- Earnings give stocks one last boost before the FOMC decision

- Consumer Confidence surges to a 2-year high

- Dow eyes longest winning streak in six years

Volatility should be elevated this week as we have a key FOMC meeting and peak earnings season. So far, the trade has been for the money flow to continue go into small stocks, with some lowering their exposure to mega-cap tech trade. This earnings week has the potential to drive the recession-based pullback that seems to have evaded us this year.

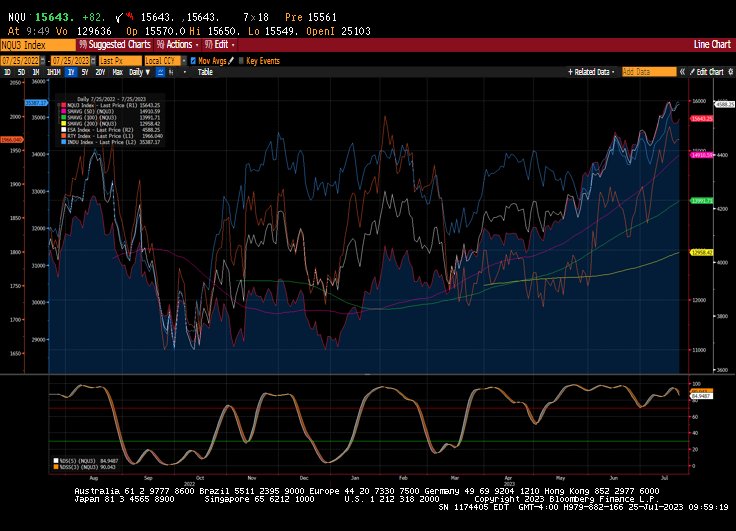

US stocks have had an interesting run here as relentless NASDAQ Composite rally has cooled, the Dow Jones Industrial Average winning doesn’t want to stop, the Russell 2000 tries to play catchup, and the S&P 500 nears record high territory.

After more than a year of Fed unity in raising rates to combat inflation, the end of the rate hiking campaign will start to see some dissent from the hawks, centrists, and doves. The voting hawks Waller, Bowman, and Logan might argue that the Fed needs to keep optionality about more tightening on the table.

The voting doves are Cook and Goolsbee, who both will probably remain supportive for raising rates on Wednesday but might show support for a long pause, that might eventually become the peak in rates. Powell and the centrists have the luxury of not overcommitting a position about the future path of rates, potentially setting up the Jackson Hole Symposium as the time to signal that they are most likely done raising rates.

US stocks are entering a consolidation phase ahead of massive earnings (Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL), Meta, and LVMH) and three big rate decisions by the Fed, ECB, and BOJ. Stocks have been mostly posting a short-term advance heading into these major market moving events and that could extend to an attempt at record highs if the Fed shows confidence that the disinflation process is firmly intact and if the mega-cap tech earnings deliver better-than-expected earnings with promising outlooks.

A lot needs to go right for a longer-term rally to unfold, which might suggest we could see the Dow Jones Industrial Average and Russell 2000 outperform the Nasdaq over the short term. If after this week, Wall Street becomes worried that the Fed is still leaning towards delivering one more rate hike, that could spook a lot of investors, which would see that as a policy mistake. If odds for a September 20 meeting rate hike end up becoming a coin flip, that could see a good portion of the recent rally with market breadth trade come undone.

Dollar-yen has entered its pre-FOMC/BOJ consolidation range. Heading into the FOMC decision the data has been holding up. The US economy has still yet to feel the complete impact of the Fed’s rate hiking campaign as the flash PMIs showed that business activity is slowing and as consumer confidence surged to a two-year high. Wall Street wants to believe the Fed will be one and done, but the data might not allow that to happen. They are likely to signal an extended pause, but hold onto a tightening bias, which could help push dollar-yen higher initially. Will USD/JPY rise towards prior intervention levels around the 145 is the big question at hand. A short-term advance in the dollar seems possible going into and that could extend post Fed if policymakers focus on the resilience of the US economy.

The bigger driver for USD/JPY might stem from the BOJ decision. There was a chance that we could get a Yield Curve Control (YCC) tweak, but that seems less likely. A key Tokyo CPI report will occur hours before the BOJ decision, but probably won’t sway the bank unless it comes scorching hot. The BOJ should deliver a tweak, but Ueda’s comments from a conference in India last week suggest they will stay the course with their ultra-loose monetary stance. The BOJ might eventually need to trigger an abrupt change to policy given the trajectory of the US economy and how high inflation has turned.

To the downside, a break of the 140 level could see momentum selling target the 137.50 region. The 142.50 level should provide initial resistance, with the 145 level likely to trigger calls of future currency intervention.

The New Zealand dollar got a boost after Chinese leaders signal more support is coming to the economy at this week’s Politburo meeting. Commodity prices across the board got a boost and that helped the kiwi-dollar end its six-day decline. The New Zealand might start looking attractive again as long as the Fed does not signal a hawkish skip and trigger a massive move back into the greenback. Major support lies at the 0.6150 region, but if bearish selling accelerates, prices might not find support until the 0.5900 level, which could potentially form a bullish Gartley pattern.

If bullishness returns to the kiwi, further upside could eye a return towards the 0.6400 area. Major resistance would like at the 0.6550 level.