While investors seem laser focused on Greece, they may want to keep a close eye on what's taking place in Germany, London and France.

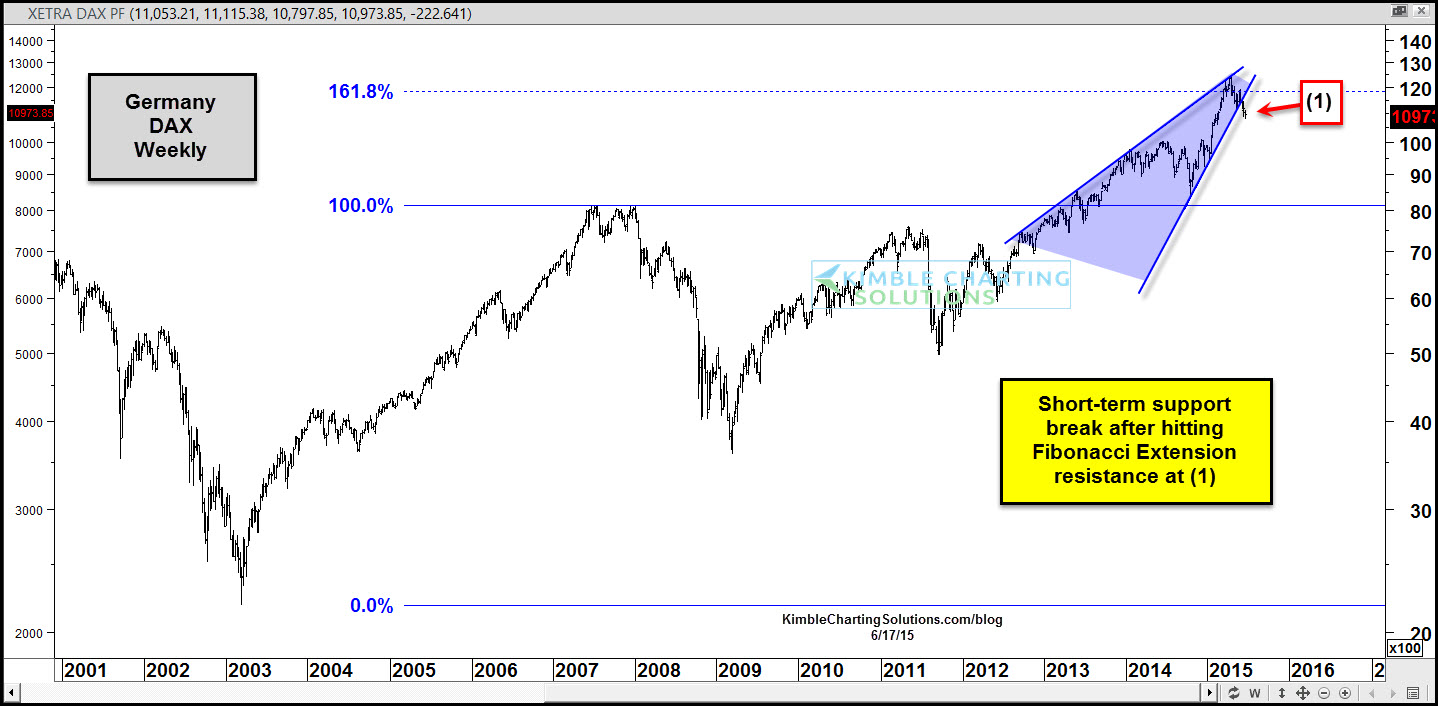

Below we see the DAX index over the past 15-years.

The German index hit the Fibonacci 161% extension level -- based on the 2003 lows and 2007 highs -- and the strong rally so far has stopped on a dime. At (1) above, short-term support looks to be breaking.

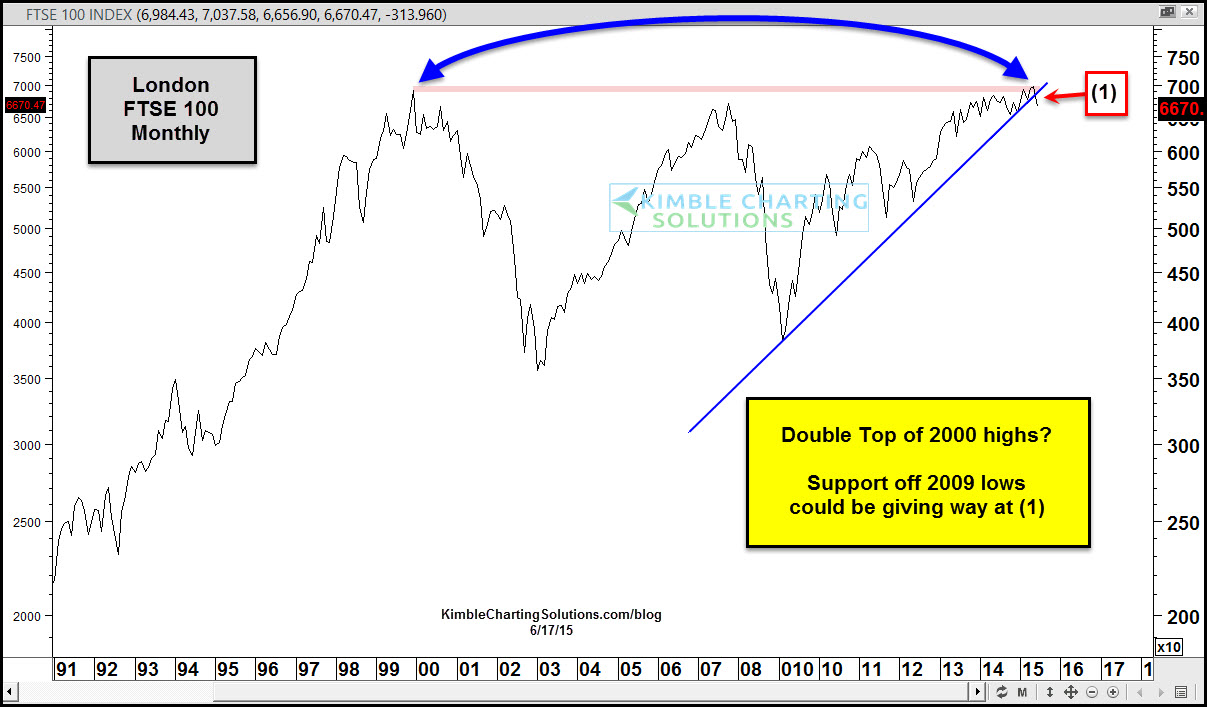

Is this the only major market in Europe acting soft? Next up is the London Exchange (FTSE 100) on a monthly basis.

The recent rally off the 2009 lows took the FTSE back to its 2000 highs. Did it make a double top? Support off the 2009 lows is being tested at (1). If the FTSE ends the month of June where it is now, it will be a little below this support line.

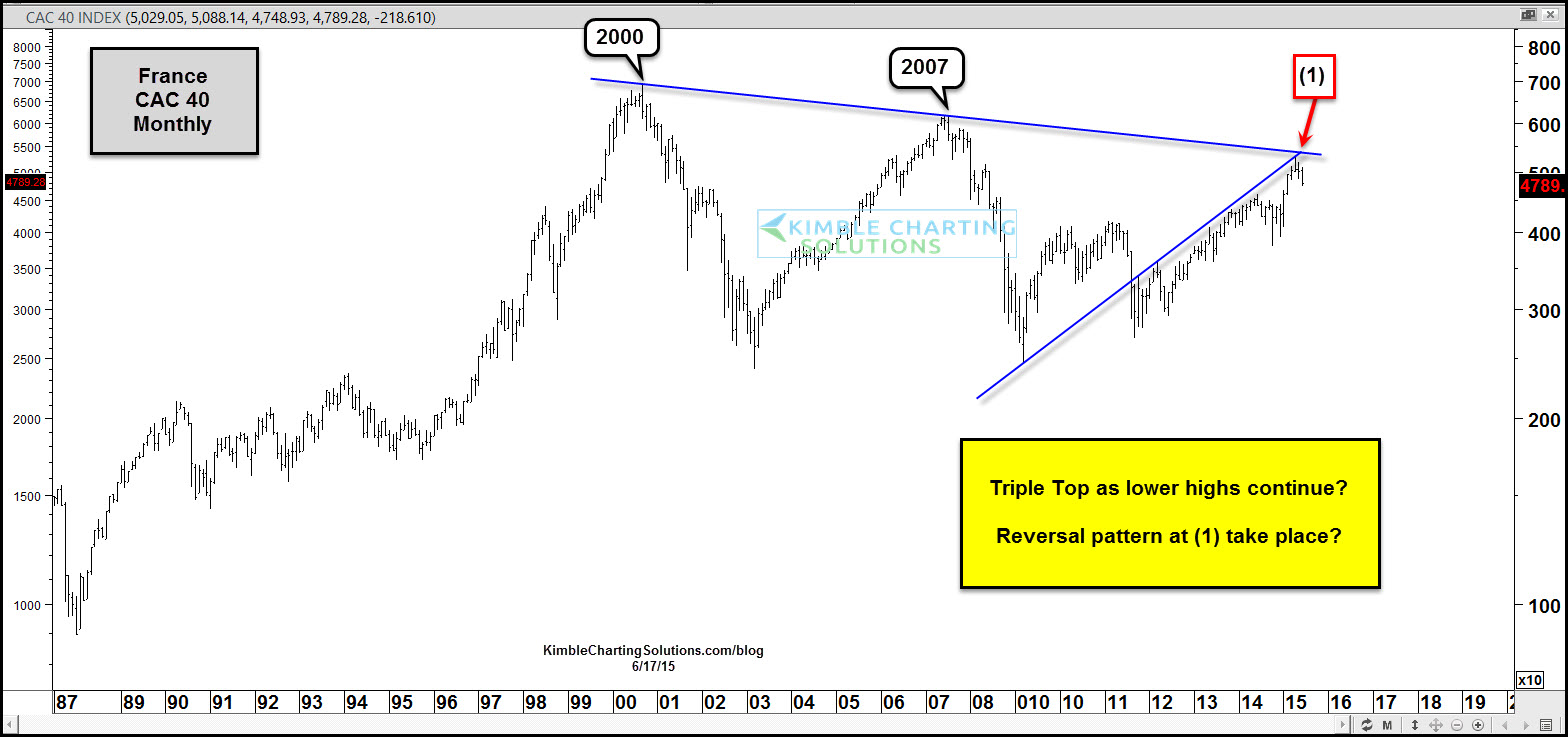

Any other key European markets to watch? Below we have France's CAC 40.

Two months ago the CAC looked like it had made a reversal pattern (bearish wick) on a monthly basis. That potential reversal pattern took place at a potential triple top at (1) above, which took place at resistance, based upon the 2000 and 2007 highs. Did a triple top take place?

Over the past 6-months, all three of these European markets have outperformed the S&P 500, despite a strong U.S dollar and weak euro.

Greece notwithstanding, what happens going forward in these European markets may well have an important influence on the broad markets in the states.