Dow hits fresh record high

US stocks advanced on Thursday as Federal Reserve Chair Janet Yellen reaffirmed the dovish stance in her testimony to Banking Committee. The dollar was little changed: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, ended at 95.758. Dow Jones industrial average added 0.1% closing at 21553.09, posting a fresh record high. The S&P 500 rose 0.2% settling at 2447.83 less by financial, energy and technology stocks. The Nasdaq index advanced 0.2% to 6274.44 for a fifth session of gains in a row.

European stocks advance

European stock indices advanced on Thursday building on previous session’s gains supported by dovish comments from US Federal Reserve chief Janet Yellen interest rates don’t have to rise all that much further. The euro extended losses while the British Pound continued rising against the dollar. The Stoxx Europe 600 rose 0.3%. Germany’s DAX 30 added 0.1% closing at 12641.33. France’s CAC 40 rose 0.3% while UK’s FTSE 100 ended 0.1% lower at 7413.44. Indices opened higher today.

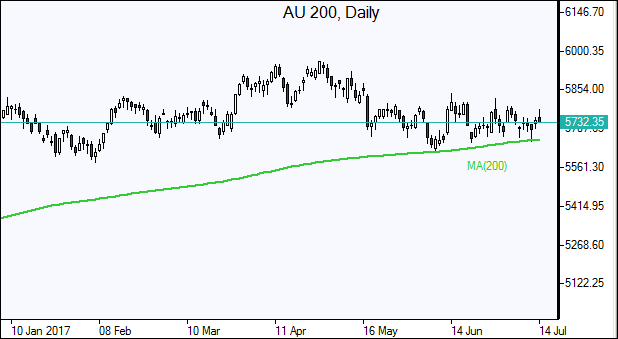

Asian markets higher

Asian stock indices are building on previous day’s gains with risk appetite buoyed by Federal Reserve Chair Janet Yellen comments that the central bank's rate hikes could be gradual. Nikkei added 0.1% to 20118.86 as yen edged lower against the dollar. Chinese stocks rising after reversing earlier losses: both the Shanghai Composite Index and Hong Kong’s Hang Seng Index are up 0.1%. Australia’s ASX All Ordinaries is up 1.1% despite the continued rally of the Australian dollar against the greenback.

Oil lower on rising supply concerns

Oil futures prices are edging lower today on concerns of rising global market supply. Prices ended higher Thursday on US crude inventory drop and forecast for stronger growth in demand this year. US crude inventories fell 7.6 million barrels last week. Concerns for global crude oil continued overhang intensified after reports OPEC compliance with agreed production cuts slipped to 98% percent in June while output from Libya and Nigeria is higher than at the time of the November OPEC agreement, offsetting about 60% percent of the OPEC cuts. Brent for September settlement climbed 1.4% to end the session at $48.42 a barrel on the London-based ICE Futures Europe exchange on Thursday.