- The current bullish trend in the German stock market is supported by positive momentum, market breadth & intermarket dynamics.

- The DAX and Hang Seng Index (HSI) have a high direct correlation where a further bullish move in HSI may trigger a positive feedback loop into the DAX.

- Watch the 21,100 key medium-term pivotal support on the DAX.

The latest key economic data for January such as manufacturing PMI and consumer confidence in the Eurozone and Germany, one of the anchor European economies are not rosy as they highlighted an increased risk of an impending recession in the Eurozone.

Also, these leading Eurozone economic indicators have yet to indicate any clear recovery from an economic slowdown in the past year where external factors such as impending trade tariffs on European manufactured motor vehicles from US President Trump may torpedo the Eurozone into a recession next year.

In contrast, the German stock market has ignored such fears. It has continued to march higher since November 2024 as the Germany DAX scales new fresh all-time highs and is on track to record its fourth consecutive positive monthly gain in February.

Outperformance of the German Stock Market

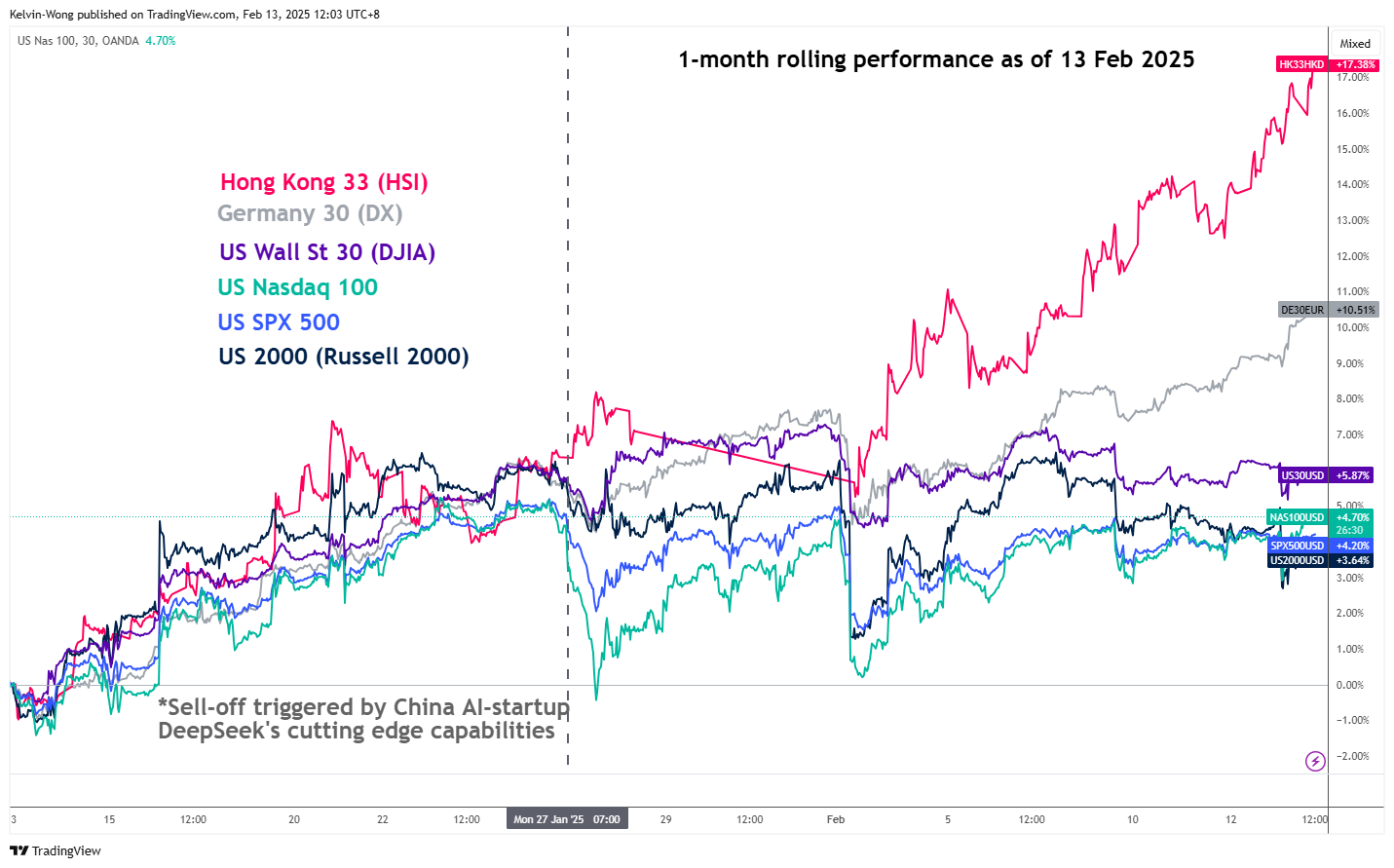

Fig 1: 1-month rolling performances of Germany 30 & US CFD stock indices as of 13 Feb 2025 (Source: TradingView)

Interestingly, the Germany DAX and Hang Seng stock indices (a proxy for international investors and traders to get exposure to China equities) have tracked closely to one another and outperformed the major US stock indices on a one-month rolling basis at this time of the writing according to the prices of contract for difference (CFD) stock indices on these markets offered by OANDA.

Based on a one-month rolling performance basis, the Germany 30 CFD stock index (a representation of the DAX) has recorded a gain of 10.50%, almost two times more than the average return of 4.6% seen on major US CFD stock indices such as US Nasdaq 100 and US SPX 500 (see Fig 1).

Improving Market Breadth

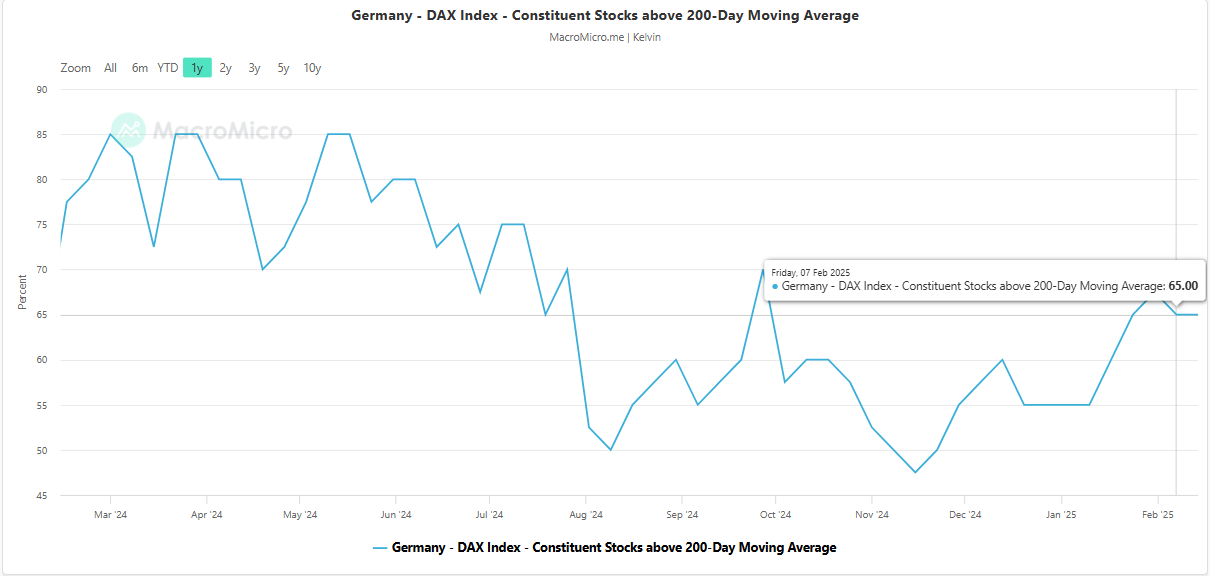

Fig 2: Percentage of DAX component stocks above 200-day moving average as of 7 Feb 2025 (Source: MacroMicro)

The percentage number of DAX component stocks trading above their respective 200-day moving averages has increased significantly from 47% in mid-November 2024 to 65% as of 7 February 2025 (see Fig 2).

These observations suggest that market breadth has improved to increase the odds of a continuation of the ongoing medium-term uptrend phase of the DAX.

Bullish Acceleration in DAX

Fig 3: Medium-term trend of Germany 30 CFD stock index as of 13 Feb 2025 (Source: TradingView)

The price actions of the Germany 30 CFD stock index (a representation of the DAX) staged a breakout above the upper boundary of a major ascending channel on 17 January.

Thereafter, it continued to trade above its 20-day moving average without any bearish divergence conditions currently on its overbought daily RSI momentum indicator (see Fig 3).

In addition, the Germany 30 CFD stock index has a high positive correlation (20-day rolling correlation coefficient at 0.87) with the Hang Seng Index (a proxy of China’s stock market).

The Hang Seng Index may continue to see an extension of its impulsive bullish up move sequence within an ongoing medium-term uptrend phase (click here for a recap of our recent analysis on the Hang Seng Index) which in turn may trigger a positive feedback loop back into the Germany 30 CFD stock index.

Watch the 21,100 key medium-term pivotal support to maintain the bullish bias for the next medium-term resistances to come in at 23,140 and 24,100.

However, a breakdown below 21,100 invalidates the bullish impulsive up move sequence to kickstart a potential medium-term (multi-week) corrective decline to expose the next medium-term supports at 20,430 and 19,690.