On Friday, bulls continued to squeeze shorts. This time I was thankful not to attack it as a short, but there didn't appear to be a lack of others on the wrong side of the trade. Volume wasn't great, but long holders won't mind that.

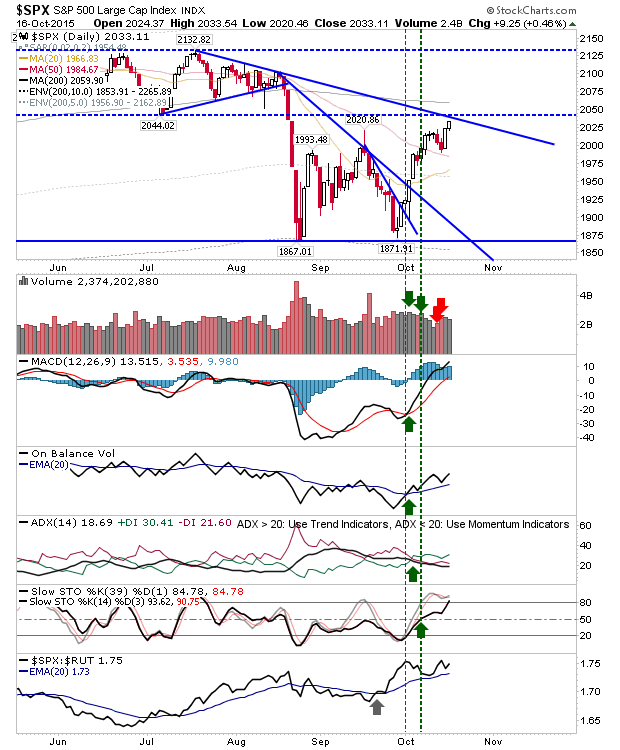

The S&P is approaching a crux of resistance between the swing low of July and declining resistance from July/August highs. Above that lies the 200-day MA, which may offer a spike high. Bears would ideally like to see a failed move above 2,044, with a close at or below 2,044. Technicals are all in the green, which gives bulls reason for optimism.

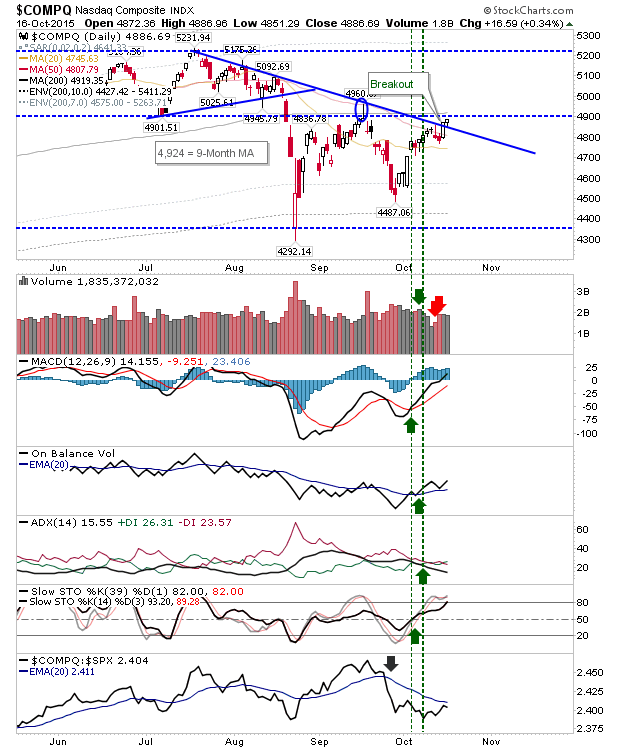

The NASDAQ went a step further and edged a break of declining resistance, although it hasn't yet got past the July swing low. The 200-day MA at 4,919 also hasn't been broken yet. A good start today would open up for a move back to 2015 highs, but the job data high at 4,960 might prove troublesome.

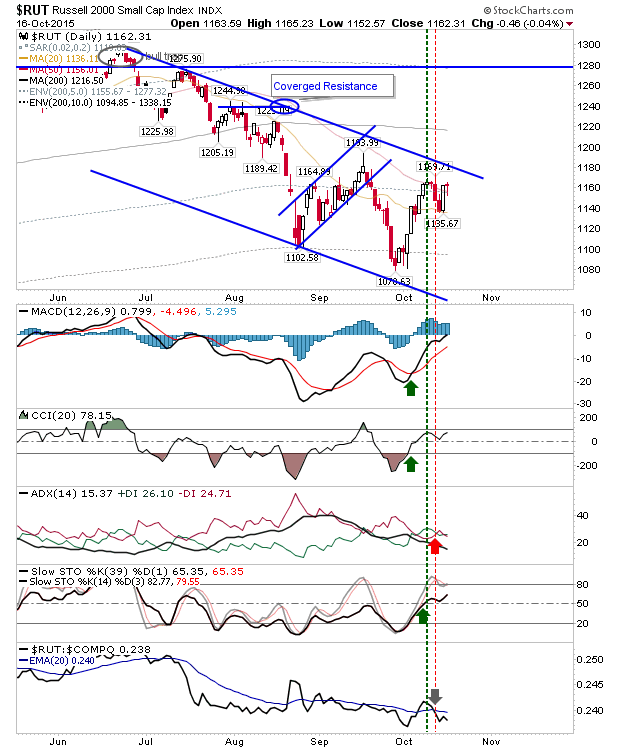

The Russell 2000 continued its run of underperformance to other indices with a flat close on Friday. The Small Caps index was able to hold above 50-day MA, but hasn't yet challenged channel resistance.

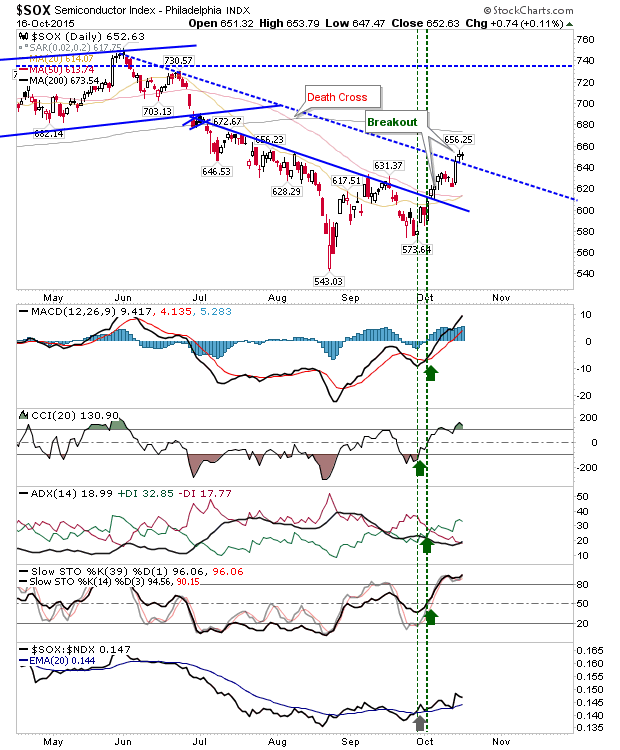

The Semiconductor Index also had a quiet Friday, but had already done enough to break declining resistance. Continued strength in the Tech indices will come on the back of continued strength in Semis.

Today will be about consolidating Friday's small gains. Moving back inside the summer trading range will set up for a test of 2015 highs. Maybe it will be doing so as part of a Santa rally in the latter part of the year?