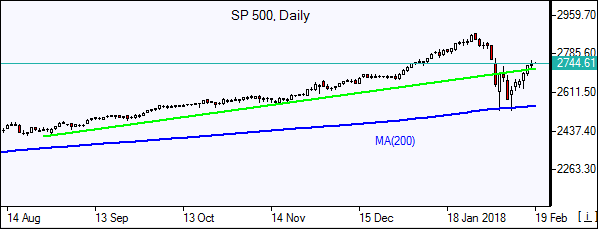

US stocks rise for sixth session in a row

US stocks inched higher on Friday ending off session highs after Special Counsel Robert Mueller announced the indictments of 13 Russian nationals and three Russian entities, accusing them of interfering in US elections. S&P 500 added 0.04% to 2732.22. The Dow Jones industrial average rose less than 0.1% to 25219.38. Both the US broad market index and Dow industrial gained 4.3% for the week, advancing for the sixth straight day. The NASDAQ Composite lost 0.2% to 7239.47. The dollar resumed strengthening as import prices rose 1% over a year after 0.2% gain in December: the live dollar index data show the ICE, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.6% to 89.148. Markets are closed in the US today for President's Day.

European stocks rise third straight session

European stock indices finished firmly higher on Friday advancing for the third straight session. Both the euro and British pound turned lower against the dollar. The Stoxx Europe 600 index rose 1.1%. The DAX 30 gained 0.9% to 12451.96. France’s CAC 40 rose 1.1% and UK’s FTSE 100 advanced 0.8% to 7294.70. Indices opened 0.1%-0.3% higher today.

Japan’s exports rise for 14th straight month

Asian stock indices are rising today on the back of improving investor confidence. Nikkei extended gains 2% to 22142 as yen weakness against the dollar continued. The risk appetite was supported by the report Japanese exports rose for a 14th straight month due to strong demand for semiconductor equipment. China’s markets are closed for Lunar New Year holidays. Australia’s ASX All Ordinaries is up 0.6% with Australian dollar steady against the greenback.

Brent up on geopolitical risk

Brent futures prices are edging higher today on rising tensions in the Middle East. Prime Minister Benjamin Netanyahu said on Sunday that Israel could act against Iran itself, not just its allies in the Middle East. Prices rose Friday: April Brent added 0.8% to $64.84 a barrel on Friday. It gained 3.3% in the week.