Market Brief

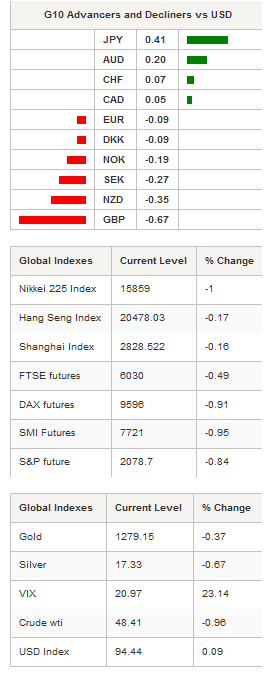

Investors across the globe are becoming increasingly anxious in the run-up to several key dates. Almost all equity indices ended in red yesterday as traders piled into safe haven assets, pushing volatility to sky-high levels. The CBOE volatility index (VIX) climbed more than 23% on Monday after a surge of 16% last Friday, while the S&P 500 lost 1.70% over the same period.

Looking at the option price on the S&P 500, it seems that investors are getting ready for a drop of the index as the 1-month 25 delta risk reversal fell to -7.50% on Monday compared to -4.50% on Friday. However, given the substantial gains of the equity market over the last few months, investors are less reluctant to buy protection to secure those gains.

In the FX market, the pound sterling is the main focus of attention as June 23 draws closer. The pound fell 0.67% against the US dollar to 1.4157. Since the beginning of May, the currency is down 4.10% and is now testing the low from mid-April as a Brexit seems to have gained traction over the last few days, according to the latest poll. The actual consequences of a Brexit are difficult to price in and the market is closely monitoring the polls - so even in the event of a Brexit, the sterling should not move much lower.

EUR/CHF stabilized somewhat in Asia, but the bias remains on the downside. On Thursday, the SNB will communicate its interest rate decision as well as its latest forecast. The CHF should remain under substantial buying pressure as we approach the UK referendum. Moreover, the mounting risk-off sentiment has accelerated the franc’s rise. We do not expect the SNB to remain sidelined for too long; however, Thomas Jordan still has some room before stepping into the market to defend the CHF.

USD/JPY moved slightly lower overnight as equities were set to end the day in negative territory. On the downside, the strong 105.23-55 support area is still standing, however, given the solid demand for safe haven asset, investors may want to test that level further during the upcoming days. US retail sales, due for release this afternoon, may be that trigger in the event of a poor reading.

In the equity market, the rebound is not for today, as most Asian equity indices continued to lose ground. The Nikkei 225 was off 1%, while the broader Topix index fell 0.98%. In mainland China, the CSI 300 was down -0.10%, while offshore the Hang Seng slipped 0.17% and the Taiex bounced back +0.47%.

In Europe, futures on the FTSE 100 are down -0.49% as are those on the DAX -0.91%. Finally, the SMI was down -0.95%.

Currency Technicals

EUR/USD

R 2: 1.1479

R 1: 1.1416

CURRENT: 1.1263

S 1: 1.1132

S 2: 1.1098

GBP/USD

R 2: 1.4660

R 1: 1.4328

CURRENT: 1.4147

S 1: 1.4006

S 2: 1.3836

USD/JPY

R 2: 109.14

R 1: 107.89

CURRENT: 105.74

S 1: 105.23

S 2: 103.56

USD/CHF

R 2: 0.9920

R 1: 0.9783

CURRENT: 0.9648

S 1: 0.9578

S 2: 0.9444