Major stock markets around the world are now in crash mode

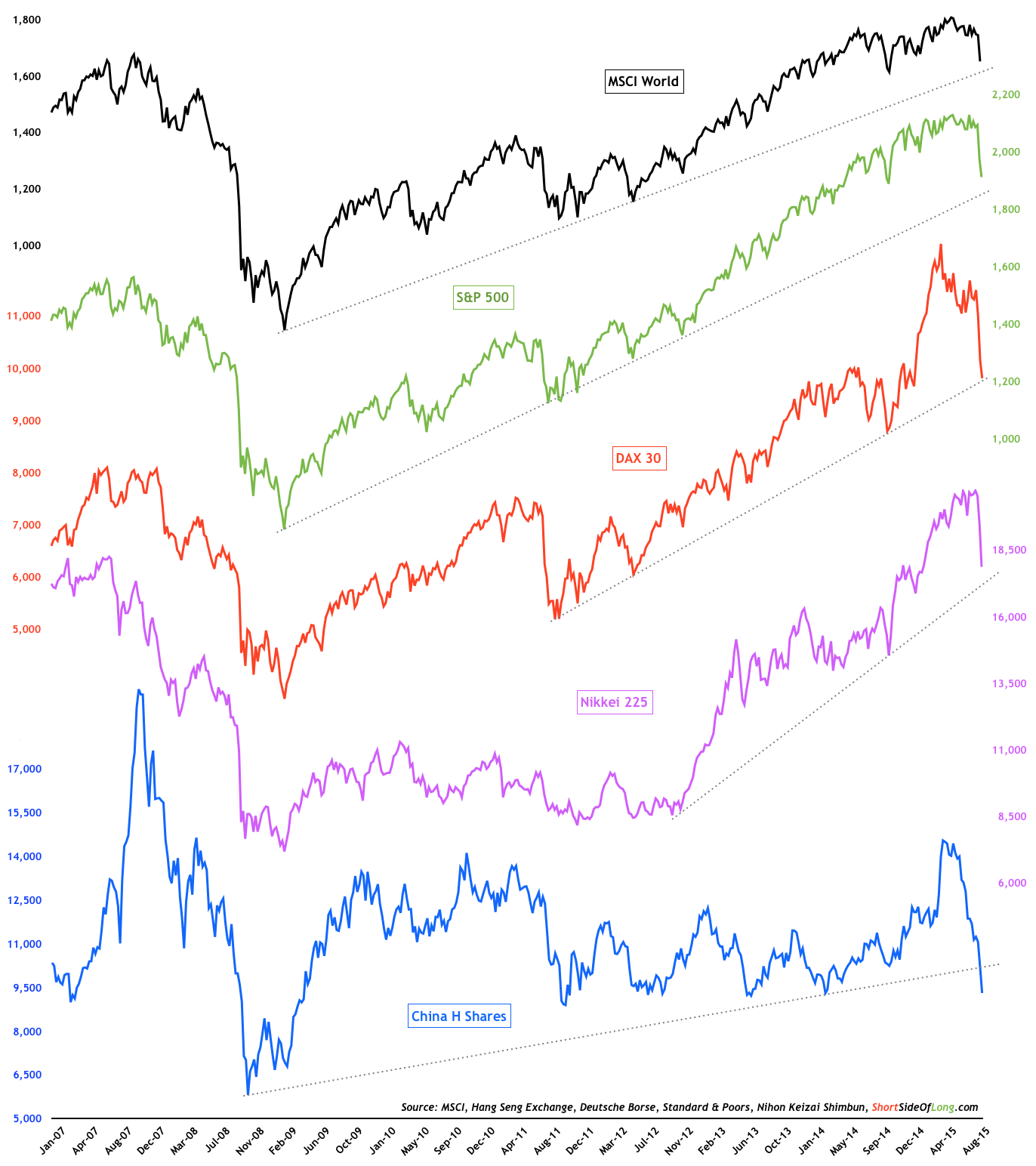

Major economies in the world are United States, China, Japan and Germany. Let us quickly observe their stock markets, as the world is going through an equity market meltdown. It is plain and obvious that these indices have fallen very rapidly in recent days, however one has to admit that we have not yet seen serious technical damage. Developed markets priced in US Dollars (MSCI World Index), together with the S&P 500, DAX 30 and Nikkei 225 all remain above their long term bullish uptrend lines (for now).

FTSE China H Share Index has broken below it this week, while the mainland SZSE A Share Index is going through a catastrophic crash (Shanghai Composite has touched 3,000 points as I write this). As stated in the previous post, we believe that the panic has started and that selling pressure should last for awhile yet. Most likely outcome is for bearish exhaustion sometime in the coming months of September or October.