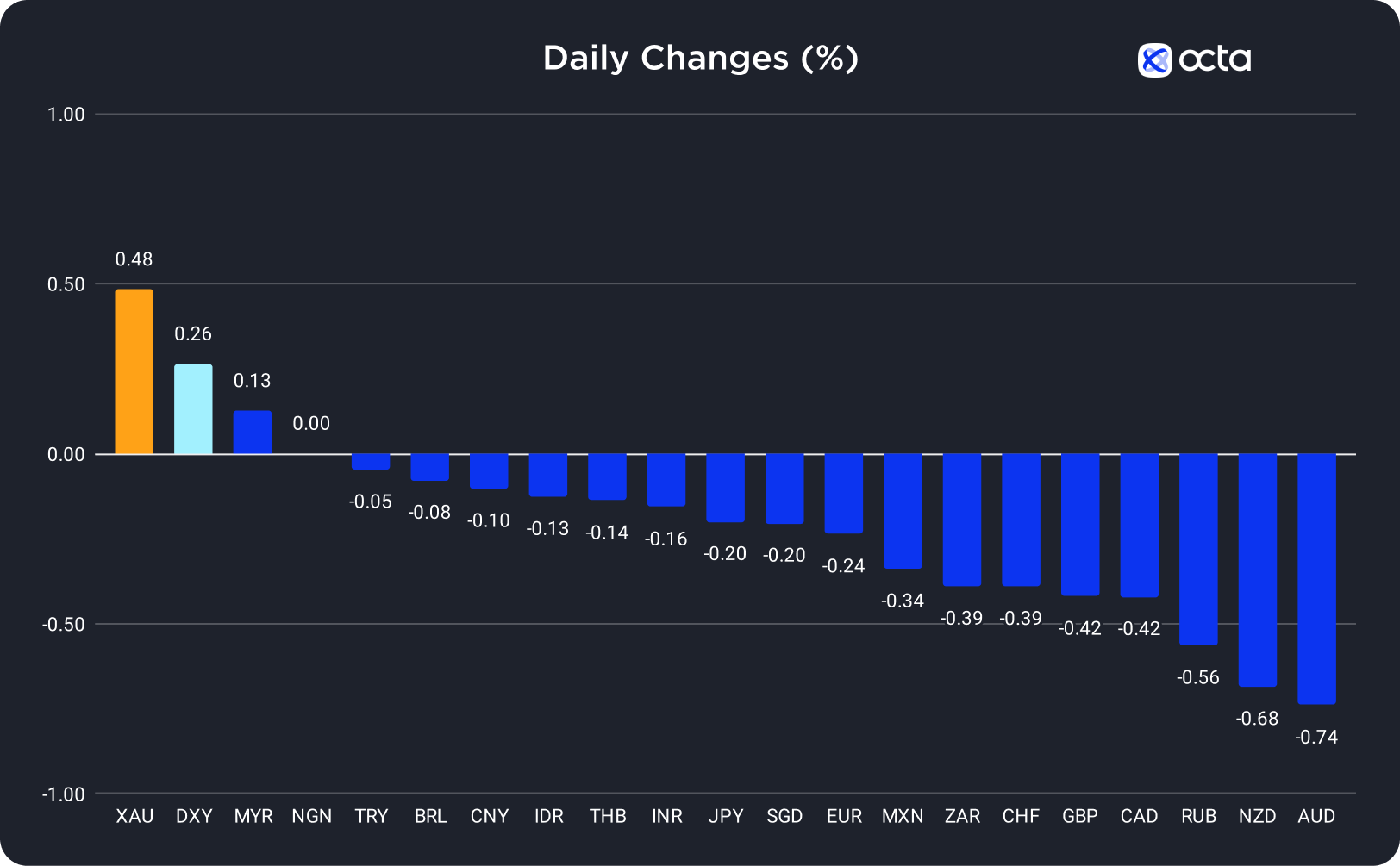

On Wednesday, the US dollar was the best-performing currency among the 20 global currencies we track, while the Australian dollar (AUD) showed the weakest results. The Malaysian ringgit (MYR) was the leader among emerging markets, while the Russian rouble (RUB) underperformed.

Gold Approaches 2,000 as Safe-Haven Demand Remains Strong

Gold (XAU) rose by 0.48% on Wednesday as safe-haven flows increased due to the ongoing turmoil in the Middle East.

"The geopolitical concerns are not going away in the short term, which will continue supporting gold," said Bob Haberkorn, the senior market strategist at RJO Futures.

However, future gains may be capped as the US Dollar Index (DXY) remains elevated while the U.S. Treasury yields are near multi-year highs. Holding non-yielding gold becomes more expensive with higher interest rates.

XAU/USD was rising during the Asia and early European trading sessions. In the next two days, traders should pay attention to the release of U.S. macroeconomic reports, which could influence the Federal Reserve's (Fed) stance on the interest rate. Based on the CME FedWatch tool, the market believes the Fed will keep the base rate unchanged at the next policy meeting, but the upcoming reports may change the expectations substantially. Today, the Gross Domestic Production (GDP) report will come out at 12:30 p.m. UTC. Lower-than-expected figures will probably bring XAU/USD down towards 1,940. However, the bullish trend in gold may continue if the numbers are higher than expected.

"Spot gold may retest resistance of 1,998 USD per ounce, a break above which could open the way towards 2,010–2,019 range", said Reuters analyst Wang Tao.

The Euro Declines Sharply Ahead of the ECB Interest Rate Decision

Yesterday, the euro (EUR) lost 0.24% as the US Dollar Index (DXY) rose towards a one-week high.

Euro traders await the European Central Bank's (ECB) interest rate decision today at 12:15 p.m. UTC. Last month, the ECB hinted that it might pause its rate-hiking cycle due to signs of economic slowdown and a potential recession. Now, the discussion is about how long the ECB will maintain the current base rate. Although the market predicts a rate cut by Q2 2024, some officials believe it's too early. Rising energy costs pose an additional challenge, potentially leading to stagflation—a phase of high inflation and stagnating economic growth.

"We think the discussion is increasingly shifting towards the timing of a cut rather than whether there should be another hike," said Martin Wolburg, the lead economist at Generali (BIT:GASI) Investments.

EUR/USD was falling during the Asian and early European trading sessions. Although the ECB's interest rate decision is unlikely to surprise the markets, traders might still react to any new details mentioned in the post-meeting statement and comments at the press conference. If the statement conveys a dovish tone, the bearish trend may persist, pushing EUR/USD towards 1.05000. However, hawkish statements could drive the pair back to its bullish trajectory.

Nasdaq Plunges Sharply as Google Shares Drag the Index Down

The Nasdaq Composite Index (NAS100), which tracks the performance of major U.S. technology companies, dropped sharply on Wednesday after the disappointing Alphabet (NASDAQ:GOOGL)'s earnings report.

On Wednesday, Alphabet Inc (GOOGL) stocks declined by more than 6% in pre-market trading due to its Q3 cloud computing revenue falling short of expectations despite the overall results surpassing forecasts. Meanwhile, Microsoft Corporation (NASDAQ:MSFT) stocks saw a pre-market rise of over 3% after its Q1 results exceeded anticipations, primarily driven by growth in its Azure cloud segment.

"As we've seen interest rates persistently rise, there has been this expectation of a dramatic slowdown in the economy which would impact earnings, and we're not seeing it yet," stated Hugh Anderson, the managing director at HighTower Advisors.

Indeed, the NAS100 drop looks excessive as investors expect the U.S. GDP figures at 12:30 p.m. UTC today to be strong.

Today, NAS100 opened with a gap down and continued to fall during the Asian and early European trading sessions. Apart from the U.S. GDP figures, traders should also prepare for the release of Amazon's (NASDAQ:AMZN) earnings report. Better-than-expected numbers may reverse the bearish trend in NAS100, resulting in a gap up on Friday morning. Likewise, higher-than-expected GDP figures will positively impact NAS100, potentially pushing its price above 14,400. However, the short-term bearish trend may continue if the figures are lower than expected.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI