Monday January 30: Five things the markets are talking about

Investors are now beginning to fear that the biggest threat to global markets stability is if Trump continues down the path of protectionism without focusing on economic policies.

Reason enough why many investors are expected to proceed with caution, limiting their risk appetite, at least until they can get a better handle on Trumps next move.

It’s not campaign rhetoric any more – capital markets are facing heightened geopolitical and trade risks after U.S President Trump’s executed an executive order last Friday to halt the immigration process from seven predominantly Muslim nations.

From an economic and monetary policy standpoint, this week should be volatile. The trifecta of central banks – Federal Open Market Committee (FOMC), Bank of Japan (BoJ) and Bank of England (BoE) – will announce their respective monetary policy decisions. None are expected to change lending rates, though the Fed’s statement on Wednesday (2pm EST) will be analyzed for any reading on Trump’s impact on the U.S economy.

Despite a holiday-shorted week in Asia, it’s also a heavy week on the economic data front with Friday’s U.S nonfarm payroll (NFP) for January dominating.

1. Global equities see red on the back of uncertainty

Equities in Europe, Japan and Australia dropped, while markets in Hong Kong, China, Malaysia, Korea, Singapore, Taiwan and Vietnam were among those closed for holidays.

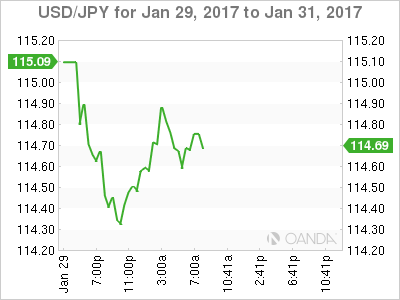

The MSCI’s broadest index of Asia-Pacific shares, ex-Japan, fell -0.4% in holiday-thin trade. Aussie shares closed down -0.9%, weighed by the tech sector, while Japan’s Nikkei was down -0.5% as the demand for safe-haven yen (¥114.57) weighed on exporters.

In Europe, equities are trading sharply lower, led by financial across the board. Energy, commodity and mining stocks are also lower, but currently mixed in the FTSE 100.

U.S equity futures are trading in the ‘red’ (-0.3%).

Indices: Stoxx50 -0.9% at 3,273, FTSE -0.9% at 7,121, DAX -0.8% at 11,724, CAC 40 -1.0% at 4,791, IBEX 35 -1.0% at 9,413, FTSE MIB -2.2% at 18,907, SMI -0.7% at 8,320, S&P 500 Futures -0.3%

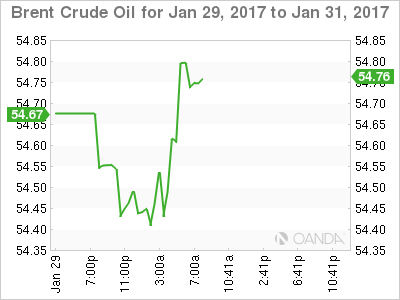

2. Oil slides as strong U.S. drilling activity

Crude Oil prices start the week on the back foot with news of an uptick in U.S. drilling activity negating producers efforts to comply with a deal to produce less in an attempt to support prices.

According to Baker Hughes data, the number of active U.S. oilrigs jumped to the highest since November 2015 last week.

Brent crude futures prices are down -25c at +$55.26 a barrel, while U.S. light crude (WTI) futures have slipped -8c to +$53.09.

Note: Oil prices have remained above the psychological $50 a barrel since the OPEC deal in November – this is incentivizing drillers in low-cost U.S. shale to ramp up activity.

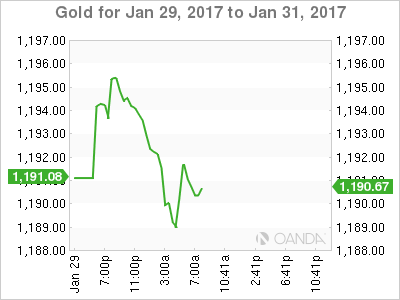

Gold prices are higher (+0.22% to $1,193.88 per ounce) ahead of the U.S open, supported by a weaker dollar and investor uncertainty over the outlook for U.S. policy.

Gold bulls believe that the U.S Presidents protectionist statements and a lack of detail on his economic policy will continue to provide bullion support on any pullbacks.

3. Euro sovereign yields on the rise

With the ECB wanting to see inflation below, but close to +2% continues to pressure European debt prices, especially German bunds, who’s own domestic inflation is officially on the rise as it hit the psychological +2% mark for the first time since the end of 2012 in three German states this morning.

That said, the “wildcard for trading” continues to be any safe haven demand on U.S Trump rhetoric or actions. The 10-Year Bund yield is trading at +0.49%, up from +0.46% at Friday’s close.

Also, with Euro government bond issuance to remain heavy this week – around +€25B from Italy, Germany, Spain and France – will weigh on Euro prices.

Elsewhere, the market is expecting the BoE to call an end to its QE bond buying at its meeting Thursday. It seems to be fully priced into the Gilt market, and if so, investors should not expect any significant reaction to the announcement. Governor Carney is also expected to revise the current +1.4% GDP forecast for 2017 higher to +0.7%.

Ahead of this evening’s BoJ decision, a Nikkei report is speculating that the central bank will heed improving trade and consumption data with an increase in its accompanying projections for growth.

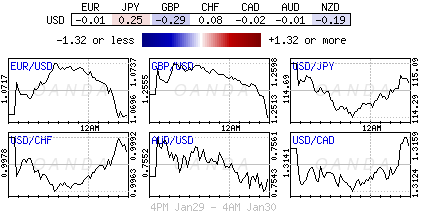

4. Dollar rebounds from its lows

Overnight, the “big” dollar was initially under pressure during the Asian session over concerns that the new U.S travel restrictions could translate into investors withdrawing funds stateside. Also weighing on the USD was last Friday’s somewhat disappointing GDP report (+1.9% vs. +2.1% e).

Nevertheless, ahead of the U.S open, the greenback is off its worst levels, trading mixed overall against the major pairs. The EUR/USD is holding below the psychological €1.07 level, while USD/JPY hovers in the mid-¥114 area. The GBP/USD is softer for its third consecutive session ahead of this week’s BoE meeting.

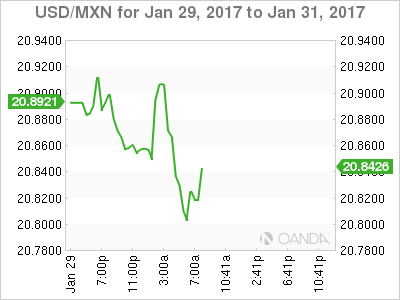

Elsewhere, many believe the Mexican peso ($20.80) is oversold by as much as -13%, but that doesn’t mean they are ready to bet on the volatile currency just yet.

5. Eurozone confidence firmed this month

Data this morning shows that Eurozone business and consumer confidence was stronger than expected this month – Economic Sentiment Indicator has rallied to 108.2 from 107.8 in December.

Note: The headline print is the highest level since March 2011 – the market was expecting a print of 107.9.

The pickup in business confidence is led by industry, with the metric for that sector rising to +0.8 from a flat print in December – its highest level since June 2011. There is also good news for the ECB – household inflation expectations rose to its highest level in three-years.