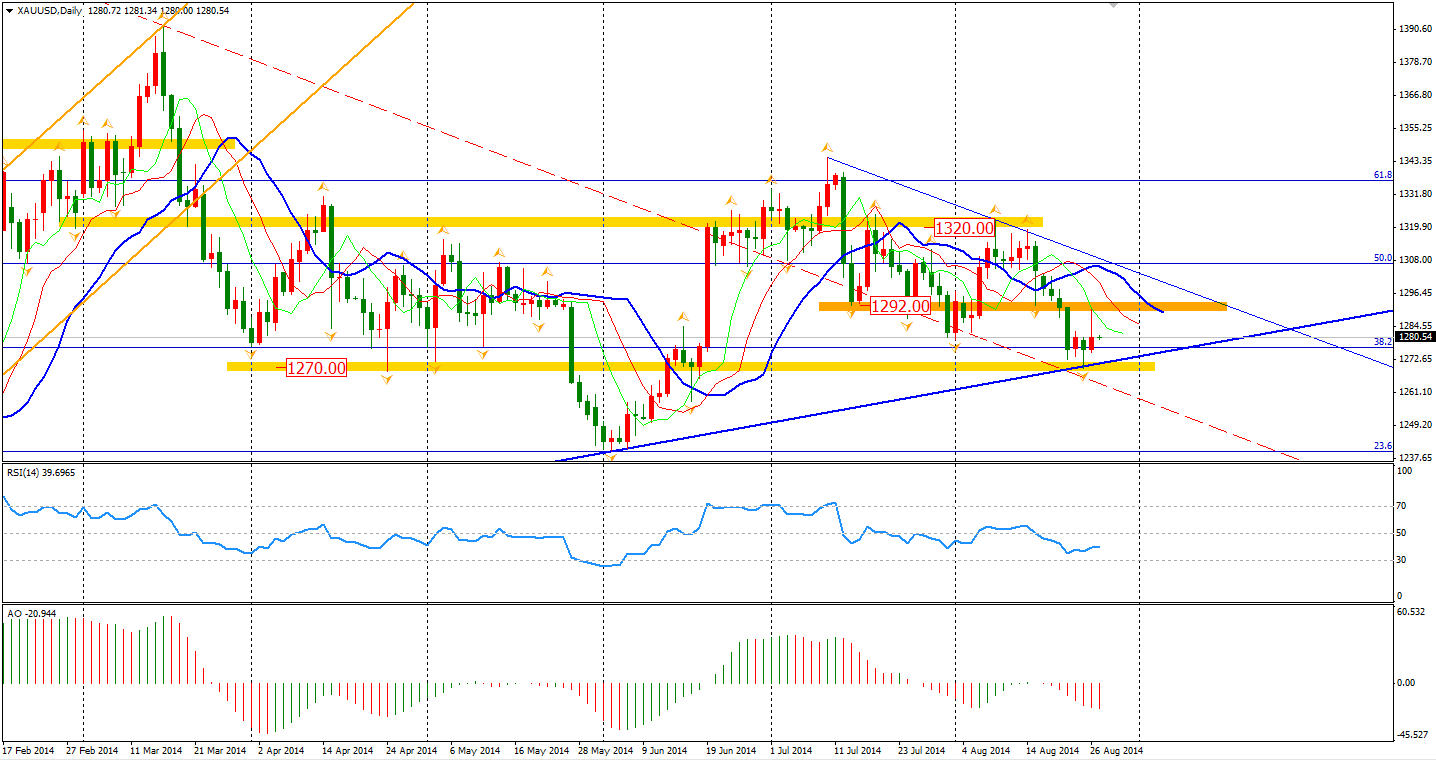

Gold departed from its sideway movement of recent days and rebounded to $1290 per ounce in the early European trading session. As we have mentioned previously, the $1270 is a strong support level – the bounce was in line with expectations. It then lost most of its gains over the rest of the day. Geopolitical fears were eased as Israel and Hamas finally reached an agreement on a Gaza truce and the result of the Russian and Ukrainian Presidential meeting was amiable.

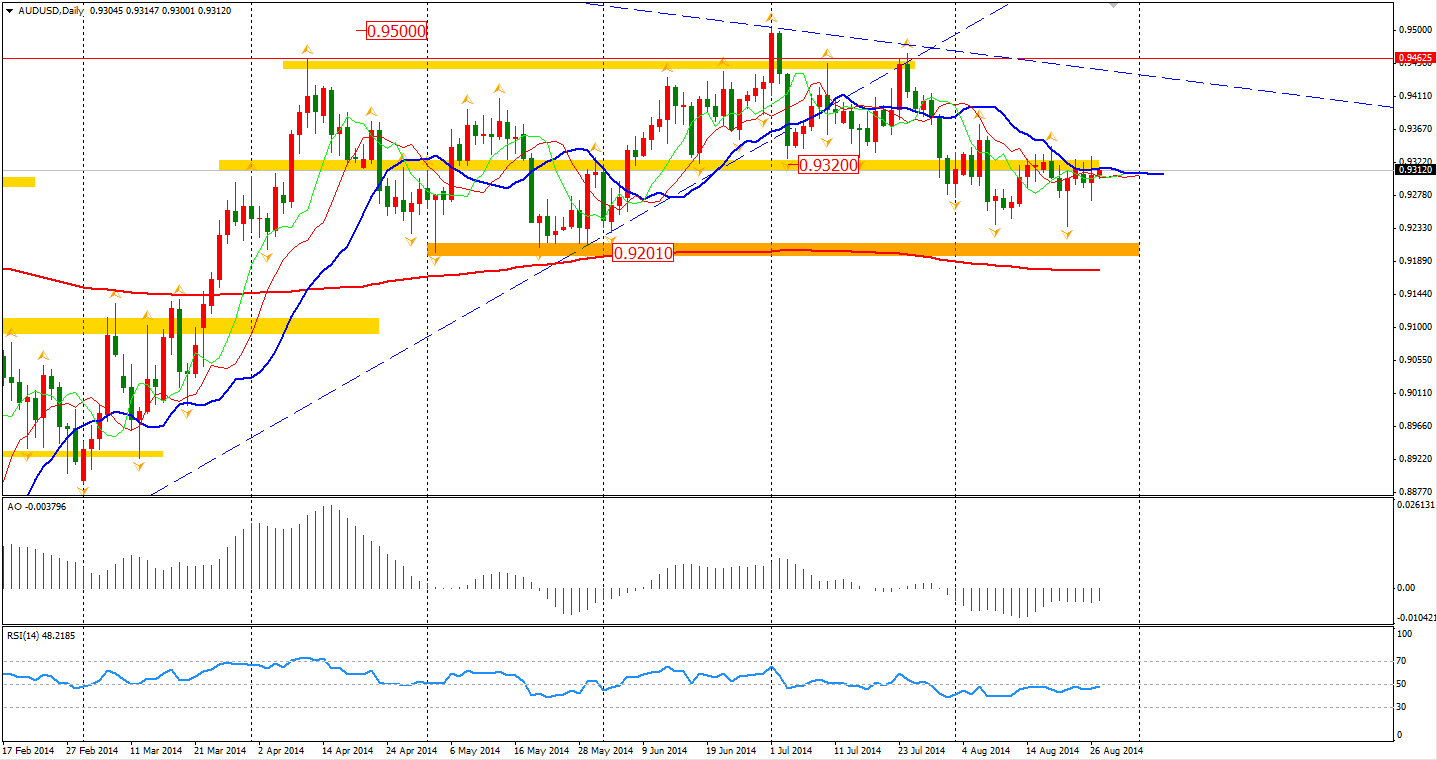

The aussie was the best performing major currency yesterday. The rise started from an open price below 0.9280 to the day’s high of 0.9330, while other changes remained in a tight range.

Nevertheless, the neckline around 0.9320 is still effective. The aussie now is still supported by the purchase from Europe as the euro weakness continues. The AUD/USD may keep moving within the 0.9200-0.9350 range for the next few trading days.

In other news, the CB Consumer Confidence and Durable Goods Orders were upbeat, supporting the strength of the USD. The Durable Goods Orders grew 22.6% in July, far greater than the expected 8% growth. Such data confirmed the stable steps of U.S. economic recovery and strengthened the dollar. The euro kept falling against the dollar yesterday to the year’s low of 1.3165 and with no bounce at all.

Most Asian stock markets closed lower with the Shanghai Composite edging 0.88% lower to 2207. The Nikkei Stock Average lost 0.59% whilst the Australian ASX 200 was up 0.05% to 5638. In European stock markets, the German DAX rose 0.82% and the CAC 40 Index was lifted by 1.18%.

U.S. stocks rose across the board. The S&P 500 lifted to its 29th high of the year and stayed above the 2000 integer level after the uplifting Durable Goods Orders result. The S&P 500 finally closed at 2000.02, rising 0.11%. The Dow gained 0.17% to 17107, while the NASDAQ Composite was up 0.29% to 4571.

Today’s data release may bore traders with only the Australian Construction Work Done data release at 11:30 AEST and the GFK German Consumer Climate will be at the beginning of European trading hours. Neither news pieces are considered that greatly important or riveting.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI