Investing.com’s stocks of the week

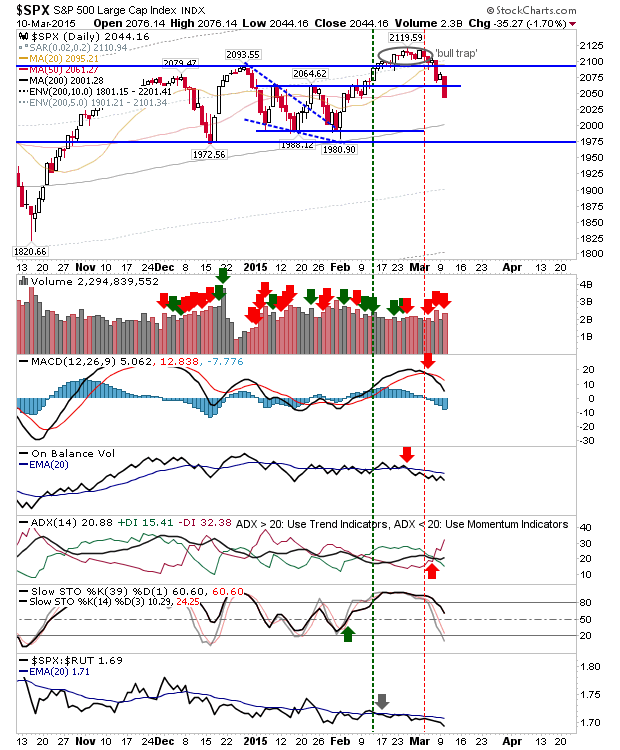

Yesterday was a tough day for bulls, a day which hurt Large Caps more than any other index. The S&P 500 cut deep below 2064. It looks good for a push back to the 200-day MA, which is just above 1,988 support. Volume climbed to register as distribution.

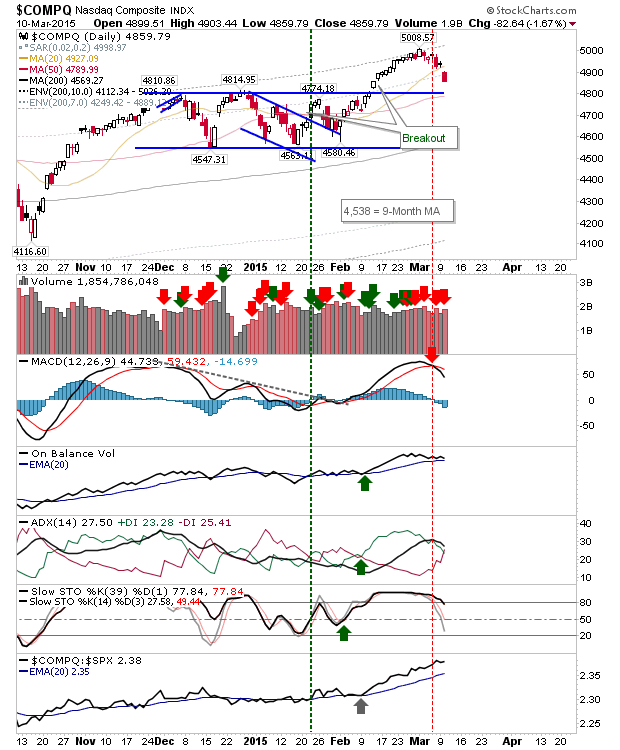

The NASDAQ still has support to work against, and room to maintain bullish momentum with the 50-day MA near 4810 support. Volume climbed to register distribution, but this is not too damaging at current levels.

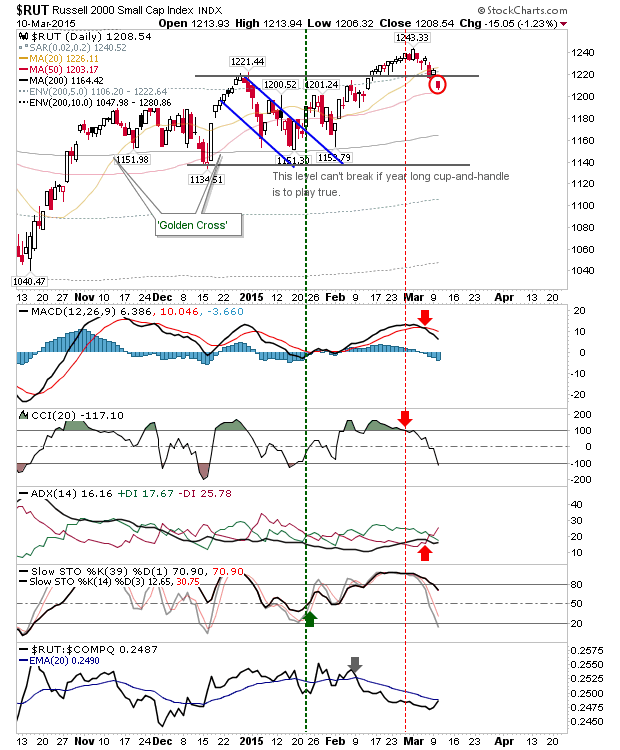

The Russell 2000 was caught in the middle. As the index most needed to have a strong 2015 (after a lackluster 2014), it has fallen back inside its prior base. Bulls can recover if there is a quick rally above 1220, as this would create a 'bear trap'. But should it drift lower, then an undercut of 1,134 is more likely; a loss of the 50-day MA would confirm.

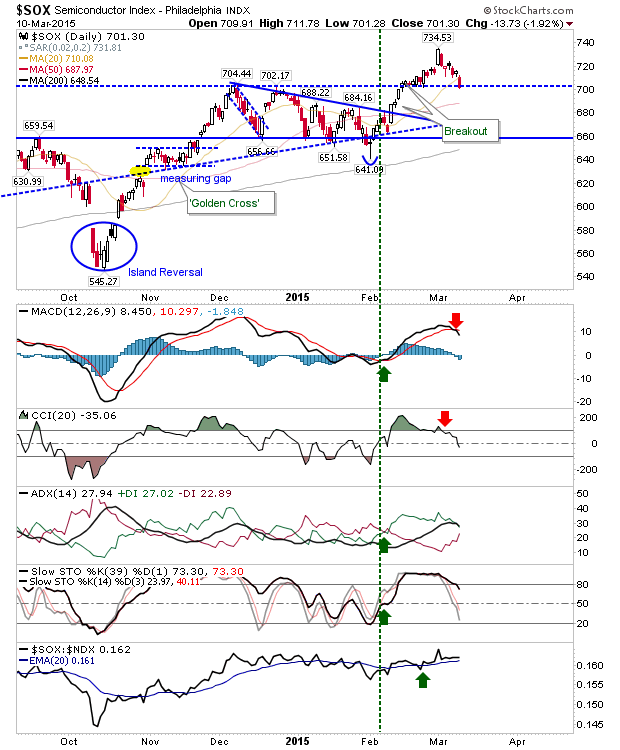

The Semiconductor Index was under similar pressure as the Russell 2000. However, it's clinging on to support, which gives bulls something to work with today.

For today early gains set up the potential for a 'bear trap' in the Russell 2000 and a workable bounce in the Semiconductor Index. If there are opening losses, then the NASDAQ has room to run before it reaches support.