Stocks are rising in afternoon trading Monday following market rallies overseas and Friday's strong employment report in the U.S. The gains put the S&P 500 index on track for a record-high close while the Nasdaq hit a 2016 high of 5,002.50 before pulling back slightly.

With markets trending upward, many value investors are likely having difficulty finding stocks trading at attractive prices. In light of this, I’ve used the finbox.io stock screener to find the ten most undervalued companies listed on the Nasdaq.

Here’s the basic screen:

- Market capitalization > $5 billion

- Consensus analyst upside > 20%

- finbox.io upside > 15%

- finbox.io fair value has low uncertainty (Meaning fair value estimates are derived from 5 or more valuation models)

And the results...

Melco Crown Entertainment (NASDAQ:MPEL) with 51% upside.

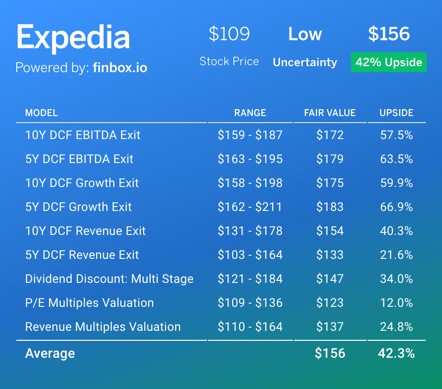

Expedia (NASDAQ:EXPE) with 42% upside.

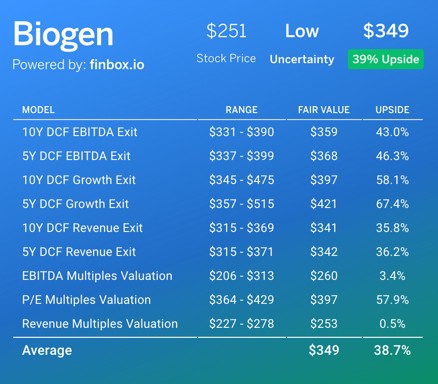

Biogen (NASDAQ:BIIB) with 39% upside.

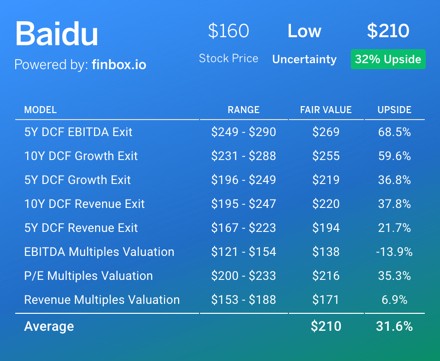

Baidu (NASDAQ:BIDU) with 32% upside.

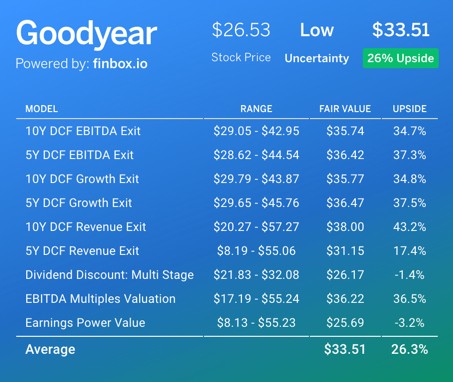

Goodyear Tire & Rubber (NASDAQ:GT) with 26% upside.

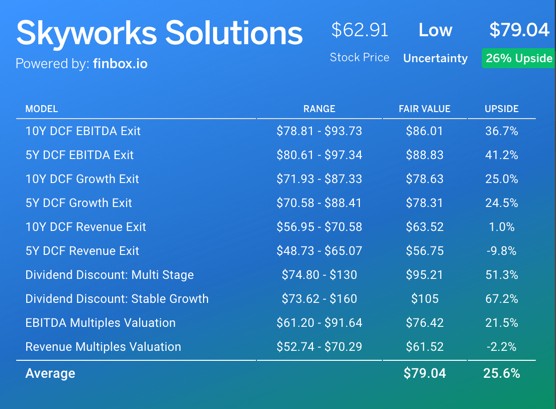

Skyworks Solutions (NASDAQ:SWKS) with 26% upside.

Apple (NASDAQ:AAPL) with 26% upside.

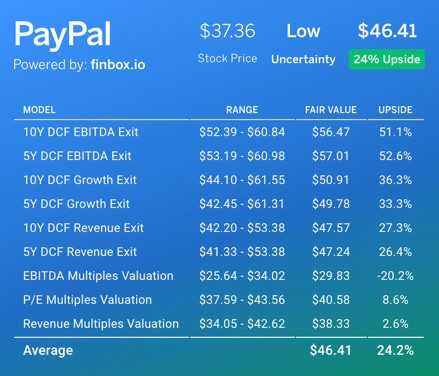

PayPal (NASDAQ:PYPL) with 24% upside.

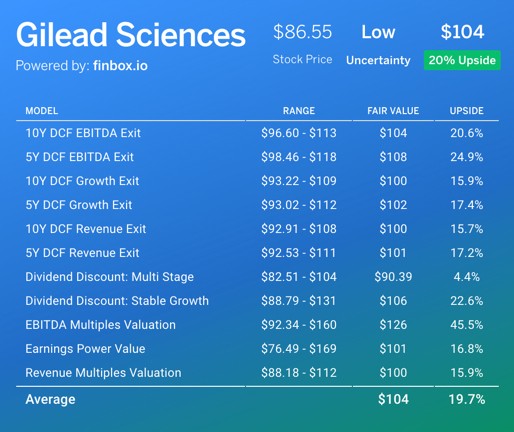

Gilead Sciences (NASDAQ:GILD) with 20% upside.

Sabre Corporation (NASDAQ:SABR) with 18% upside.