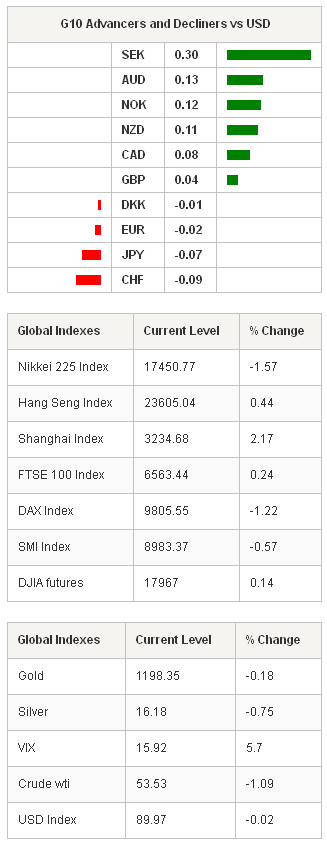

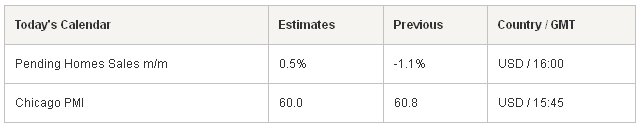

The Nikkei is closed for Tokyo holiday limiting activity in JPY. Asian regional equities exchanges were mixed as the Hang Seng and Shanghai rose to 0.44% and 2.18% respectively, while ASX fell -0.10%. USD/JPY opened around 119.50 after falling 1% the previous day, and stuck to a tight 119.25 to 119.80 range. EUR/USD continues to be weighed down by political uncertainty in Greece and growing anticipation of ECB QE. EUR/USD traded down to new lows at 1.2124 before bargain hunters pushed the pair marginally higher to 1.2165. China manufacturing PMI fell to 49.6, down from final 50.0 in November, but stronger than the 49.5 “flash” reading. This was the first time in seven months that China factory sector contracted and it increases the possibility that 2014 GDP will miss the official 7.5% target. AUD/USD was trading around the 0.8181 levels prior to the China PMI print but quickly rallied to 0.8220 (short squeeze) as the number beat the flash estimate. However, realization that Chinese manufacturing actively was now in contraction territory has hurt AUD/USD trading to pre-data levels. Weak Chinese manufacturing data also damaged demand sentiment around oil as Brent breached the $57 handle. The USD was the biggest gainer in the G10 for 2014, and with the Fed on path to tighten policy 2015 (despite risks of falling inflation) should also see the greenback appreciate further. There are no first tier data release scheduled in the European session, so traders will be waiting for US Chicago PMI and pending home sales.

Then it’s on to 2015. On behalf of the Swissquote Bank Strategy Desk, we wish you and yours a happy & healthy new year.

Currency Tech

EUR/USD

R 2: 1.2351

R 1: 1.2300

CURRENT: 1.2189

S 1: 1.2134

S 2: 1.2043

GBP/USD

R 2: 1.5786

R 1: 1.5682

CURRENT: 1.5547

S 1: 1.5500

S 2: 1.5423

USD/JPY

R 2: 121.85

R 1: 121.00

CURRENT: 120.43

S 1: 119.32

S 2: 118.26

USD/CHF

R 2: 0.9972

R 1: 0.9900

CURRENT: 0.9867

S 1: 0.9785

S 2: 0.9723