Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Market Brief

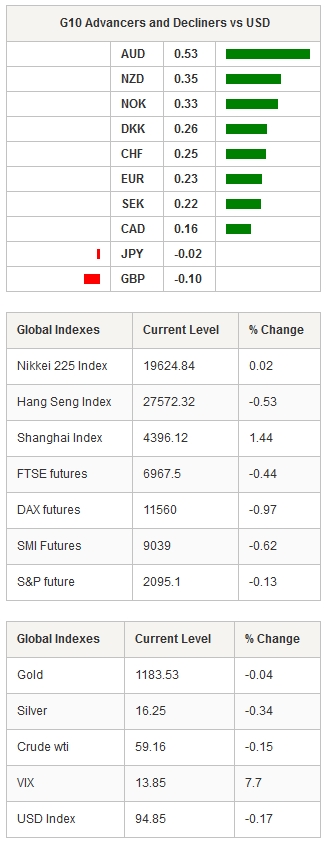

Equity returns are mixed this morning. Nikkei is up 0.02% and is right in the middle of its 1-month range. In the wake of the PBoC’s third interest-rate reduction in six months, the Shanghai Composite is about to close in positive territory for the third day in a row, up 1.44%. The Hang Seng retreats -0.53% while Australian shares gained 0.88% as Home Loans came in above expectations at 1.6%m/m verse 1% expected, confirming that the Australian housing market is still surging. The 25bps rate cut to 2% last Wednesday by the Reserve Bank will not help to relieve the pressure. However, the RBA declared working with regulators to assess and contain risks that may arise from the housing market. In India, the Sensex is down 1.62%.

USD/JPY is edging higher, back above 120 and currently testing the 120.18 resistance (Fib 50% on March decline). The pair is trading within the 118-122 range since March. AUD/USD didn’t move much over the last 24h and is still sitting on the 0.7869/84 support (Fib 50% on April rally). However, the Aussie remains in its uptrend channel and will need some fresh boost to break the next resistance standing at 0.8030 and 0.8076 (previous highs). The kiwi consolidated around 0.7360 in the Asian session after having break the 0.74 psychological threshold. Next support lies at 0.7192 (low from March 11th).

The US government bonds market suffered a heavy sell-off in New York yesterday. The 10-Year Treasury yield jumped 15bps to 2.28% before climbing higher to 2.30% in Asia. Since yesterday, the 30-year yield shot up by 19bps to 3.07% while the 5-year one bounced 14bps to 1.61%. In Europe, 5-Year Bund yield skyrockets by 4bps to 0.11% after Greece paid the €750bn on Monday.

EUR/USD is on buy, up 70pips from its low from the previous day. GBP/USD broke the strong resistance standing at 1.5552 (high from February 26th) and printed a new 4-month high at 1.5613. We remains sterling bulls as the pair is about to validate the break of the long-term 38.2% Fibonacci level at 1.5569 (on July 2014 – April 2015 sell-off). EUR/GBP erases previous losses and tests the 0.7193 resistance induced by the 61.8% Fibonacci level. On the downside, the cross will find some support at 0.7120 (multi lows) and 0.7014 further. European futures are blinking red on the screen: FTSE futures down -0.44%, DAX down -0.97%, CAC down -0.81% and SMI down -0.62%.

USD/CHF is on bid this morning and erased yesterday’s gains overnight. The pair is trading around 0.9310 and should find a support at 0.93. However, the recent USD weakness will help the Swiss franc to break that support easily. EUR/CHF was well support by the 1.0390 level (low from April 2nd) and is hedging higher.

Today traders will watch CPI out of Sweden, UK industrial and manufacturing production, Indian industrial production, Brazilian FIPE-CPI.

Swissquote Sqore Trade Ideas: http://en.swissquote.com/fx/news/sqore

Currency Tech

EUR/USD

R 2: 1.1529

R 1: 1.1450

CURRENT: 1.1169

S 1: 1.1111

S 2: 1.1000

GBP/USD

R 2: 1.5826

R 1: 1.5552

CURRENT: 1.5414

S 1: 1.5156

S 2: 1.5051

USD/JPY

R 2: 122.03

R 1: 120.10

CURRENT: 119.98

S 1: 118.91

S 2: 117.94

USD/CHF

R 2: 1.0240

R 1: 0.9571

CURRENT: 0.9325

S 1: 0.8936

S 2: 0.8823