Monday was a continuation of Friday's action: gains for the S&P and NASDAQ, losses for Russell 2000. The issues in play at the start of the day, remained in play at the close.

The Russell 2000 is perhaps the most worrying of the indices. Yesterday's losses took the index back to the 50-day MA, but with the index stuck inside a trading range, this moving average is unlikely to play as major support. Technicals are also a little iffy: a 'sell' in the ADX is coming up against a potential 'sell' in the MACD, and relatively neutral CCI and Stochastic. The worst of the action is the sharp relative under-performance against the NASDAQ.

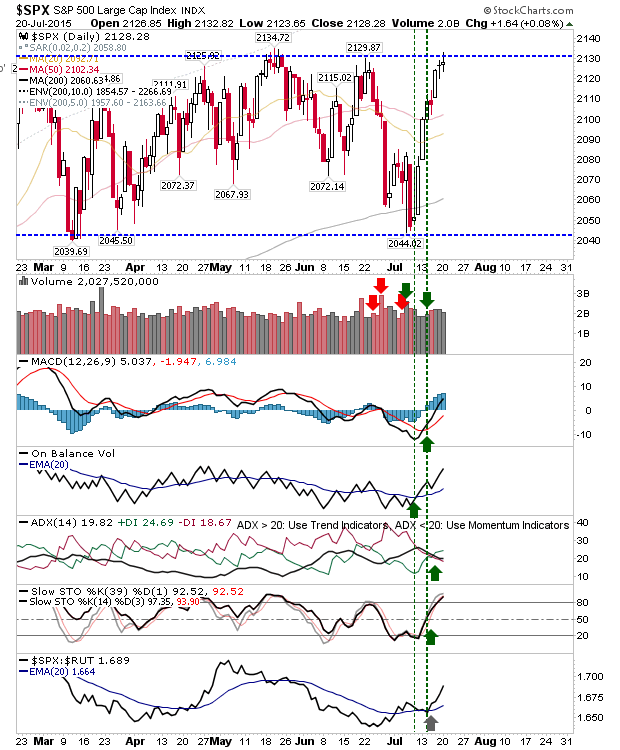

Gains in the S&P were tempered by resistance at 2,130. Yesterday's candlestick finished with an indecisive 'spinning top'; balancing bullish and bearish action. Volume fell as buying interest wanes, but bears haven't done enough to suggest they will take control here. Technicals hold to the bullish side.

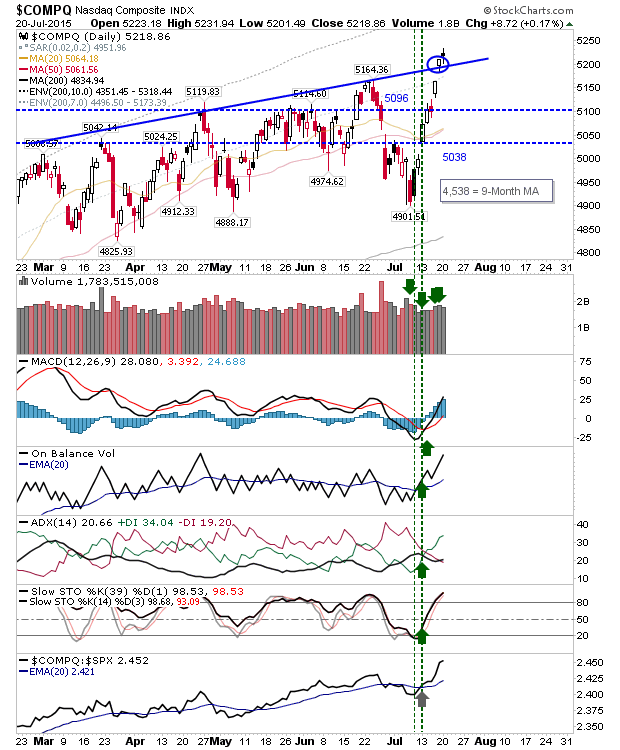

The NASDAQ break of upper resistance holds for another day. Like the S&P it finished with an indecisive spinning 'top', but at least does so from a point of a breakout. Technicals also hold to net bullish technicals. Luckily, the NASDAQ is outperforming the S&P, which will make it harder for shorts to press any advantage.

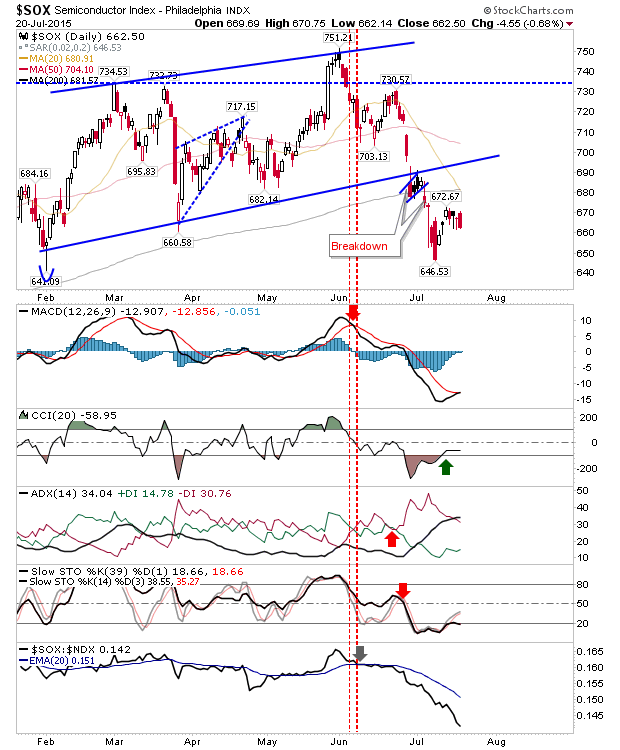

The Semiconductor Index closed with a weak bearish 'engulfing pattern,' and is struggling to recover after the loss of 200-day MA and break of rising consolidation.

For today, shorts should continue to track weakness in the Russell 2000 and Semiconductor Index. Longs will be looking to defend the breakout in the NASDAQ. The S&P could go either way; a good swing trade opportunity.