Bulls were not willing to give up the breakout gains from earlier in the week last week and with the exception of the Russell 2000 it was a decent finish for markets.

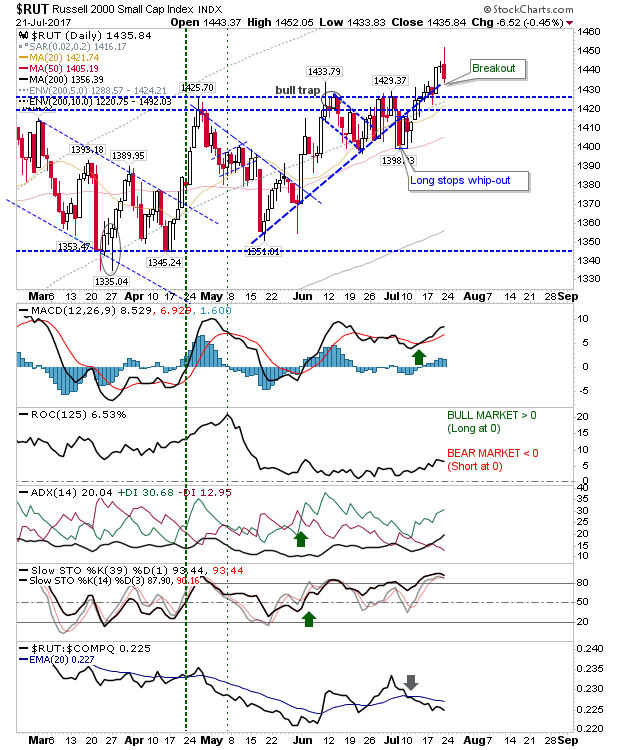

Action in the Russell 2000 was only disappointing because it was unable to hold on to early day gains. The spike high may mark resistance over the coming days as Friday's candlestick was a typical reversal marker. Technicals are healthy, although the index is underperforming relative to Tech and Large Caps.

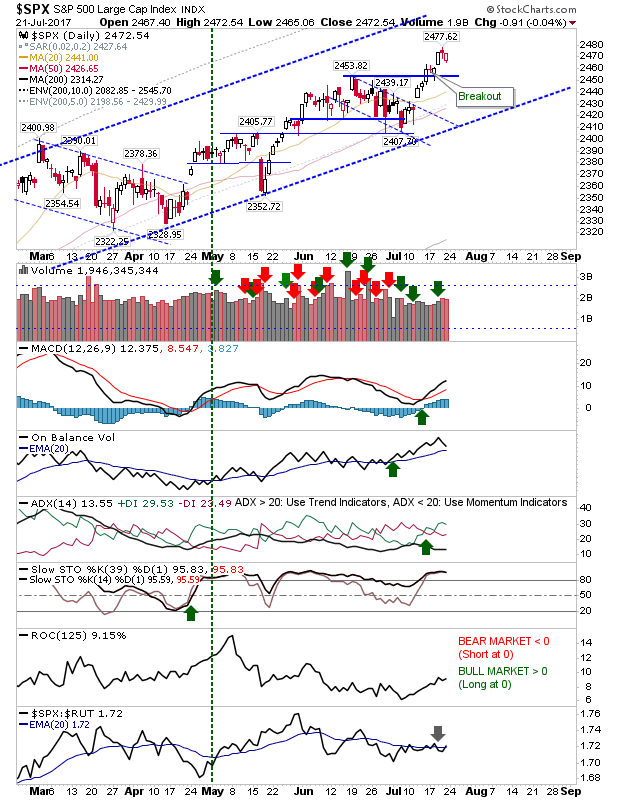

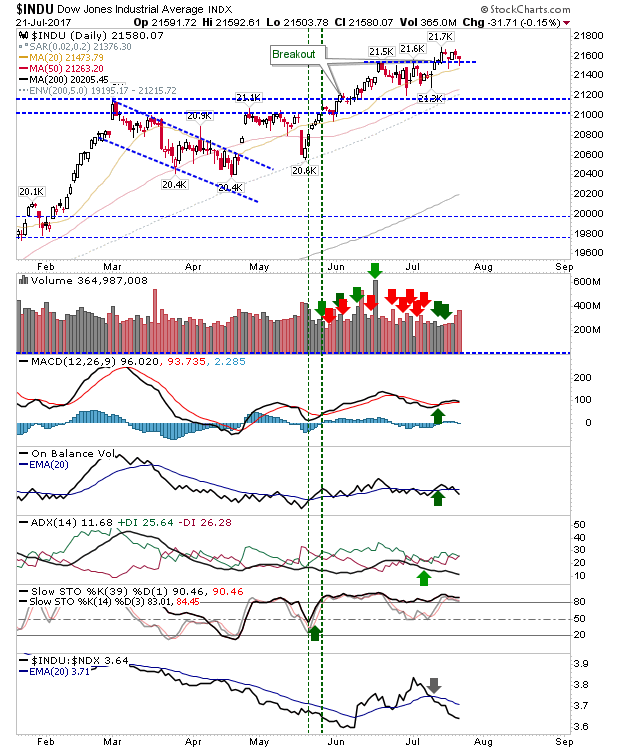

Large Caps had the best of the action. The S&P finished above its open while the Dow Industrials clung to its breakout.

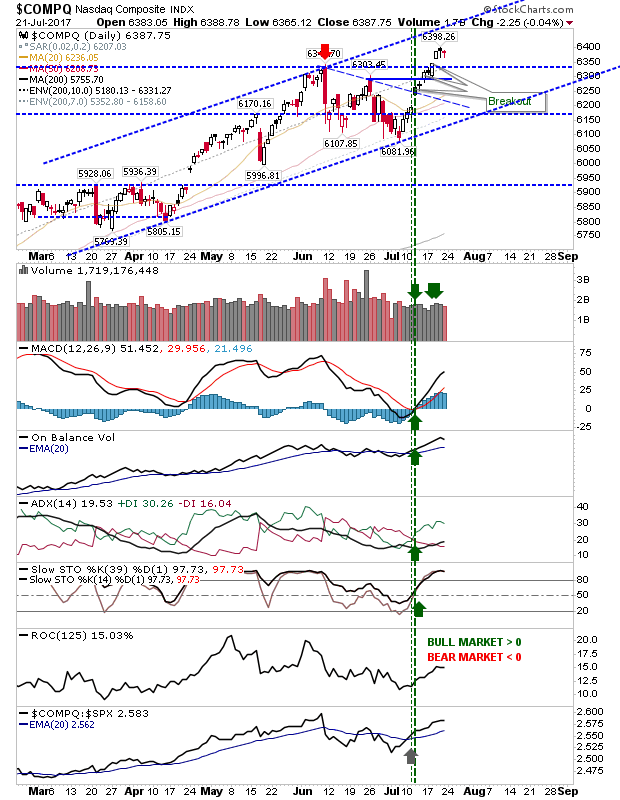

The NASDAQ held its ground and Tech averages remain the strongest of the indices. Momentum traders should keep their focus here.

For today, Monday, look for Friday's gains to push on to new highs. Shorts should watch the Russell 2000, particularly if there is a move into Friday's spike high range— this might be an opportunity to take an aggressive short with a stop above Friday's high.