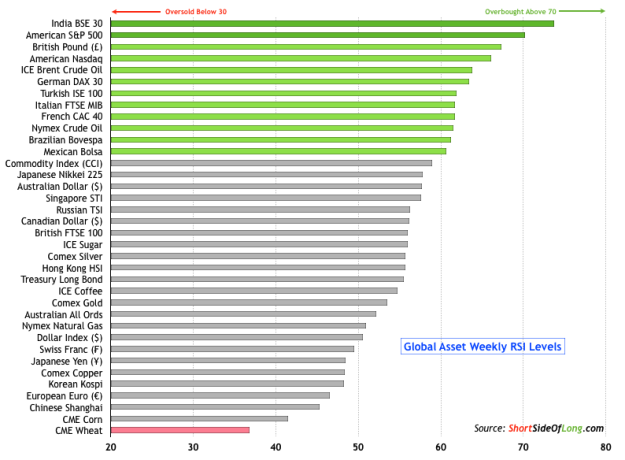

Chart 1: Global markets show no signs of oversold conditions anywhere

From time to time I like to look at global macro asset Overbought vs Oversold conditions by checking weekly RSI readings. Obviously, there is no perfect indicator when it comes to judging short or long term valuation of any assets, but nevertheless the chart above always produces some interesting perspectives. Here are a few observations I have made (with the most important one highlighted):

- No major asset class is currently oversold (RSI below 30)

- US and Indian stock markets are overbought (RSI above 70)

- Global equities are more overbought then bonds, currencies and commodities

- The British pound is close to being overbought and is now the most favoured currency

- Crude Oil is close to being overbought and is now the most favoured commodity

- Grains such as Corn and especially Wheat are close to being oversold

- Even though Chinese stocks continue to be disliked, they aren’t oversold (yet)

I’m sure you can make many more obvservations of your own