Tensions in the Ukraine have escalated again last week as NATO claims to have satellite images showing that Russian soldiers entering the Ukrainian border joining the rebel forces. The Ukrainian government stated that a full-scale war is on the horizon whilst EU member-states are discussing another round of sanctions on Russia.

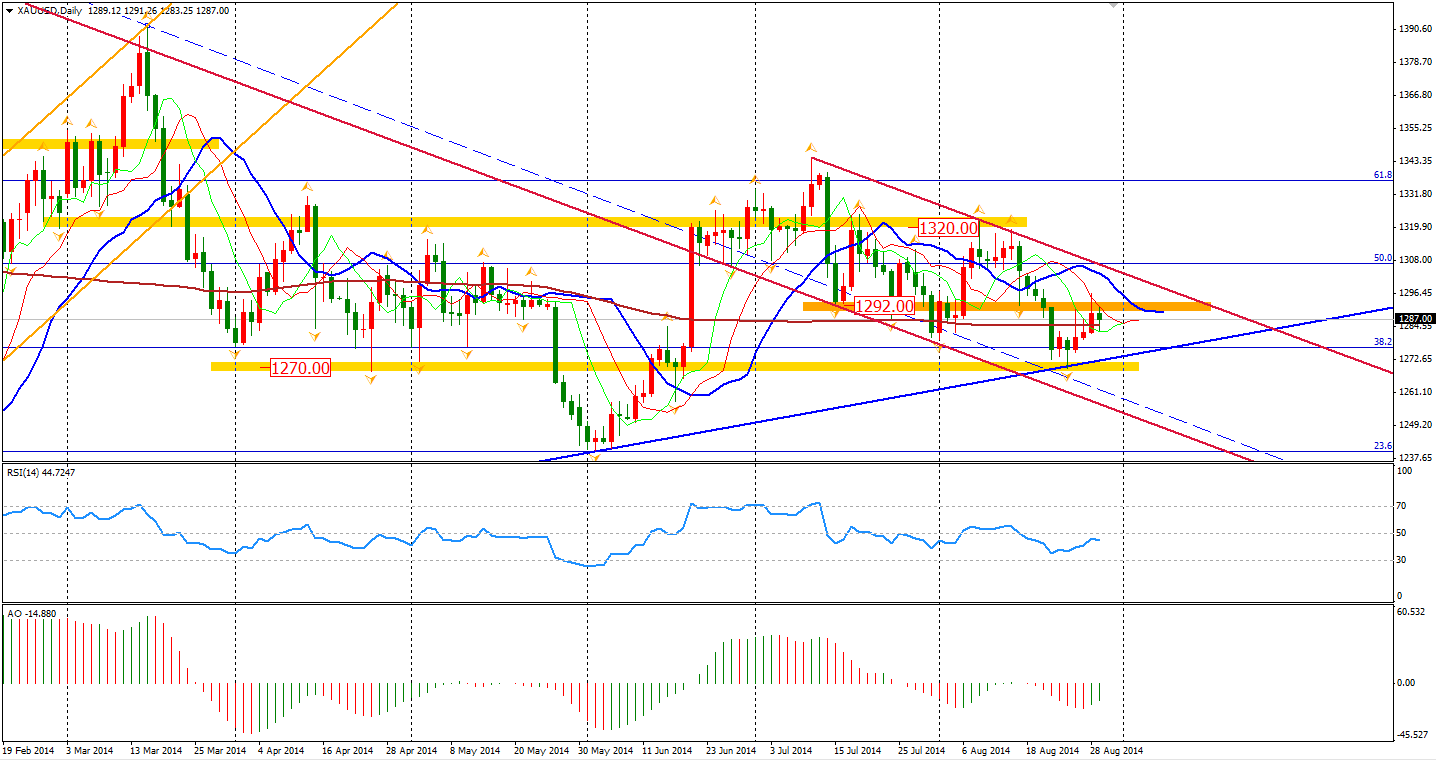

Personally, I don’t think Russia will add heat to the situation this week as they can’t truly benefit from a real war. A large-scale war against the Western world would certainly be an unwise choice for the Kremlin. It appears that they are simply using the situation to bargain for a better deal. The movement of Gold seems to reflect how other traders are also of this thinking. Gold failed to stand beyond the important level $1292 on Friday but managed to stay upon the 200-day Moving Average. It may drop to $1270 support again soon.

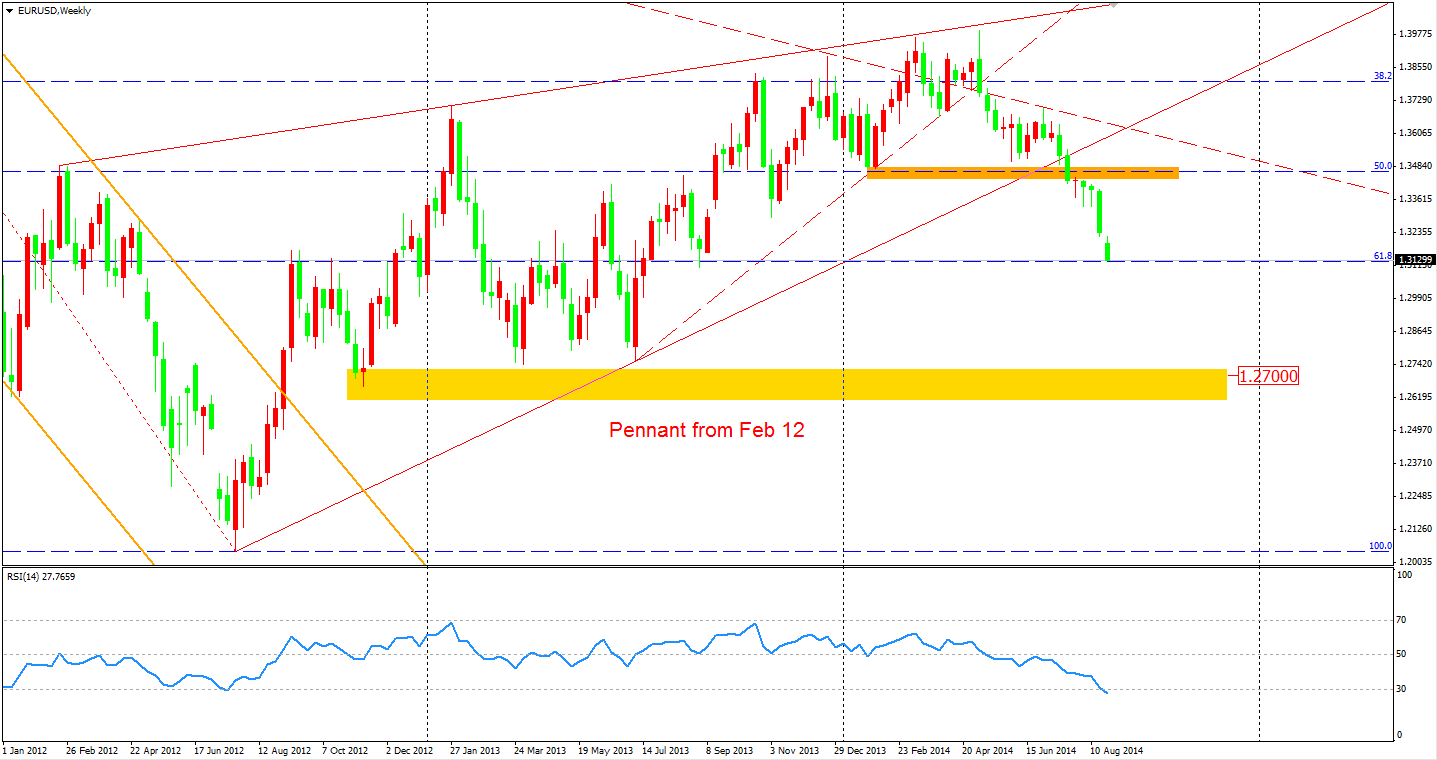

An important item in this month’s calendar key events is the next ECB meeting happening on Thursday. A more dovish statement is expected and Governor Draghi may disclose more details about QE or ABS purchasing program. However, actions may not be implemented in this meeting, as the ECB may be waiting for confirmation of a decreasing inflation rate and may need more time to observe the effects from June’s rate cut. The Euro closed at a new low for the year at 1.3132.

China’s market led the rise for Asia's stock markets on Friday. The Shanghai Composite surged near 1% up to 2217. The Nikkei Stock Average lost 0.23%. The Australian ASX 200 was up 0.03% to 5626. In European stock markets, the UK FTSE rose 0.20%, the German DAX gained 0.08% and the French CAC Index lifted 0.34%.

U.S. stocks kept the rising with the NASDAQ Composite Index hitting its highest level since March 2000. The Hi-tech stocks Index was down 0.50% to 4580. The S&P 500 rose 0.33% to 2003 – another new record high. The Dow gained 0.11% to 17098.

On the data front, China official Manufacturing PMI will be released at 11:00 AEST and HSBC Manufacturing PMI will be at 30 minutes after. In the early European session, traders will look at UK Manufacturing PMI at 18:30 AEST. Today is the U.S. Labour day, so lower trading volume can expected around midnight.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Global Markets Ignore Escalating Geopolitical Tensions

Published 08/31/2014, 09:25 PM

Global Markets Ignore Escalating Geopolitical Tensions

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.