Technical Analsys

Technical Analysis HK50 : 2019-05-02

Widening trade deficit bearish for HK50

Hong Kong trade deficit widened in March. Will the HK50 decline continue?

Chinese economic data were weak recently: Caixin China manufacturing purchasing managers index dropped to 50.2 in April from 50.8 in March, while Hong Kong’s trade deficit widened to H$59.2 billion in March from H$48.8 billion in February. Mainland China’s factory activity weakened in April but still recorded expansion: a reading above the 50 level indicates an expansion in activity. Hong Kong trade deficit increased by 6.7% in March from H$55.5 billion in the same month of the previous year as exports fell 1.2% while imports declined 0.1%. The downtrend in Honk Kong’s exports is still intact due mainly to declining manufacturing and trade activities in the region, according to state statistics agency. The US-China trade dispute is a downside risk for Hong Kong stock market while there are positive developments: Treasury Secretary Steven Mnuchin and Trade Representative Robert Lighthizer resumed trade negotiations with China, with sides reportedly close to a final deal.

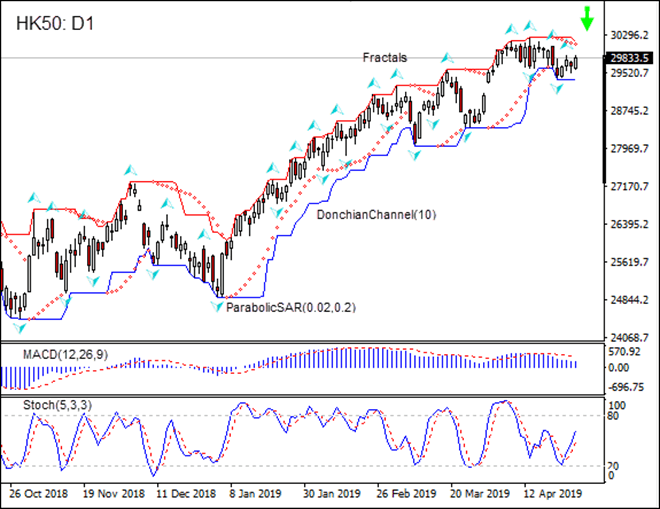

On the daily timeframe HK50: D1 is retracing after hitting 11-month high in mid-April.

-

The Parabolic indicator has formed a sell signal.

-

The Donchian channel indicates downtrend: it is narrowing down.

-

The MACD indicator is above the signal line with the gap narrowing. This is a bearish signal.

-

The Stochastic oscillator is rising but has not reached the overbought zone.

We believe the bearish momentum will continue after the price breaches below the lower Donchian boundary at 29373.5. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above the upper Donchian boundary at 30176.5. After placing the pending order the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop-loss level (30176.5) without reaching the order (29373.5) we recommend cancelling the order: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

- Position Sell

- Sell Stop Below 29373.5

- Stop loss Above 30176.5

Market Overview

US stocks retreat as Fed stays pat

Dollar strengthening resumed as rates kept in 2.25-2.50 range

US stock market pulled back on Wednesday as Federal Reserve held policy steady. The S&P 500 fell 0.8% to 2923.73. The Dow Jones Industrial Average lost 0.6% to 26430.14. Nasdaq composite index slid 0.6% to 8049.64. The dollar strengthening resumed despite mixed data indicating Supply Management manufacturing index for April came in at 52.8%, below expectations while Markit’s manufacturing purchasing managers index came in at 52.6, above forecasts: the live dollar index data show the ICE (NYSE:ICE) US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.1% to 97.62 and is higher currently. Futures on US stock indexes point to higher openings today.

Futures indicate lower openings for European indexes

European stocks indicate lower openings today for markets, which remained closed for Labor Day. The EUR/USD turned lower while GBP/USD continued climbing and both pairs are maintaining their dynamics currently. UK’s FTSE 100 lost 0.4% to 7385.26 on Wednesday.

Australia’s All Ordinaries Index down while Hang Seng climbs after reopening

Asian stock indices are mixed today. Japan’s markets are closed and will reopen next Tuesday while yen resumed its slide against the dollar. Mainland China’s markets are closed, Hong Kong’s Hang Seng Index is 0.8% higher. Australia’s All Ordinaries Index pulled back 0.6% as Australian dollar turned higher against the greenback.

Brent Down After US Crude Inventories Build

Brent futures prices are inching lower today. Prices edged up yesterday despite the report US gasoline stocks rose above expected 9.9 million barrels while crude stockpiles rose by 0.9 million last week. July Brent crude added 0.2% to $72.18 a barrel on Wednesday.