US stocks finally join the selling pressure that has plagued rest of the world

Stock markets around the world, together with industrial commodities and emerging market currencies, felt the full force of selling pressure this past week. Various currency devaluations and slowing global growth seem to be the catalysts. Over a span of 5 trading days, global equities (iShares MSCI ACWI (NASDAQ:ACWI)) declined 6.3% while US equities (SPDR S&P 500 (NYSE:SPY)) fell 5.6%. Emerging Market equities (iShares MSCI Emerging Markets (NYSE:EEM)) had the hardest fall, crashing 7.8%. In Europe, equities (SPDR Euro Stoxx 50 (NYSE:FEZ)) lost 6.5% during the same period. US volatility jumped 118.5% in a single week.

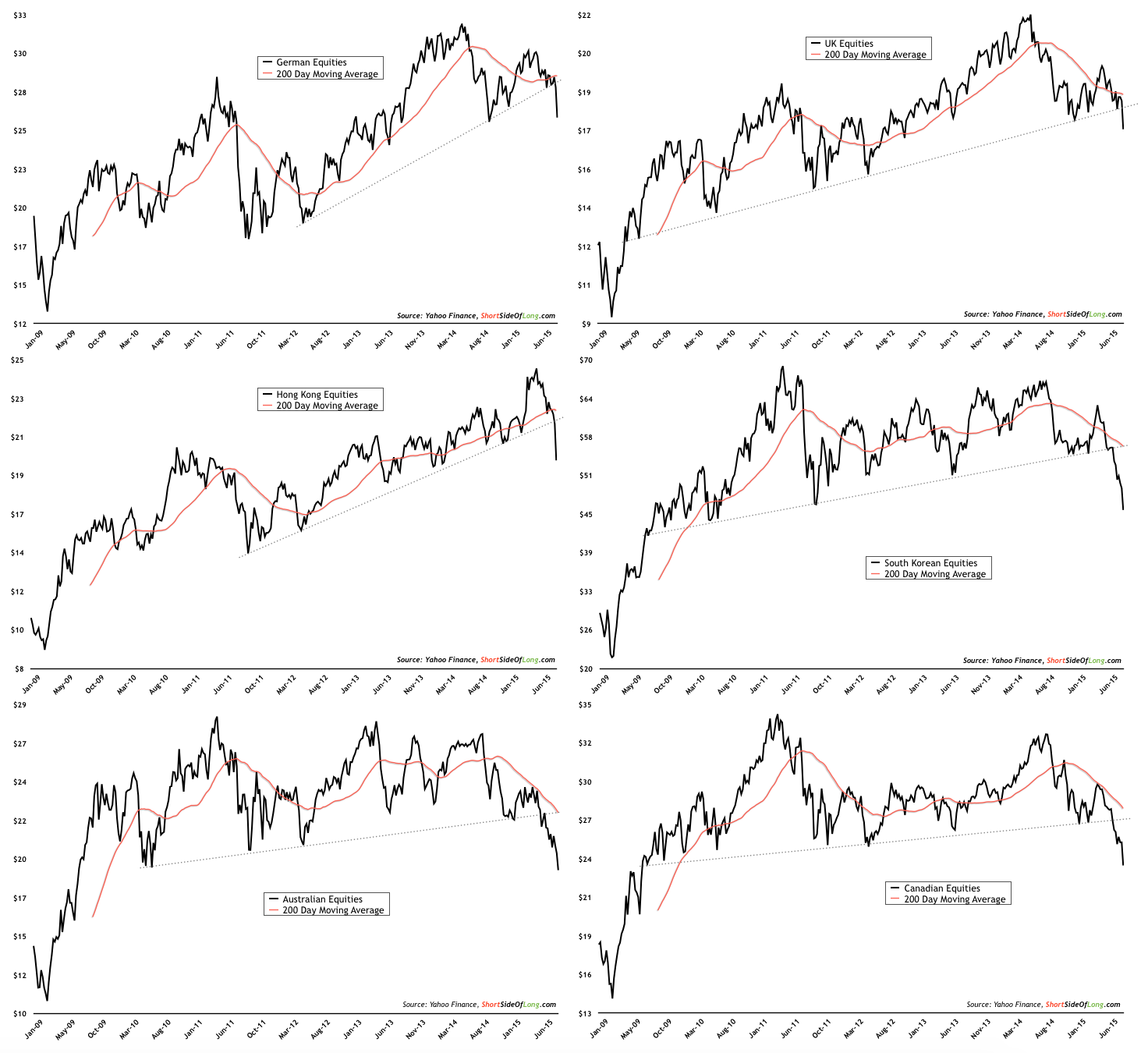

The two charts (above and below) show the technical damage is very serious, as all major bullish trend lines and support levels around the world were broken. The All-Country World Equity Index doesn’t really represent the world very well, as it is heavily weighted towards the US. Consider that European powerhouse stock markets of Germany and UK broke their supports this week, while the stock markets of developed Asian economies such as HK and South Korea (as well as Singapore not shown here) have been falling like a rock in recent months.

Finally, commodity exporters like Canada and Australia are not faring any better either. The majority of global stock markets peaked in 2011 or 2014, when priced in US dollars. It remains clear that US equities still continue to outperform, though not by rallying but only by falling less.

Markets from America to Europe and from Asia to Australia are in bearish trends