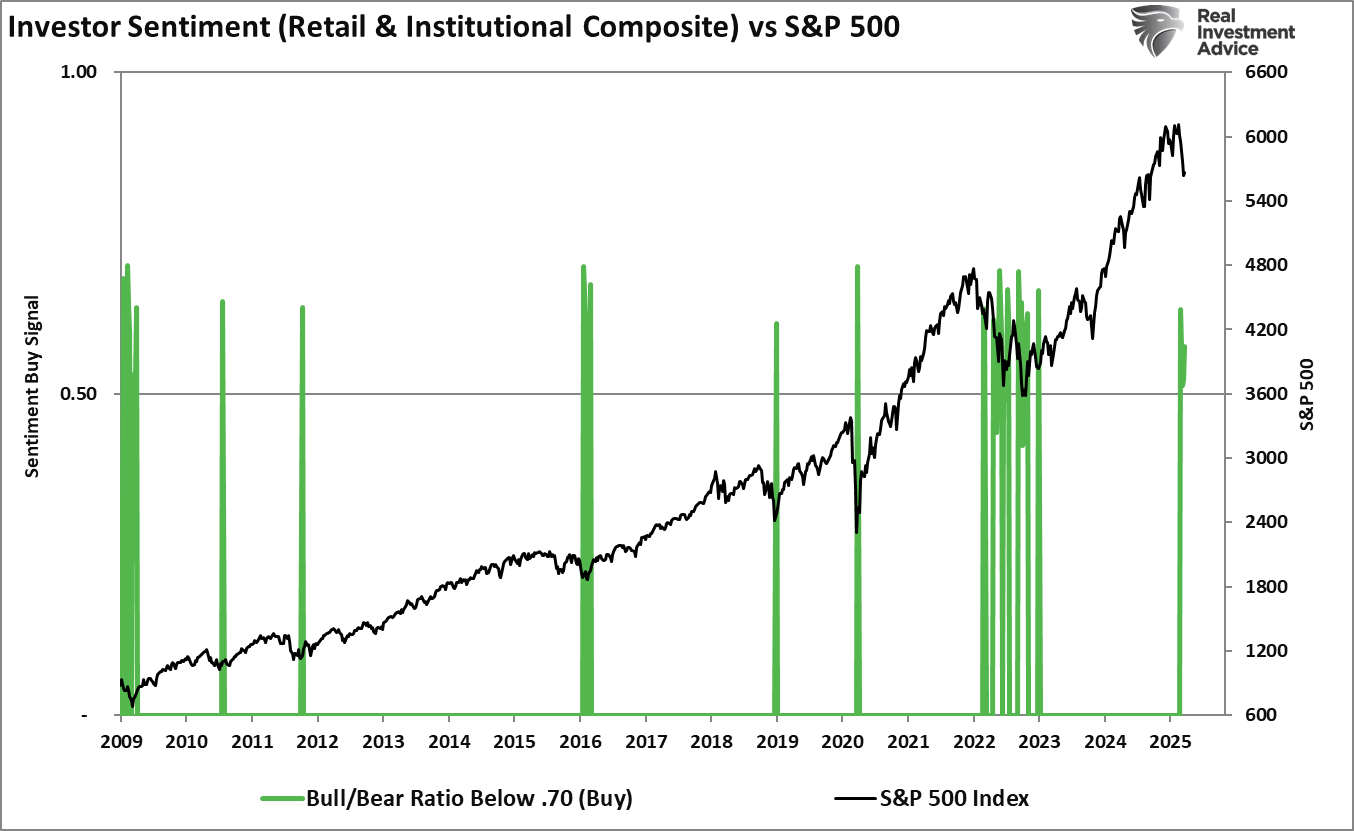

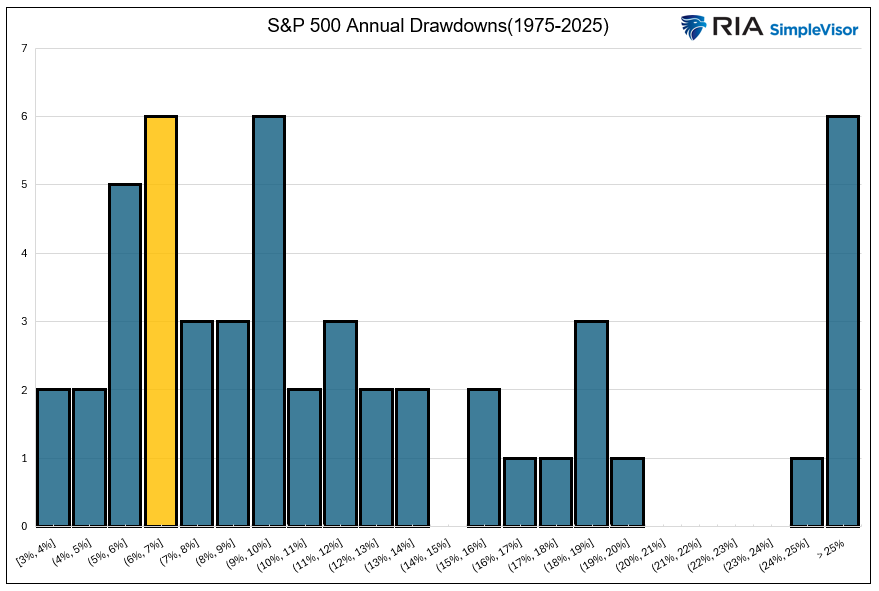

Given the fear as represented in investor surveys and various sentiment gauges a couple of weeks ago, one would think the recent market drawdown was significant. As a testimony to the concern, investor sentiment hit bearish levels that had only been witnessed during significantly larger market drawdowns, not the relatively measly 6.5% decline from the start of 2025 to the recent low. Therefore, to help calm investor nerves, we provide historical context to put perspective around the market activity this year to date.

The histogram, with data going back to 1975, shows the number of annual instances of market drawdowns in 1% increments. We highlight the current 6.5% decline in yellow. As shown, there have been five other years in which the market had a similar drawdown. Moreover, on average, the market experiences a 13.3% decline every year. As the graph shows, there is nothing abnormal about the recent swoon. Even if the S&P 500 were to fall another 6% or so, it would still be a typical year. It’s worth noting that there are still nine months left in the year, and there is nothing that says the market bottomed last week. Conversely, we also can’t know if the bull trend that started in late 2022 has ended.

The important takeaway is that the historical context for recent losses is critical to managing our fears and behavioral instincts, which often work against our best interests.

What To Watch Today

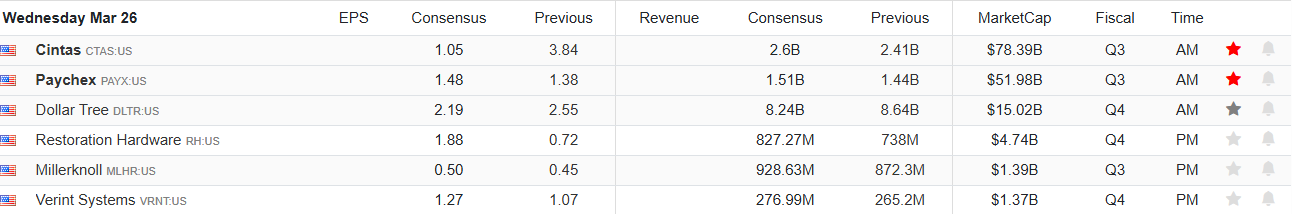

Earnings

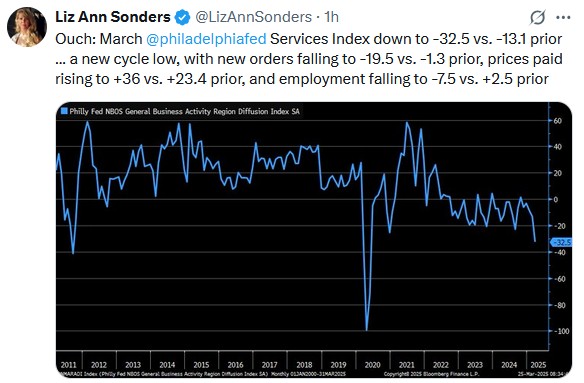

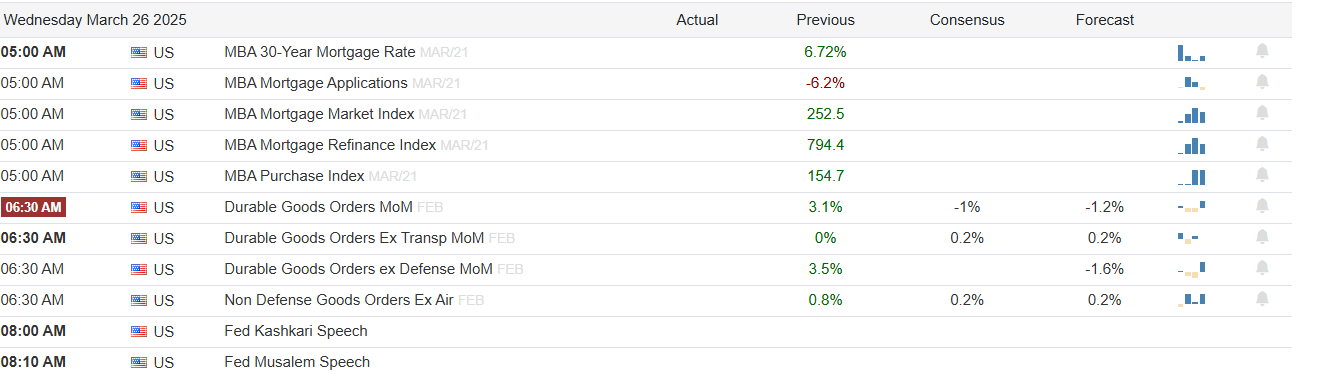

Economy

Market Trading Update

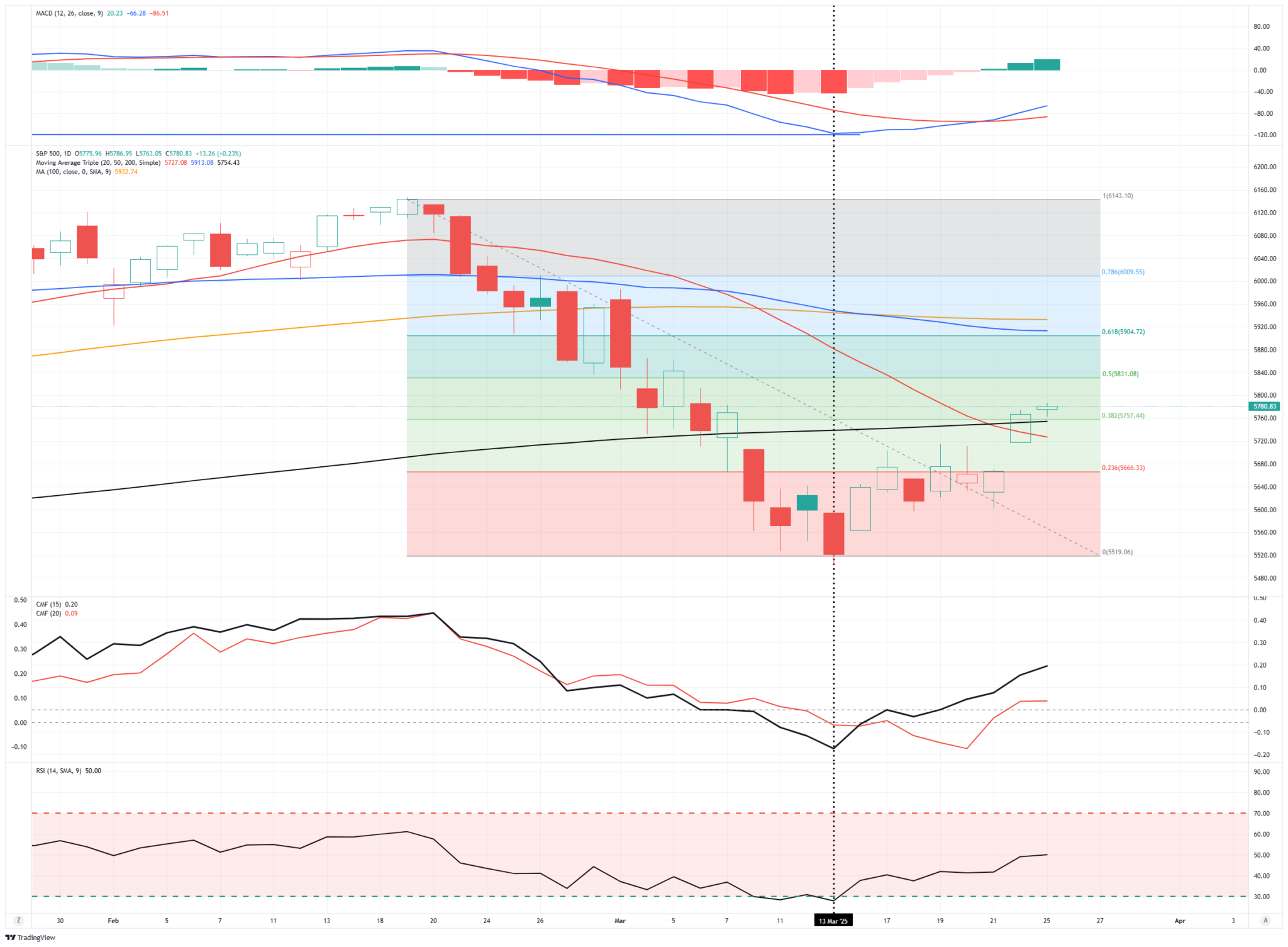

Yesterday, we discussed that the correction is likely over, at least for now, as multiple signals confirm that buyers are returning to the market. Notably, that does not mean that another correction can’t happen; it is just likely that the market could rally first, giving investors an opportunity to rebalance portfolio risk as needed. The chart below shows the potential retracement levels from the recent lows. The market initially struggled at initial resistance of the 23.6% retracement level. However, Monday’s rally pushed the market above key resistance at the 200-DMA and triggered the momentum buy signal. While that is bullish in the short term, the market has several challenges.

The following key resistance level will be the 50% retracement level, around 5831. However, if the market can clear that 50% retracement, it will have to contend with the 50 and 100-DMA, which also happens to be hovering at 61.8% retracement level at 5904. I suspect that the market will be sufficiently overbought by the time it reaches this level. Furthermore, many investors were trapped in the recent sharp sell-off, so they will be looking for an exit, which will likely bring sellers into the market. If, and I suspect this is a reasonably significant hurdle, the market can move above the 61.8% retracement, a move to previous highs is likely. However, given the current market dynamics, slowing economic growth, and high levels of economic policy uncertainty, a rally to all-time highs faces significant challenges.

As such, we recommend that investors use the current rally to rebalance portfolio risk, raise cash levels as needed, and consider adjusting portfolio weightings and reducing leverage to lower overall portfolio volatility. As is always the case, if the market does rally and portfolio risk is reduced, it is always a simplistic process to increase portfolio exposures if the market backdrop improves.

April 2 Could Be A Negative Surprise- Per Goldman Sachs

Recently, it appears that Donald Trump has taken a more friendly path with tariffs. For instance, on Monday he stated:

I may give a lot of countries breaks. It’s reciprocal, but we might be even nicer than that. You know, we’ve been very nice to a lot of countries for a long time.

Goldman Sachs warns that this may not be the case, and the markets may no longer be pricing in a negative surprise. Per their logic, the Trump administration uses tariffs as a negotiating tool. Therefore, they might want to start with higher tariffs and negotiate them down in the future. A recent Goldman survey shows market participants believe reciprocal tariffs beginning on April 2nd will amount to a 9% reciprocal tariff rate. Goldman Sachs expects the initial tariff rate could be double that, setting investors up for a negative surprise.

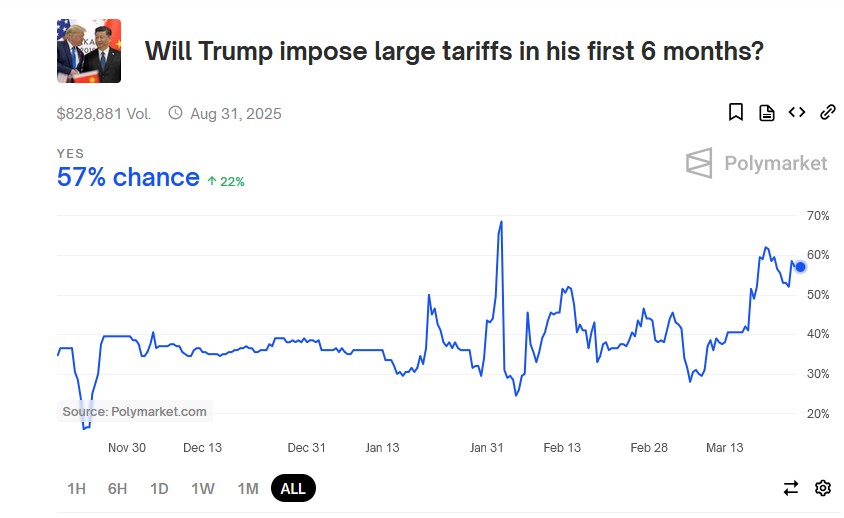

While the market has rallied on Trump’s more flexible stance, the betting markets are not as optimistic, as shown below.

Correction Over? Or, More To Go?

The biggest question I have been getting from clients and prospects lately is, “Is the correction over?”

This is not surprising, given that market declines are brutal on emotions. However, as investors, we often forget that, like the laws of gravity, “what goes up must come down.”

Therefore, in today’s blog post, I want to provide two takeaways:

- The technical backdrop of the market – does it support a tradeable bottom for investors, and;

- A list of rules for investors to follow to navigate whatever comes next.